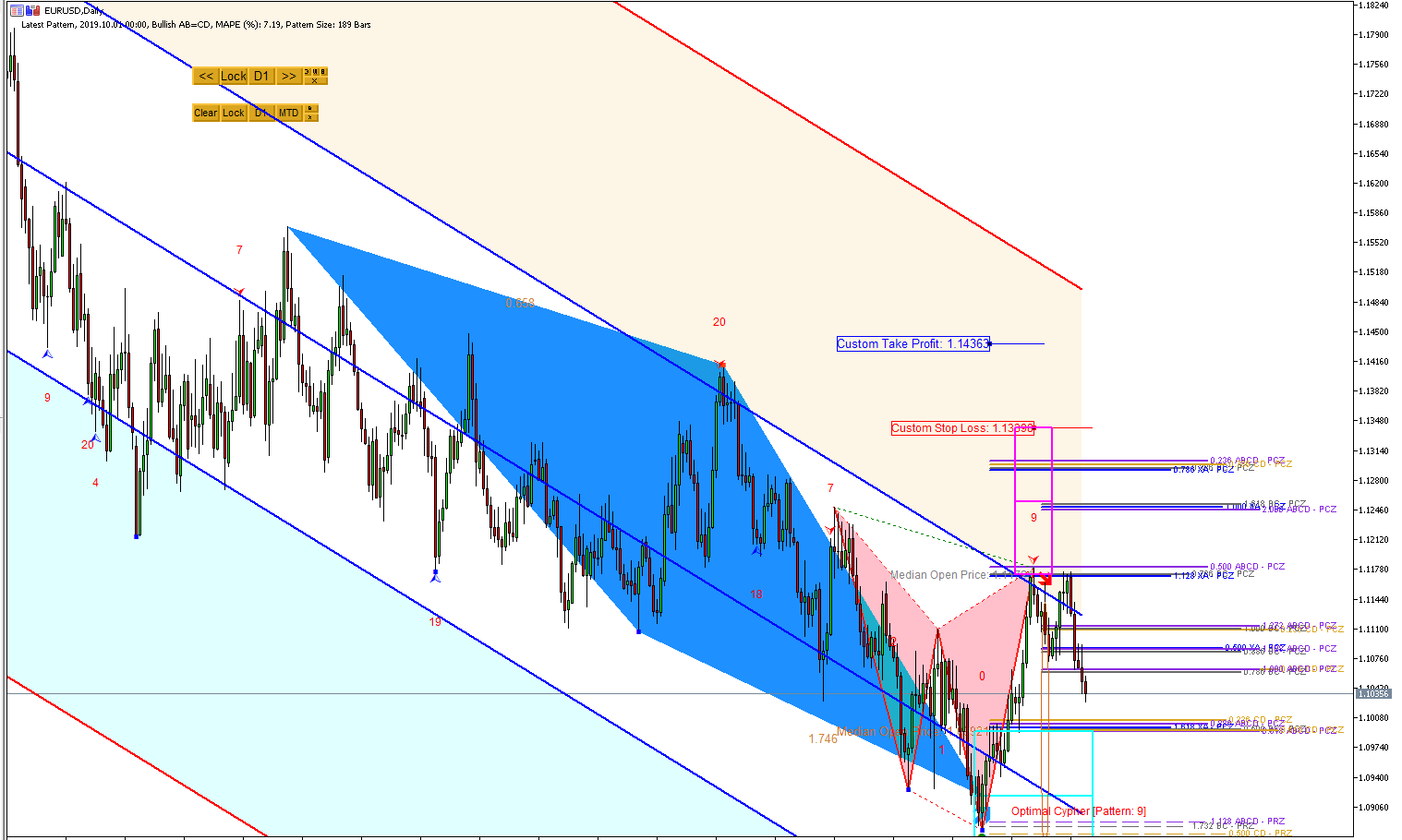

Using Harmonic Pattern and X3 Chart Pattern Together

Harmonic patterns and X3 chart patterns are advanced technical analysis tools used by traders to identify potential trend reversals or continuations in the financial markets. Here’s a brief overview of each pattern and how to use them. Firstly, let’s discuss about harmonic pattern. Harmonic patterns are geometric price patterns that repeat themselves in the financial markets. They are based on Fibonacci retracement and extension levels and consist of specific price formations that signal potential turning points in the market. The most common harmonic patterns include the Butterfly pattern, Gartley pattern, Bat pattern, and Crab pattern.

