Pairs Trading

Pairs Trading is a strategy trading two currency pairs at the same time matching long position of the one currency pair against short position of another currency pair. Pairs trading can be applicable to Stock trading too. In fact, Pairs trading was originally born from the quantitative research in stock market trading. Pair trading naturally uses hedging between highly correlated pairs and due to such hedging potential, Pair trading strategy is often preferred between experienced traders. Due to the mathematical complexity in analytical framework, average traders often could not have access to Pair Trading Strategy. To bring the advanced trading strategy to all traders, we have brought Pair Trading Station but made it easy and simple.

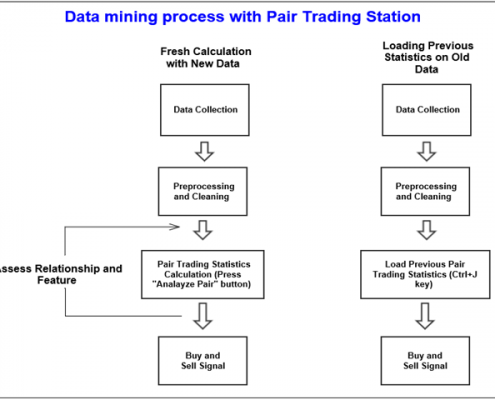

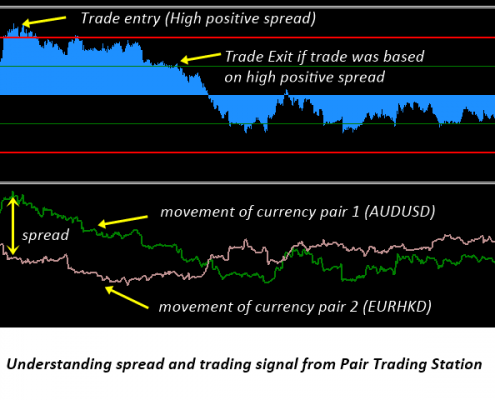

Pair Trading Station provides entry and exit signal purely based on Statistical analysis including correlation, co-integration and regression. This type of trading strategy is also called statistical arbitrage or spread betting between Professional traders. The operation principle of Pair Trading Station is based on big data analytics. Therefore it requires serious amount of data and serious amount of computation to extract intermarket knowledge from the data and their relationship. In industry, this kind of data mining task was carried out by some seriously qualified individuals and pulling insights from data normally involves serious amount of mining time too. Fortunately our Pair Trading Station is fully automatic and such a knowledge discovery can be performed by just one or two mouse clicks. So we can recommend our Pair Trading Station to all level of Professional Traders.

We also provide the free Pair Trading Spread Analyzer to add extra capability to our Pair Trading Station. So feel free to download this free Spread Analyzer and use it together. To run Pair Trading Spread Analyzer, you need to run Pair Trading Station in the first place. You can find more information for the Pair Trading Spread Analyzer in this link:

https://algotradinginvestment.wordpress.com/2018/08/27/pair-trading-spread-analyzer/

Pairs Trading Features

- Cover the blind area coming from Technical indicator and Price Action Trading – The Pair Trading Station uses established economic theory and it covers more of fundamental part of your trading. (Therefore, we recommend Pair Trading Station to traders who have good knowledge in technical indicator trading and Price Action Trading.)

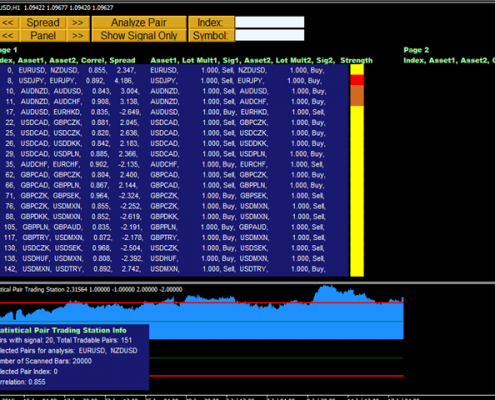

- Real Time Signal Scanning and ranking the signals for all currency pairs helps you to spot the easiest currency pairs to trade at that time. (We have tested up to 70 currency pairs for the functionality of Pair Trading Station.)

