Pattern Completion Zone VS Potential Reversal Zone

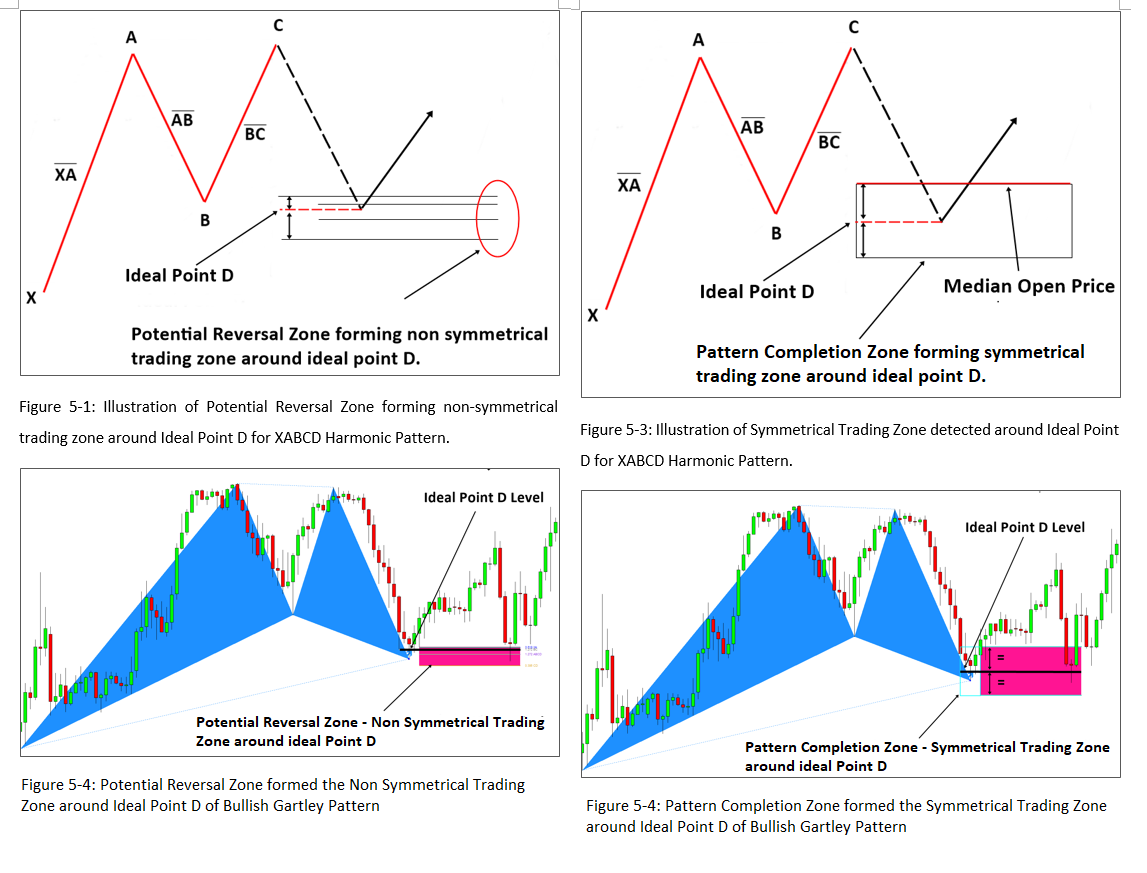

This article explains the trading entry for Harmonic Pattern with Pattern Completion Zone and Potential Reversal Zone. In previous chapter, we have described the Pattern Completion Zone, also known as Pattern Completion Interval, in details. Now many harmonic pattern trader can be curious how the Pattern Completion Zone (PCZ) is different from the Potential Reversal Zone (PRZ). In first place, as the PCZ and PRZ are derived from different process, they are different tool to trader. Having said that, the deriving process for PCZ and PRZ might be too complicated causing some traders to confuse the concept of each other. For this reason, we will clarify the difference by directly comparing PCZ and PRZ look. Let us look at the Potential Reversal Zone. So what is Potential Reversal Zone? Simply speaking potential Reversal zone is the area where three or four Fibonacci levels are converging together. Potential Reversal Zone can be used to detect the final Point D of the Harmonic Pattern by projecting several Fibonacci retracements respectively from the point X, A, B and C. The area of the Potential Reversal Zone can be defined by the top and the bottom projected levels in the all projected levels as shown in Figure 5-1.

The main difference between PCZ and PRZ is that Pattern Completion Zone forms the strict Symmetrical Trading Zone around the ideal Point D (Figure 5-3 and Figure 5-4). The Potential Reversal Zone (PRZ) does not form the symmetrical zone. However, the PRZ area formation is dependent on the location of each Fibonacci level projections as shown in Figure 5-1 and Figure 5-2. Sometime PRZ area can form the symmetrical trading zone but it is only by chance. Most of time, Potential Reversal Zone will not form the symmetrical trading zone. On the other hands, Pattern Completion Zone will strictly form symmetrical trading zone for every harmonic pattern. Due to this symmetrical property of the Pattern Completion Zone (= Pattern Completion Interval), trader can use many different trading strategies around the symmetrical trading zone beyond the classic harmonic pattern trading setup. With Pattern completion Zone, you can expand your classic trend reversal entry to hedging and breakout trading by setting identical but opposite trading. For example, for bullish Harmonic Pattern formation, you are able to setup the buy and sell hedging positions or straddle breakout setup around the Pattern Completion Zone. This is possible because the Pattern Completion Zone provides the median open price, which can be mirrored around the Ideal Point D.

In addition, Pattern Completion Zone provides you the direct numerical description corresponding to the size of the Harmonic Pattern. Therefore, the size of symmetrical trading zone around the Pattern Completion Zone is a sensible measurement for your stop loss and take profit for each Harmonic Pattern. Especially, once you have mastered the Pattern Completion Zone for your trading, you can gauge your Reward/Risk Ratio with real time market data without the need of any other additional tools. You can expand this with limit and stop order for better managing your order and risk. Overall, Pattern Completion Zone can provide you precise and fast decision-making process for your Harmonic Pattern Trading. In next chapter, we will continue to show you how the symmetrical trading zone works to manage your order and risk in details.

If you want to access automated Harmonic Pattern Detector, then you can also buy the Harmonic Pattern Plus or X3 Chart Pattern Scanner available in MetaTrader 4 and MetaTrader 5. In Harmonic Pattern Plus, you can access many additional features on top of the harmonic pattern trading signals. For example, you can also access Advanced Channel and around 52 Japanese candlestick pattern. It will also draw the Pattern Completion Interval automatically in your chart helping you to set your stop loss and take profit targets. It is a repainting indicator but it comes at the affordable price.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

If you need more advanced one than Harmonic Pattern Plus, then you can use our X3 Chart Pattern Scanner. X3 Chart Pattern Scanner is the non repainting and non lagging Harmonic Pattern and Elliott Wave Pattern Scanner with multiple of advanced features. You can even customize the patterns you want to detect by changing their pattern structure. At the same time, you can use both repainting and non repainting Harmonic Pattern Indicator together. This means that you can combine to use Harmonic Pattern Plus with X3 Chart Pattern Scanner if you wish.

Below are the Links to X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

You can read Guide to Precision Harmonic Pattern Trading to understand more about the Harmonic Pattern Strategy.

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

Related Products