Profitable Chart Patterns in Forex Market

In the forex market, profitable chart patterns are visual representations of price movements over time that traders use to analyze and predict future price movements. Some chart patterns have historically shown a tendency to be profitable when used in conjunction with other technical analysis tools and risk management strategies. Here are a few of the most commonly recognized profitable chart patterns in the forex market:

- Gartley Pattern: The Gartley pattern is named after H.M. Gartley and is one of the earliest harmonic patterns identified. It consists of four price swings, forming specific Fibonacci ratios. The pattern typically resembles an “M” or “W” shape and indicates potential trend reversals. The key Fibonacci ratios involved are 0.618 and its inverses.

- Butterfly Pattern: The butterfly pattern is similar to the Gartley pattern but has more stringent Fibonacci ratios. It is characterized by a sharp reversal point that marks the completion of the pattern. The pattern resembles the wings of a butterfly and consists of three legs. The critical Fibonacci ratios involved are 0.786 and 1.272.

- Bat Pattern: The bat pattern is another variation of the Gartley pattern with tighter Fibonacci ratios. It typically forms after a significant price move and indicates potential reversal points. The pattern consists of four legs and resembles the shape of a bat’s wings. The key Fibonacci ratios involved are 0.886 and 0.886 of XA leg.

- Crab Pattern: The crab pattern is one of the most precise harmonic patterns and has the most stringent Fibonacci ratios. It is characterized by deep retracements and sharp reversals. The pattern consists of five legs and is often seen as a reversal signal at extreme market points. The key Fibonacci ratios involved are 0.382, 0.618, 1.618, and 2.618.

- Shark Pattern: The shark pattern is relatively rare but is known for its accuracy when it does occur. It is characterized by deep retracements against the prevailing trend and indicates potential trend continuation rather than reversal. The pattern consists of five legs and is defined by specific Fibonacci ratios. The key Fibonacci ratios involved are 0.886, 1.13, 1.618, and 2.24.

- Head and Shoulders: This pattern consists of three peaks—the left shoulder, head, and right shoulder—where the central peak (head) is higher than the other two. It indicates a potential trend reversal from bullish to bearish or vice versa.

- Double Top and Double Bottom: These patterns occur when the price reaches a peak (double top) or trough (double bottom) twice before reversing direction. Double tops often signal a bearish reversal, while double bottoms indicate a bullish reversal.

- Ascending and Descending Triangles: Ascending triangles form when there is a horizontal resistance level and an upward sloping trendline. Descending triangles form when there is a horizontal support level and a downward sloping trendline. Both patterns suggest a potential breakout in the direction of the prevailing trend.

- Flags and Pennants: Flags and pennants are continuation patterns that occur after a strong price movement. Flags are rectangular-shaped, while pennants are small symmetrical triangles. Both patterns suggest a brief consolidation before the continuation of the previous trend.

- Wedges: Rising wedges occur when both the slope of the upper resistance line and the slope of the lower support line are rising. Falling wedges occur when both lines are falling. Rising wedges typically signal a bearish reversal, while falling wedges indicate a bullish reversal.

- Cup and Handle: This pattern resembles a tea cup with a handle and is considered a bullish continuation pattern. The cup is formed by a rounding bottom, followed by a consolidation period forming the handle. Traders typically look for a breakout above the handle’s resistance level to enter a long position.

- Symmetrical Triangles: Symmetrical triangles form when the slope of the upper resistance line and the slope of the lower support line converge. This pattern suggests indecision in the market and can lead to either a bullish or bearish breakout.

It’s important to note that while these chart patterns can be profitable when identified correctly, they are not foolproof and should be used in conjunction with other technical indicators, risk management strategies, and fundamental analysis for comprehensive trading decisions. Additionally, false signals and market noise can occur, so traders should always exercise caution and use proper risk management techniques.

Profitable Chart Pattern is the technical tool in detecting turning point when you trade in Forex and Stock market. Fractal wave is our specialized microscope in studying the profitable chart patterns in the financial market. Then you might be curious why turning points or zigzag price patterns happen fundamentally. This is an important question in our trading. To answer the question, we need to understand a underlying theory behind the Profitable Chart Pattern, which is known as Fractal Wave.

Fractal or Fractal wave is commonly observable in nature like in snowflake, in tree leaves, in heartbeat rate, and in coastal line. Hence, many traders believe that identifying profitable patterns in price series are the same as spotting natural order or regularity. By definition, Fractal wave is infinitely repeating self-similar patterns in time domain. The main regularity in Fractal wave is the shape of the pattern. Typically, this shape of pattern is referenced for some geometric shapes like triangle, circle, square, etc. In Fractal wave, we can have both strict self-similar and loose self-similar patterns. If the repeating patterns have the same geometric shape and all individual patterns have matching parameters in that shape (i.e. ratio of width to height in rectangle or angles of triangle), we call this as strict self-similarity. If repeating patterns have the same geometric shape but majority of individual patterns have non-matching parameters in that shape, then we call this as loose self-similarity. Fractal wave in Forex and Stock market price series have triangle as the geometric shape. However, individual triangle can be wider, narrower, longer, and shorter than other triangles. Hence, Fractal Wave in Forex and Stock market data possess the loose self–similarity. Loose self-similarity does not mean that all the triangles are non-identical in shape. Even in loose self-similarity, we can have some triangles in identical shape or at least within allowed range in precision.

