YouTube Video for X3 Chart Pattern Scanner

“X3 Chart Pattern” was born with RECF chart pattern framework, consists of retracement, expansion, closed retracement, factored expansion for technical analyst. X3 Chart pattern was initially developed to conduct the scientific research over the existing price patterns like Fibonacci price pattern, Harmonic Pattern and Elliott Wave Theory. Then it was developed further to improve over the limitations and weakness of the existing price patterns.

Firstly, all the previous pattern theory used points and lines as the main reference in their pattern structure. For example, in Harmonic Pattern, the main reference to its structure is the XABCD points. This letter is assigned to each point in the price pattern. In Elliott Wave, the main reference to its pattern structure is Wave 12345 and Wave ABC. Each number and letter in Elliott Wave represent the price swing at each wave. The building block of the ratio analysis over the price pattern is a triangle, which is made up from three zigzag points or two price swings. Hence, in the X3 Chart pattern, the main reference to the pattern structure is the triangles of the pattern instead of points and lines. When you have too many point and line references in the pattern structure, we will feel not easy as the number of lines and points are increasing in our chart. Hence, we are limited to study more complex patterns with points and lines. When you study the triangles of the price pattern directly, you can study more complex pattern structure with less overhead cost as well as with shorter expression.

Secondly, Fibonacci price pattern, Harmonic pattern, and Elliott Wave theory are Fibonacci number oriented. In regards to this point, here is some data present. We have created the distribution of Retracement ratios present in several currency data. This retracement ratio was counted after the price series was transformed to Peaks and Troughs. We can tell that some Fibonacci ratios are placed on top of distribution but some of the non-Fibonacci ratio like 0.55 or 0.66 was placed higher over 0.500 and 0.618 for EURUSD daily timeframe. In GBPUSD, the Golden ratio 0.618 occurrences is far below the 0.500 ratio. In USDJPY, it is rather 0.750 ratio was placed on top of this distribution.

We can draw some important insight from the ratio distribution data. For example, Pattern with non-Fibonacci ratio can be as good as the patterns based on Fibonacci Ratios depending on the data. What is matter to trader is really the success rate of the pattern. However, do not get us wrong. X3 pattern framework does not discourage you to use Fibonacci ratio at all. It is not the point. If they work with sufficient success rate for your trading, you have no problem. X3 pattern framework does not mind to find the profitable patterns outside the Fibonacci ratio as well as inside Fibonacci ratios. It prevents you to search the profitable patterns inside the Fibonacci ratio only and it helps you to think outside the box.

Thirdly, the classic patterns have its fixed structure. For example, Harmonic pattern uses five points of XABCD (i.e. three triangles) and Elliott Wave pattern uses Wave 12345 (i.e. four triangles) as an impulse wave and Wave ABC (i.e. two triangles) as corrective wave. X3 Chart pattern allows you to readily modify their ratios to suit for the real world trading if you are not happy with the old ratios and if you feel the need for the improvement. In addition, X3 Chart pattern allows you to extend the pattern structure into more number of triangles readily. These features in X3 Chart pattern are important because the scientific trading is all about improving and fine-turning of what we have over time.

With the three points, we can tell that X3 chart pattern can provide the wider opportunity to find the profitable patterns. Still X3 chart patterns are based on the fractal wave analysis. Hence, X3 patterns share many similarities with Fibonacci price pattern, Harmonic pattern and Elliott wave patterns in terms of the trading application. Although under the X3 chart pattern framework, you could develop and create numerous price patterns to trade, we introduce five X3 chart patterns for the illustrative examples. These price patterns include Trident Pattern, Horse Pattern, Eagle pattern, Phoenix pattern, and star river pattern.