- Convenient way of intermarket analysis with few button clicks

- Fully automatic calculation and signal generating capability

- Research and strategy development capability for chosen currency pairs by displaying their historical spread and historical price series in the same charts

- Signal aggregation and Improvement in your profitability

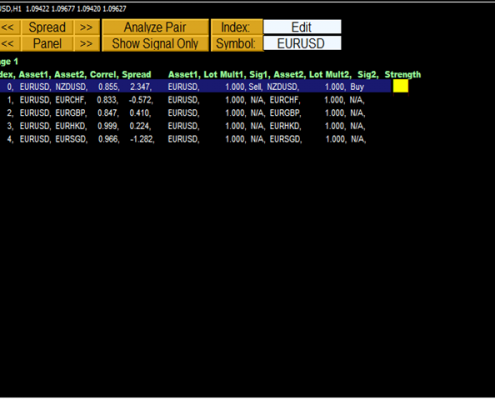

- Index search and Name search (name of currency pairs) to find out the current market state for your favourite pairs

Must Read and Follow

Keep the right amount of symbols in your market watch. Otherwise, it can overload your cpu and memory. Start with 8 important symbols first in market watch, then gradually increase the numbers as you understand the process.

Many traders are not aware of how much historical data is loaded in your charts. In default setting, normally short historical data, pre-set by your broker, is loaded on your charts. To quickly increase historical data in your charts for many currency pairs, in the history center, you can just download H1 historical data only for fast processing. Once the pair trading statistics is calculated and saved, you don’t have to worry about if your brokers overwrite or delete your historical data because Pair Trading Station will carry on generating signals using the saved information.

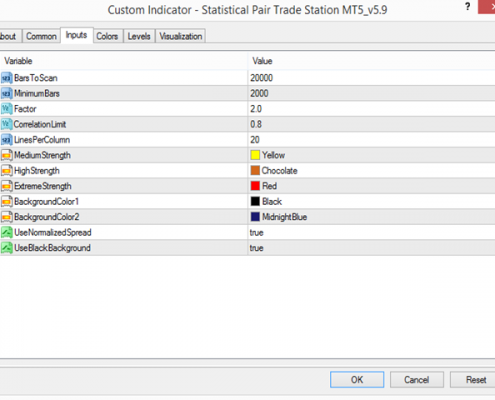

Pairs Trading Setting

- Bars to scan for calculation: To calculate pair trading statistics, you need to specify how much historical data you are going to use in the calculation. Check the currency pairs with smallest and largest historical data to get some idea of how much historical data is available in your Meta Trader terminal. Then choose good amount of data to calculate pair trading statistics.

- Minimum Bars to qualify for calculation: Pair Trading Station will skip calculation if currency pair have less than minimum bars

- Minimum Factor to qualify for signal: normally signal is qualified from factor 2 as in z score of standard deviation

- Correlation Limit to match pairs: If correlation is too low, then Pair Trading Statin will skip the calculation.

- Lines Per Column when signal is displayed: This variable will specify how many lines of signal to be displayed per column in your chart

- Colour for Medium Strength Signal: Control colour for medium strength signal

- Colour for High Strength Signal: Control colour for high strength signal

- Colour for Extreme Strength Signal: Control colour for extreme strength signal

- Background colour 1: Control Background colour of your chart

- Background colour 2: Control Background colour of your chart

- Use Normalized Spread: To equally weight two currency pairs, Pair Trading Station will normalize the historical data to start with

- Use Black Background (default = true): Recommended to set to true most of time.

How to trade using Pair Trading Station

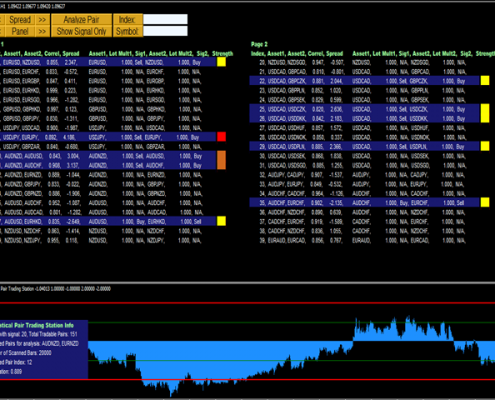

Once Pair Trading Station generated all the necessary statistics, Pair Trading Station will display buy and sell signals in your chart. Note that Pair Trading Station will show the signals from all the currency pairs in your market watch in one chart. Therefore you can monitor signals from 100 different currency pairs. You can get 3 type of signals including medium strength, high strength and extreme strength signals.

