Wave Indicator

EFW Analytics is a wave indicator designed for Fractal Wave Analysis for Forex and Stock trading. EFW Analytics is a great price action tool to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

- Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

- Superimposed Pattern Detection

- Equilibrium Fractal Wave (EFW) Channel detection

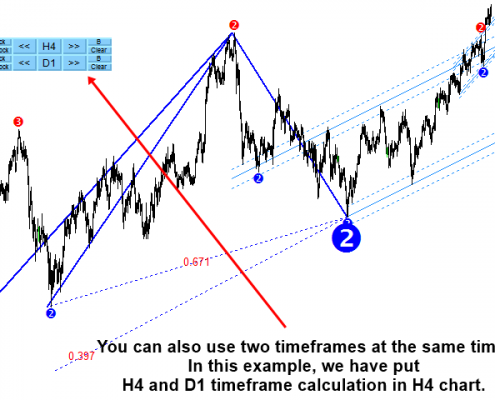

EFW Analytics provide the graphic rich and fully visual trading decision support. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Equilibrium Fractal Wave Index

Equilibrium Fractal Wave index is an exploratory analysis tool for your trading. How to use the EFW index is similar to Hurst Exponent by Harold Edwin Hurst (1880-1978) or Fractal Dimension coined by Mandelbrot in 1975. Literally, EFW index can help you to confirm the presence of equilibrium fractal waves in the financial market. However, Equilibrium fractal wave index is more practical and intuitive comparing to Hurst Exponent and Fractal Dimension for your trading. The value of equilibrium fractal wave index can range from 0.0 to over 1.0. The higher the equilibrium fractal wave index, you can confirm the stronger presence of a particular shape ratio of equilibrium fractal wave. Hence this ratio will be your choice of trading. If you strongly believe on Fibonacci ratios like 0.618, 0.382, etc, then you may skip this part because default ratio setting uses 0.382, 0.500 and 0.618. However, you will find that some Fibonacci ratios are not significant for some currency pairs.

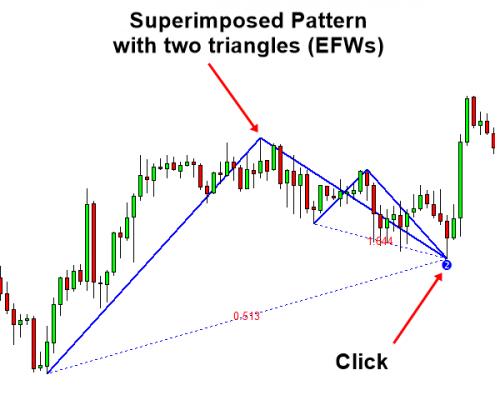

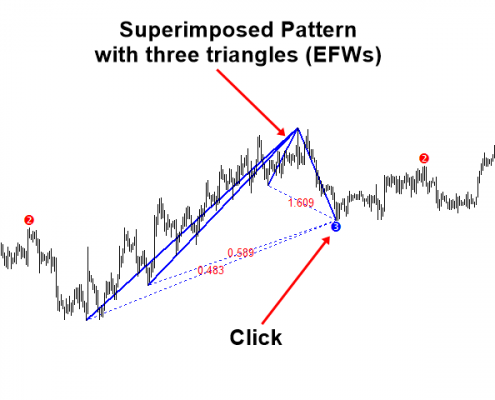

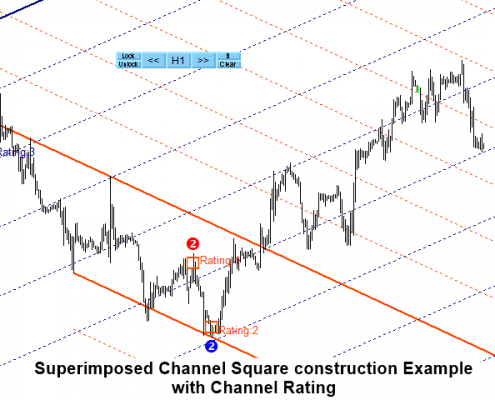

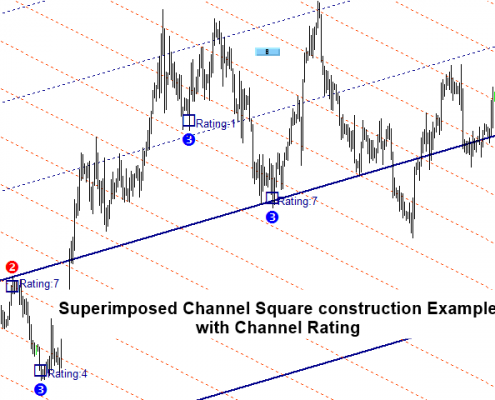

Superimposed Patterns

Superimposed patterns are the several triangles overlapping in the same place in your chart. Superimposed pattern can provide the good trading entries when it is used together with EFW channel.