Here’s a general guide on how to use harmonic patterns:

- Identify Swing Points: Look for significant swing points on the price chart where the market has made major highs or lows.

Draw Fibonacci Retracement and Extension Levels: Use Fibonacci retracement and extension tools to measure the price swings between these points. Harmonic patterns rely on specific Fibonacci ratios to validate the pattern. - Recognize Harmonic Patterns: Once you’ve applied Fibonacci levels, look for specific price formations that resemble harmonic patterns. These patterns often have distinct structures and ratios between the price legs.

- Confirm with Additional Indicators: While harmonic patterns can be powerful signals on their own, it’s often helpful to confirm them with other technical indicators or price action signals for added conviction.

- Trade Execution: After identifying a harmonic pattern and confirming it with other factors, traders may execute trades based on the anticipated price movement suggested by the pattern. This typically involves placing entry, stop-loss, and take-profit orders according to the trading plan.

X3 Chart Pattern:

Next, let’s talk about X3 Chart Pattern. The X3 chart pattern, also known as the X3 Price pattern, is a variation of the classic Elliott Wave theory and Harmonic Pattern. X3 Chart Pattern identifies Harmonic Pattern and Elliott Wave Pattern using the rule based approach with Fibonacci Ratios. X3 Chart Pattern allows you to optimize each wave in the harmonic pattern and Elliott Wave pattern. X3 chart pattern allows to you backtest the harmonic pattern and Elliott Wave pattern, immediately. Hence, X3 chart pattern is highly customizable. Here’s how to use the X3 chart pattern:

- Identify Swing Points: Look for three consecutive price moves in the same direction, where each move exhibits a similar structure and magnitude. These drives should be roughly equal in length and form a recognizable pattern on the price chart.

- Apply Fibonacci Extension Levels: Once you’ve identified the three drives, use Fibonacci extension levels to project potential reversal or continuation points for the pattern. The most common extension levels used are 1.272, 1.618, and 2.0.

- Put the Fibonacci rule in X3 Chart Pattern Scanner and inspect the profit and loss immediately in the chart.

- If the performance of the pattern in the chart is significant, then start to make money with it. Otherwise, reoptimize your pattern until you see the profits in your chart by changing the Fibonacci rule. For your information, you do not need the strategy tester or etc as X3 Chart Pattern scanner provides non repainting way to simulate each chart pattern in the Forex chart. So all you need is a chart with X3 Chart Pattern Scanner.

- Confirm with Other Factors: As with any trading signal, it’s important to confirm the X3 pattern with other technical indicators, such as momentum oscillators, volume analysis, or support/resistance levels.

- Trade Execution: After identifying and confirming the X3 pattern, traders may execute trades based on the anticipated price movement suggested by the pattern. This typically involves placing entry, stop-loss, and take-profit orders according to the trading plan.

Both harmonic patterns and X3 chart patterns require practice and experience to recognize effectively. Traders should also consider risk management principles and trade with discipline to mitigate potential losses. Additionally, it’s essential to combine these patterns with other forms of analysis for a comprehensive trading strategy.

This article will explain how to use Harmonic Pattern and X3 Chart Pattern covering with Rolling Ball Effect for reversal trading strategy. Firstly, some trader asked me if they can use Harmonic Pattern Plus and X3 Chart Pattern Scanner together. The short answer is yes. It is possible to combine them. Even though both indicators detect harmonic patterns, they are using completely different pattern detection algorithm. Harmonic pattern Plus uses the classic pattern detection algorithm whereas X3 Chart Pattern Scanner uses non repainting pattern detection algorithm (i.e. latest pattern detection technology). There can be some overlapping in the detected patterns. However, many patterns can be detected in different timing. If both indicator detect the same patterns, then the patterns are often more accurate. At the same time, with non overlapping patterns, you have less chance to miss out the good signals. When you want to use the channel function together with Harmonic Pattern, then use the channel function in X3 Chart Pattern Scanner because it is more advanced version. Of course, the same logic applies to Harmonic Pattern Scenario planner.