First important characteristic of fractal wave is the infinite scales. In theory, repeating triangles in forex and stock market can have infinite variation of scales from very small to extremely large triangles. For example, one day we can observe one triangle formed in thirty seconds but another triangle in same shape can be formed in thirty days. In our pattern study, scale is an independent factor. As long as triangles are identical in shape, or within allowed range in precision, triangle formed in thirty seconds is treated as identical to the triangle formed in thirty days, regardless of their size. For some practical example, Fibonacci price pattern with 61.8% retracement formed in twenty-candle bar in hourly timeframe is an identical pattern to the other 61.8% retracement pattern formed in thirty six candle bar in daily timeframe. Hence, we use Fibonacci price pattern with 61.8% retracement to make buy and sell decision across all timeframe.

Second important characteristic about Fractal wave pattern is that many small pattern are jagged together to make a bigger pattern. For example, in triangular fractal wave as in financial market, one bigger triangle can be formed from many small triangles. In our pattern study, we often seek this sort of jagged patterns for our trading opportunity. Especially, in Harmonic pattern, Elliott Wave patterns, and X3 patterns, this sort of jagged pattern are commonly utilized to find the profitable patterns with good success rate.

Recognizing Chart Patterns is the valuable skills for your trading. These Chart Patterns can help your trading immensely but in different angles from the technical indicators. Of course, you will need some guidance before you can apply these profitable Chart Patterns for your trading. Consider to take some time to practice trading with these Chart patterns. This could become the game changer for your trading career. If you want to become successful trader, you need both knowledge and practice on how these Chart Patterns works for your trading. You can use them together with fundamental data if you wish.

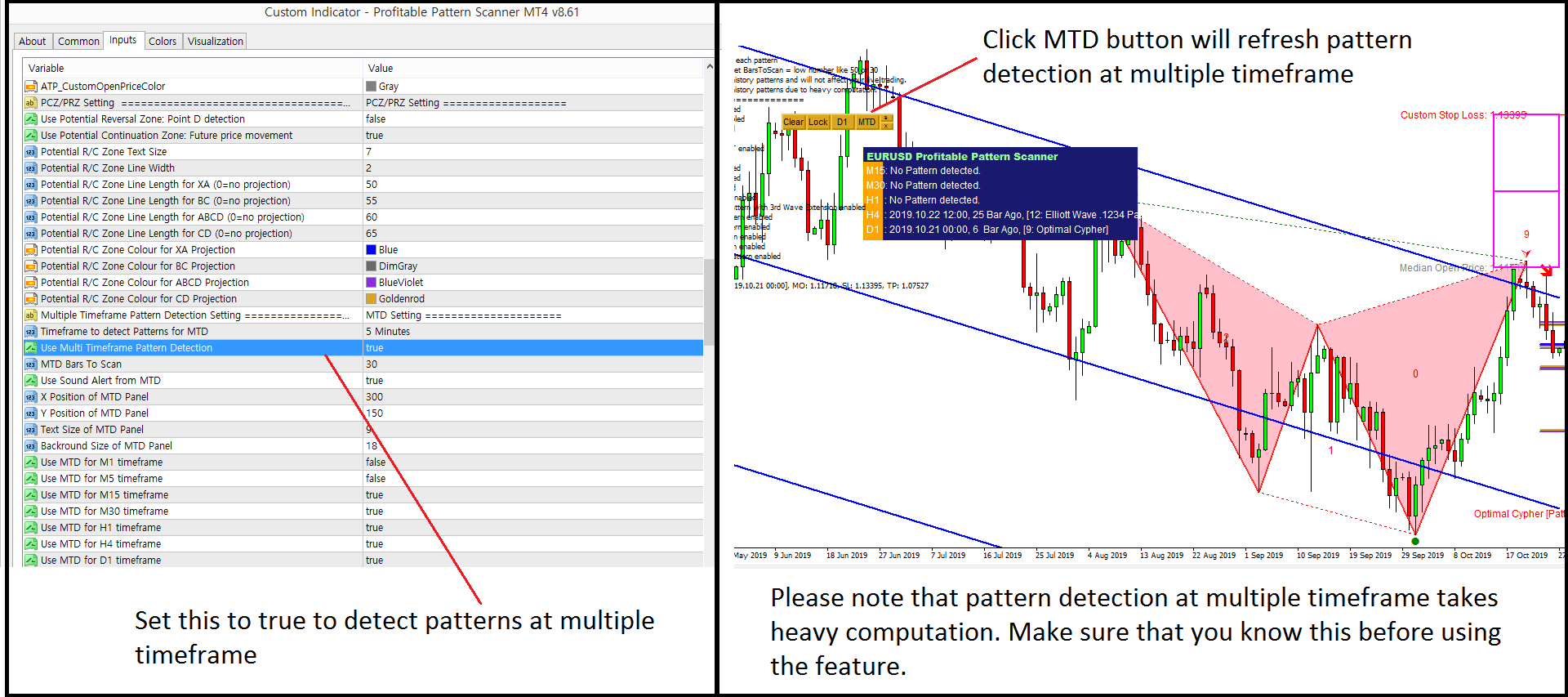

We do have some automated tools in detecting these profitable patterns for your trading too. Below are the links to the two of these automated profitable pattern detection indicator for your trading designed in Metatrader 4 and MetaTrader 5 platform.

Harmonic Pattern Scenario planner

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

In addition, you can find the book explaining some basics of these chart patterns. Below are the links to the book: Profitable Chart Patterns in Forex and Stock Market: Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern. It is available from major book distributors.

Link to Book 1: https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

Link to Book 2: https://books2read.com/u/m0rgOW

Related Products