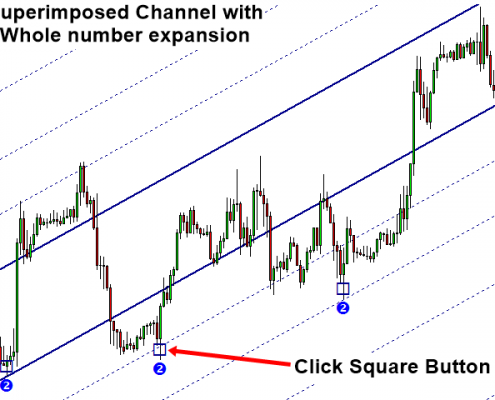

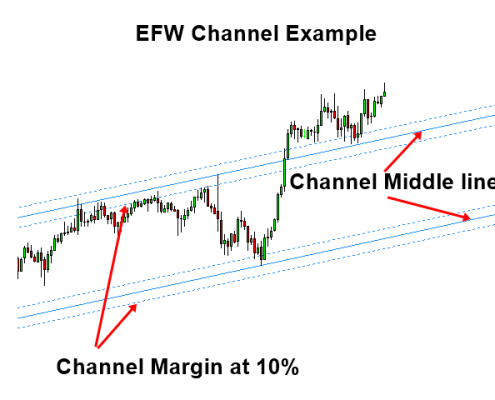

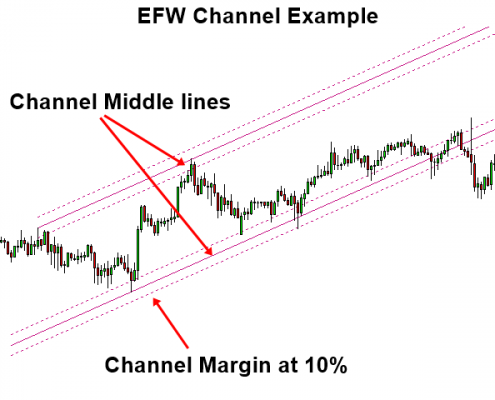

Equilibrium Fractal Wave (EFW) Channel

How to use EFW channel is extremely simple. You can use it for both breakout and reversal with EFW channel. When you trade with reveral trading strategy, you can tune your entry with superimposed pattern together. To manage your risk, you can simply use the proportional trigger method as it shown in the book “winning financial trading with equilibrium fractal wave” or “Financial Trading with Five Regularities of Nature: Scientific Guide to Price Action and Pattern Trading” (2017, Young Ho Seo).

How to Trade

When you use this tool alone, we recommend the combined signal from superimposed pattern and EFW channel. You can use EFW Analytics with some of our other products. Here is some example of trading signal you can generate:

- Superimposed patterns + EFW channel (Default Reversal trading strategy when you are using EFW Analytics alone)

- You can also use EFW Channel for breakout trading too. But please use your own setup for this case.

- Superimposed patterns + Price Breakout Pattern Scanner

- EFW channel + Harmonic Pattern Plus (or Harmonic Pattern Scenario Planner)

- Superimposed pattern or EFW channel + Mean Reversion Supply Demand

- Superimposed pattern or EFW channel + Elliott Wave Trend

- Superimposed pattern or EFW channel + Excessive Momentum Indicator

Indicator Setting

The EFW Analytics has five controllable inputs including:

- Common User setting – common input setting for EFW Analytics

- EFW Index setting – this input controls everything related to EFW index

- EFW Channel setting – this input controls everything related to EFW Channel

- Superimposed pattern setting – this input controls everything related Superimposed patterns

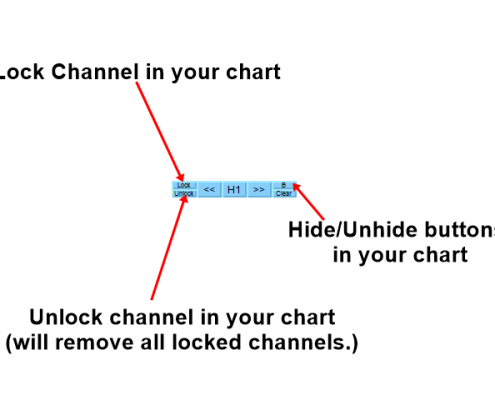

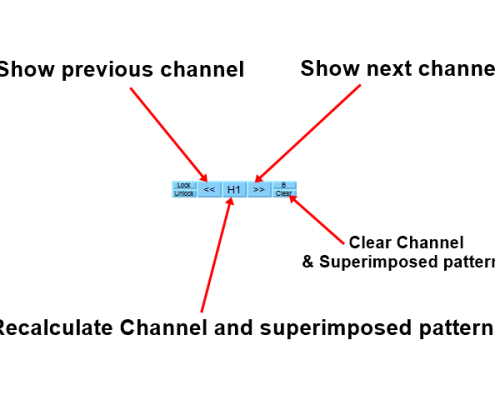

- Button display settings – this input controls how the buttons shows in your chart

Important Note

This product is the off the shelf product in the store. Therefore, we do not take any personal modification or personal customization request. For our products, we do not provide any code library or any support for your coding.