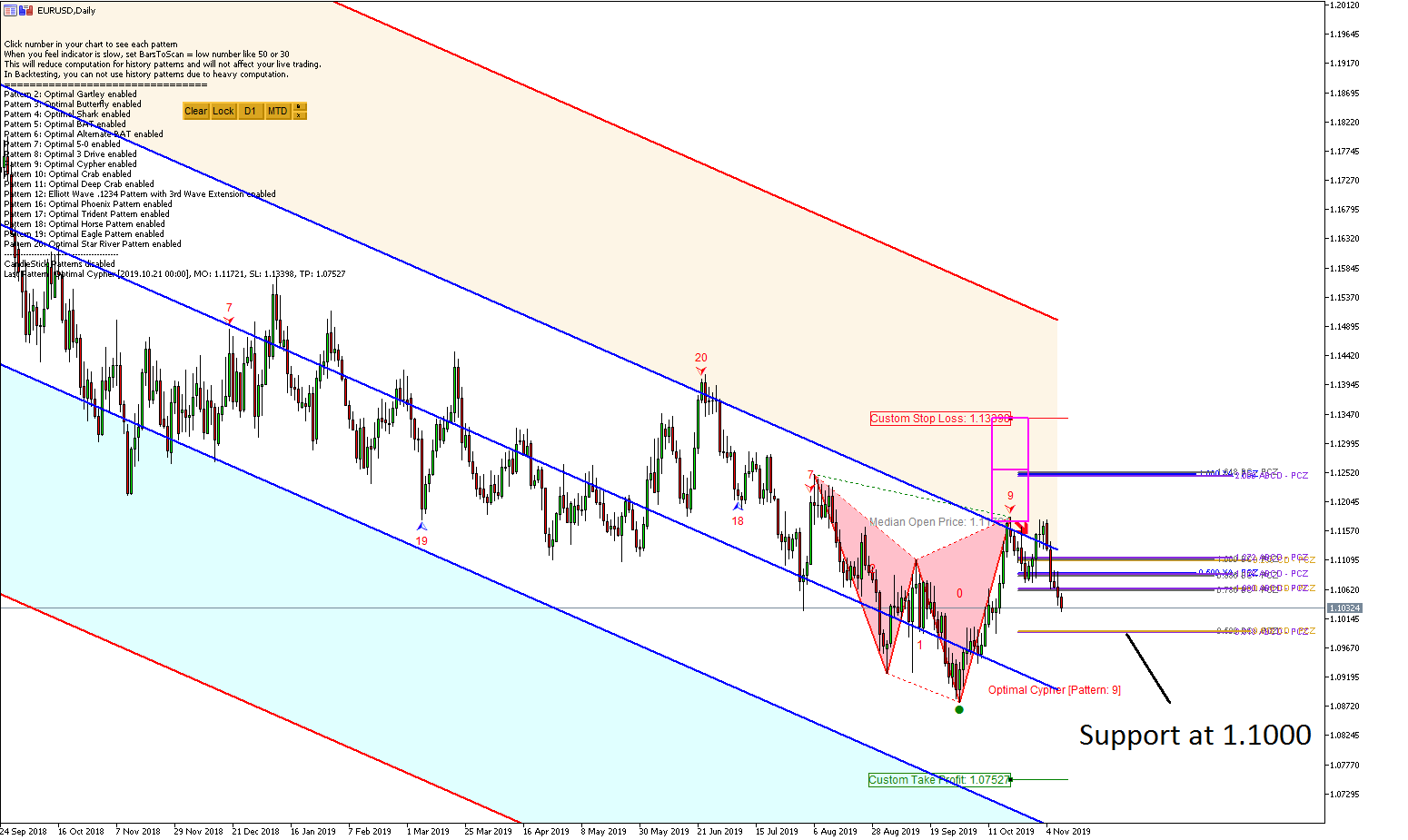

Video can explain a lot of details about how things works. You can use this video for first guide on using X3 Chart Pattern Scanner.

This video was originally created for the previous Optimal Turning Point Pattern Scanner. However, X3 Chart Pattern Scanner uses almost same user interface (with a lot of powerful additional features). Hence, you can use this video for X3 Chart Pattern Scanner too. For your information, since X3 Chart Pattern Scanner comes with a lot of new additional features, the video does not cover for those features. For example, X3 Chart pattern scanner can provide

- Harmonic Patterns

- X3 Chart Patterns

- 52 Japanese candlestick patterns

- Automatic double standard deviation channel

- and many more powerful features

Non Repainting Non Lagging Harmonic Pattern Scanner: https://www.youtube.com/watch?v=uMlmMquefGQ

Chart Pattern Scanner: https://youtu.be/2HMWZfchaEM

Also here is the product page for the X3 Chart Pattern Scanner. Enjoy the powerful non repainting and non lagging Harmonic Pattern, X3 Pattern and Elliott Wave Pattern indicator.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Related Products