How to trade using this signal is straight forwards. There are three ways of using our Pair Trading Station in profitable way. Firstly, you can trade according to the entry signal given from Pair Trading Station. Secondly, you can avoid trading against the signal given from Pair Trading Station if you have your own trading strategy. The signal generated from Pair trading station is very similar to economic force monitored by Professional Economist or such big spread between highly correlated pairs could possibly highlighted in the main headline on the Economic news. Therefore, it is not wise to trade against the signal given from Pair Trading Station. Thirdly you can use your own trading strategy as a primary decision making tool and then you can use the intermarket knowledge from Pair Trading station on top.

If you are trading according to the signal from Pair Trading Station, then you should perform both buy and sell at the same time according to the recommendation given from Pair Trading Station to get hedging effects. The lot size for each currency pairs is also specified under the columns named Lot Mult1 and Lot Mult2. To perform pair trading, you just need to multiply this lot size to the amount of lot you want to open. Due to hedging, you don’t have to put stop loss or take profit target. Your take profit target and stop loss target is actually based on dollar value or percent value of your equity or spread and not based on pip values. So you will hold the two pairs buy and sell position until your position have target profit or target loss or spread is filled up.

If you want to use Pair Trading Station as your own macroeconomic indicators or intermarket analysis tool, this is also fine. As described before, the ways of calculating spread and their relationship is very much similar to analysis carried by professional economist. One piece of advice is that do not trade against the signals from Pair Trading Station. If possible, try to trade the same direction as Pair Trading Station.

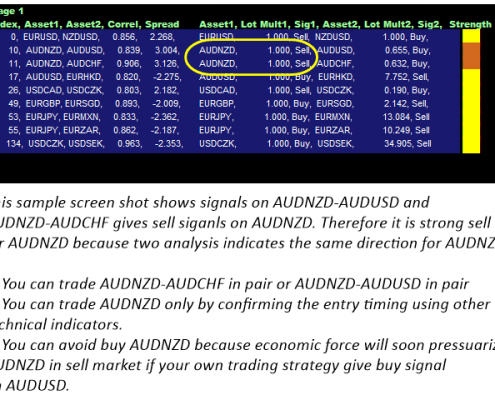

If you want to use your own trading strategy and you want to use Pair Trading Station to improve your trading strategy, this is also good reason to have Pair Trading Station. You will see that the aggregated signal will alerts you the weakness or strength of particular currency pairs you are watching. In this case, you can just perform buy or sell according to the signal from your trading strategy when Pair Trading Station give you the same directional advice to your trading Strategy.

Compatibility with other trading strategy

Pair Trading Station can cover the blind area of Price Action Trading and Technical Indicator trading. Therefore, you can combine Pair Trading Station with any other trading Strategy. When you use Pair Trading Station with Harmonic Pattern Plus or Price Breakout Pattern Scanner, simply don’t trade against signals from Pair Trading Station. For example, when Pair Trading Station, give you buy signals on EURUSD, then don’t open buy entry on EURUSD even if Harmonic Pattern Plus or Price Breakout Pattern Scanner might give you buy trading signals. You can do the same for your trading Strategy using technical indicators.

Important Note

This product is the off the shelf product in the store. Therefore, we do not take any personal modification or personal customization request. For our products, we do not provide any code library or any support for your coding.

Further Trading Tips

- Pair Trading Station is based on economic analysis of different currency pairs and not based on technical indicators. The signal is generated from spread between two co moving pairs.

- Pair Trading Station is recommended on H1 time frame. However, signals generated from H1 time frame can be used any time frame for your trading.

- Rather than making trading decision based on 1 signal, it is better to make decision when you see 3 or 4 signals agrees for sell or buy signal for that currency pairs. Pair Trading Station provide convenient ways of monitoring many currency pairs.

- You may use Pair Trading Station on its own or with your own Trading Strategy but you should never trade against the signals generated from Pair Trading Station. If your own trading strategy gives signal against Pair Trading Station, then you may just skip the signal.

- You can include as many currency pairs in your Market Watch. However, you can only trade if your broker offer access for that currency pairs. So make sure that you know what currency pairs you can trade with your brokers.

- Pair Trading Station need real time Ask and Bid price from your brokers to calculate the spread. Therefore, make sure that you only include the active currency pairs offered from your brokers in your analysis (i.e. in your Market Watch).

YouTube Video about Pairs Trading

YouTube Link: https://www.youtube.com/watch?v=fAE9pByxZDA