Mean Reversion Supply Demand Basic Guideline

The supply and demand zone indicator is a tool used in technical analysis to identify potential levels where the market may experience a shift in direction. These zones are based on the principles of supply and demand, where supply represents the level at which sellers are willing to sell an asset, and demand represents the level at which buyers are willing to buy. In the context of mean reversion, the supply and demand zone indicator can be particularly useful. Mean reversion is the theory that prices tend to revert to their historical averages over time. When prices deviate significantly from these averages, there is a tendency for them to move back towards the mean.

Here’s how the supply and demand zone indicator relates to mean reversion:

- Identifying Extremes: Supply and demand zones are often found at price levels where there has been a significant imbalance between buyers and sellers, leading to a sharp move in price. These zones can represent extremes in market sentiment, which may lead to mean reversion.

- Reversion to the Mean: When prices reach these supply or demand zones, traders often expect a reversal or at least a retracement towards the mean. This means that if the price has moved excessively in one direction, it’s likely to correct back towards its average value.

- Confirmation Signals: Traders using the supply and demand zone indicator for mean reversion often look for additional confirmation signals before entering a trade. This could include candlestick patterns, momentum indicators, or trend analysis to validate the potential for a mean reversion move.

- Risk Management: Like any trading strategy, mean reversion trading with supply and demand zones requires proper risk management. Traders should set stop-loss orders to limit potential losses if the price continues to move against their position. Additionally, they should have a clear exit strategy if the price fails to revert to the mean as expected.

- Time Frame Consideration: Mean reversion trading with supply and demand zones can vary in effectiveness depending on the time frame being analyzed. Shorter time frames may exhibit more noise and false signals, while longer time frames may provide more reliable indications of mean reversion.

Overall, the supply and demand zone indicator can be a valuable tool for traders employing mean reversion strategies, helping them identify potential reversal points in the market and manage their trades effectively. However, like any trading approach, it’s essential to combine it with other analysis techniques and exercise proper risk management.

Supply and Demand zone is the extended version of support and resistance trading with more skills. We provide our own Supply and Demand Zone indicator, Mean Reversion Supply Demand.

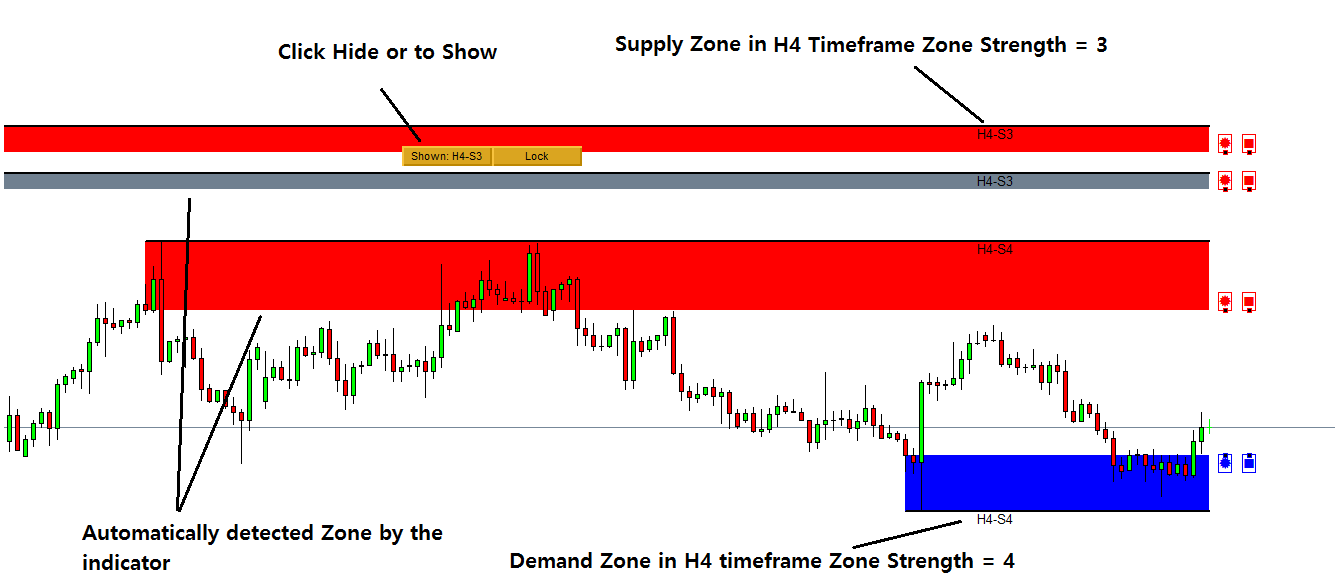

Here is the really basic guideline in using Mean Reversion Supply Demand.

- H4 = Zone detected in H4 timeframe

- S3 = Zone Strength 3

You can also show or hide zones from your chart using button click.

Below are the links to the Mean Reversion Supply Demand indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Related Products