Questions on Defining Profitable Patterns

Please attempt to answer to all these questions after you have read about Defining Profitable Patterns within 20 minutes.

1. Find wrong statement

a) Retracement ratio (R) is calculated by dividing right swing by left swing of a triangle.

b) Expansion ratio (E) is calculated by dividing right swing by left swing of a triangle.

c) Closing Retracement ratio (C) is calculated by dividing right swing by left swing of a triangle.

d) Factored Expansion (F) is calculated by dividing right swing of the first triangle by left swing of the first triangle.

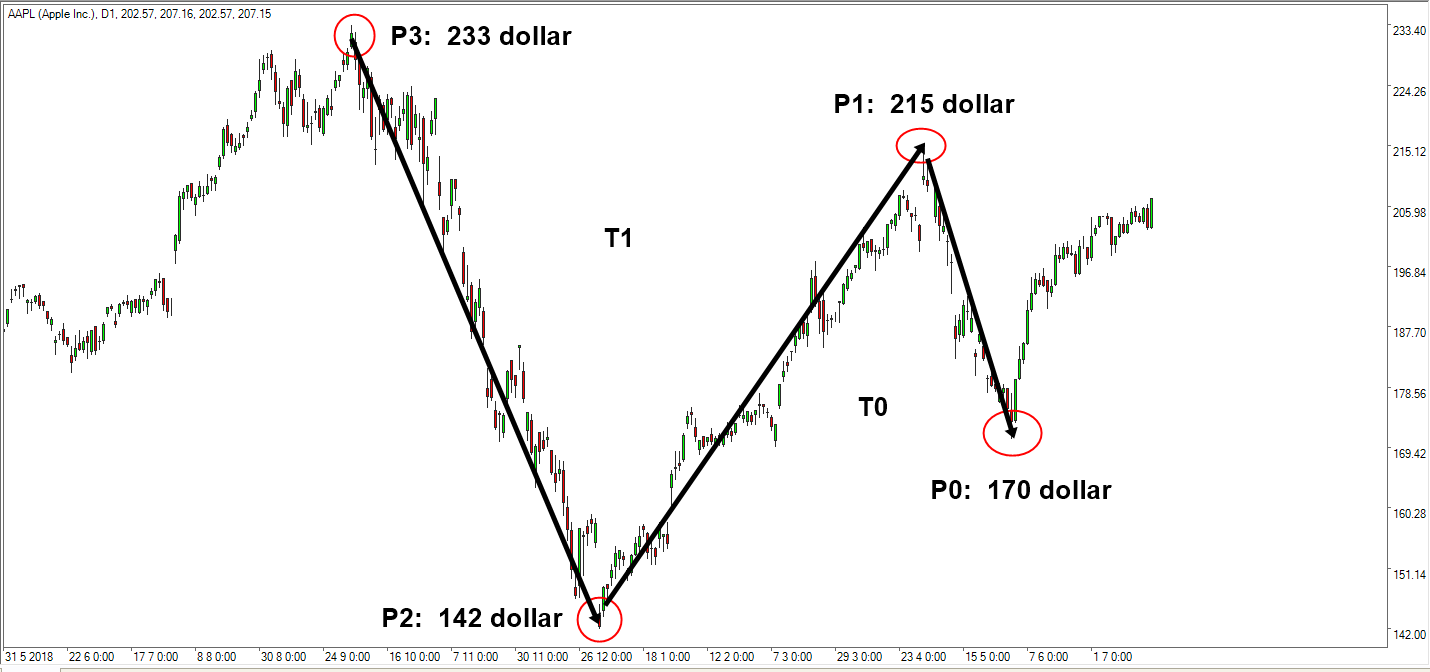

2. Below is Apple’s Stock price. Calculate height of right swing (Y0) and left swing (Y1) of Triangle 0 (T0)

3. Below is Apple’s Stock price. Calculate height of right swing (Y1) and left swing (Y2) of Triangle 1 (T1)

4. Below is Apple’s Stock price. Calculate Retracement ratio (R0) at P0 for Apple’s Stock price

5. Below is Apple’s Stock price. Calculate Retracement ratio (R1) at P0 for Apple’s Stock price

6. Below is Apple’s Stock price. Calculate Expansion ratio (E0) at P0 for Apple’s Stock price

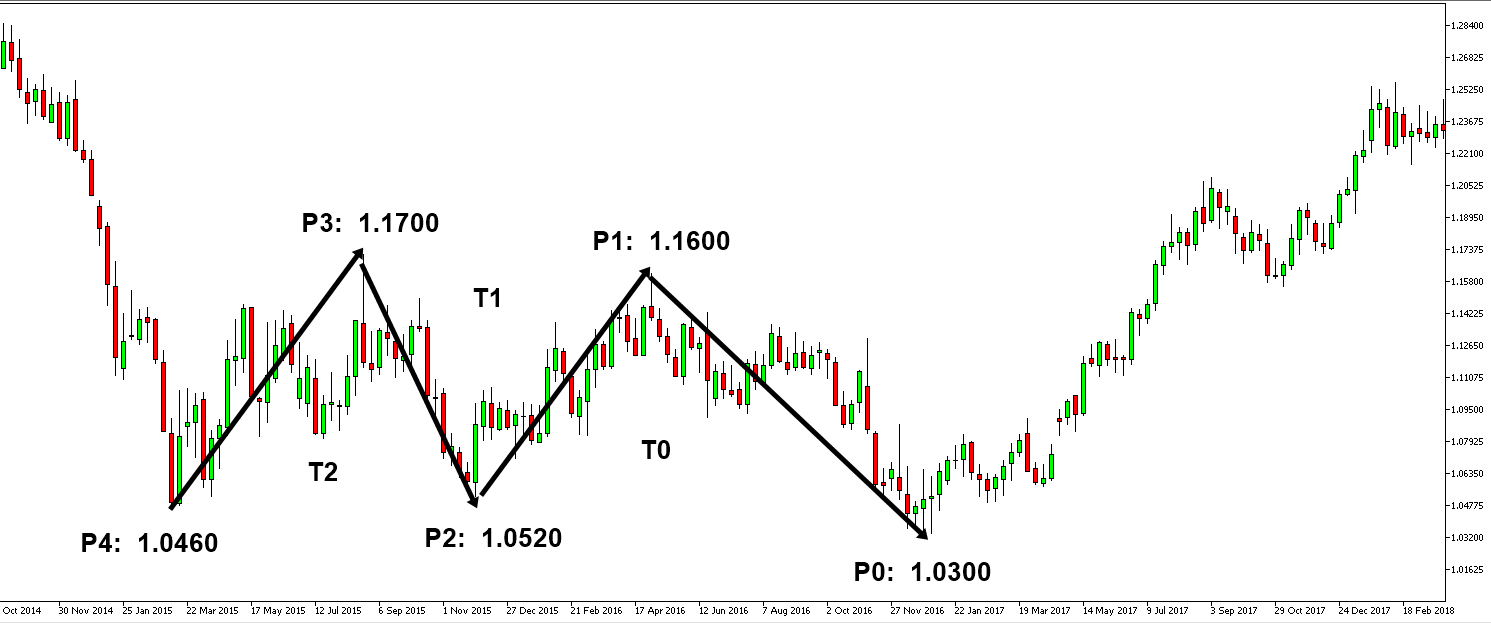

7. Below is EURUSD price. Calculate height of right swing (Y0) and left swing (Y1) of Triangle 0 (T0)

8. Below is EURUSD price. Calculate height of right swing (Y1) and left swing (Y2) of Triangle 1 (T1)

9. Below is EURUSD price. Calculate height of right swing (Y2) and left swing (Y3) of Triangle 2 (T2)

10. Below is EURUSD price. Calculate Retracement ratio (R0) at P0 for EURUSD price

11. Below is EURUSD price. Calculate Retracement ratio (R1) at P0 for EURUSD price

12. Below is EURUSD price. Calculate Retracement ratio (R2) at P0 for EURUSD price

13. Below is EURUSD price. Calculate Closing Retracement (C0) for T0, T1 and T2.

14. Below is EURUSD price. Calculate Expansion ratio at P0.

15. Below is EURUSD price. Calculate Factored Expansion ratio for T0: 1 by T2: 1

About this Article

This article is the part taken from the draft version of the Book: Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern). This article is only draft and it will be not updated to the completed version on the release of the book. However, this article will serve you to gather the important knowledge in financial trading. This article is also recommended to read before using Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and Profitable Pattern Scanner, which is available for MetaTrader or Optimum Chart.

Below is the landing page for Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner in MetaTrader. All these products are also available from www.mql5.com too.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Related Products