Here we explain how to increase your trading performance when you trade with Harmonic Pattern and X3 Chart Pattern. You can read this especially if you are trading on reversal turning point. Let us start. We use turning point strategy because of their high reward/risk ratio. Higher rewards/risk ratio means relatively lower winning rate comparing to other lower rewards/risk trading setup. As an extreme example, in scalping, you can achieve over 90% of winning rate if you have the target profit of 1 pip against 20 or 30 pips risk. However, it does not mean that scalping is better technique than other strategies. With scalping, you have to increase frequency of trading to achieve the same profit level as other techniques do. In addition, few losing trades will risk your account quickly. In harmonic pattern trading, higher rewards/risk ratio will reduce your winning rate dramatically. It is hard to say exact winning rate. Roughly, your chance to be successful is somewhere between 10% and 60%. Of course, it can be higher depending on your discipline and rewards/risk ratio. When we trade with turning points, we can be wrong many times. However, few winning trades will offset your loss and will offer you profits. Several losing trades will never impose a lot of pressure on your account when you are taking reasonable risk for each trade. Turning point strategy has nice operating characteristics for trader. Unlimited profit range is the key merit on why the turning point strategy is loved by many traders. In addition, the required frequency of trading is much less than other trading strategy. This sort of strategy will fit to the life style of many of us. Having said that, many traders do not understand the skills and discipline required for turning point strategy. In essence, the key to apply successful turning point strategy is reducing number of losing trades.

To reduce number of losing trades and to increase your winning rate, you must understand the rolling ball effect. What is rolling ball effect? To explain the rolling ball effect in harmonic pattern context, let us start with some example of bullish harmonic patterns. We will be using bullish trading example thoroughly in this chapter. For selling case, please turn the logic explained here the other way around.

Most of time the bullish turning point will come after heavy selling period. In the case of global turning point, it would come after intensive selling. In the case of continuation and local turning point, the turning point will come after some selling. When we look back this in chart, it seems everything is ok. However, if we are standing at the time before the turning point happens, this is not fun to be honest. Especially we have just sent some large buying orders when all bearish investors think this might be suiciding. Even in this fearful moment, we still do this because we know that there are people waiting to enter buy when price is sufficiently discounted. However, this is only half of our equation.

To win, you have to understand the other half of equation. The other half of equation is that it is not easy to stop the rolling ball on the slope. Even the rolling ball reaches end of the slope, we cannot expect the rolling ball to be stopped right at the end because the rolling ball has the built up momentum in the rolling direction. Instead, it usually takes several hard attempts to stop them or they will role until they lose all the momentum by the friction of surface and air and other obstacles on its way. This rolling ball effect is the typical cause behind the failed harmonic patterns. Less sophisticated trader does not see this rolling ball effect. They are almost careless about the built-up momentum of the selling market. If you miss this point, you will be joining the 90/90/90 club, 90% of the traders losing 90% of their money within 90 days.

To deal with this rolling ball effect, sometimes, you can employ the multiple entry technique for harmonic pattern trading. In multiple entry technique, you will split your order into two or three smaller. At first, you will open first entry with the order size of half or one third of one full order. Then you will monitor how the market is responding. If market is going down further, this means that the rolling ball effect is still not cleared yet. As price is going down further, the harmonic pattern can fail. During this process, this might be losing trade or this might be breakeven if you are skilled. At the same time, you have to check if the market is showing some intent to become bullish or not for your future second entry. If the market showed some intent to become bullish, then you can wait for the second opportunity. It is important to have sufficient price distance between your first and second entry though. Second entry must be well below outside the Pattern Completion Interval of the first entry to account for the rolling ball effect. If we meet the turning point in our first entry, it is the best scenario. In such scenario, make sure that you are using maximum profit range to account for the reduced position size. Even if our first entry did not go well, we still have the second chance. Now, you might be wondering how many entries are recommended in multiple entry. Typically, two is recommended and three is the maximum I can suggest. If you split your order into too many pieces, then you profit size is getting smaller too. I do not recommend going over more than three typically. Two is good choice and three is the maximum.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Related Products