Understanding Gann’s Angles with Probability – Brand New Technology

Gann’s Angles, aka Gann’s Fans, is popular trading concept. The idea behind Gann’s Angle is good. Gann Angles help us to measure the strength of trend based on these Angled lines. Gann’s Angle requires us to find the true 45 degree in our chart. However, in implementing the idea, there are some practical limitations. These practical limitations make it harder to use Gann’s Angle in our trading.

Let us try to understand what these limitations are in using Gann’s Angle in practice. Gann tried to equate price and time in 1 to 1 scale. In pursuing this idea, many of us can make some serious mistake. It is because price and time have different unit. In Forex market, price would be expressed as pips or points. In stock market, price would be expressed in US dollar or some other currency in the case of international stock market. The standard unit for time is second, minute, and hour. Probably this is clear to everyone.

Equating price and time in 1 to 1 scale is not necessarily achieved using the angle (or slope) with 1 pip to 1 second or with 1 dollar to second. There is no meaningful use for this angle (or slope) of 1 pip to 1 second or 1 dollar to 1 second. Price and time use different unit. Hence, no one would suggest that 1 pip of price should be equal to 1 second of time. There is no theoretical background behind this. When you try to equate to 1 pip to 1 minute or 100 pips to 1 hour, or 10 dollar to 5 minute, all these attempts does not make much difference.

However, just saying this is not enough for you. Hence, let us try to see what happens if we are using the angle (or slope) of 1 pip to 1 minute or 10 dollar to 5 minutes in practice.

Different platforms provide different implementation for Gann’s Angle – inconsistency

When each platform does not agree with each other, this is bad sign for consistency. For example, Gann’s Angle drawn in one platform looks different from the other platform, even though they are fixed to the same pip per candle bar. It is not only just they look different but also each line goes through different values. You can not trade if there is no consistency in chart.

The same Gann’s Angle reacts differently per symbols – inconsistency

This shows exactly why we should not be using the approach like equating 1 pip to 1 second or 20 pips to 1 hour, etc. Try on multiple charts, see what happens if you apply, for example, the angle with 10 pips to 1 hour or 10 dollar to 1 hour. The purpose of angle is to have some nice spacing between diagonal lines for our trading. However, applying 10 pips to 1 hour might look good on some currency pairs but in another currency pairs, the space between angles could be too narrow or too wide. Once again, you can not trade if there is no consistency in chart.

The same Gann’s Angle reacts differently per timeframe – inconsistency

Say you achieved nearly 45 degree in H1 timeframe using the angle of 100 pips per candle bar. Now when you apply the same angle of 100 pips per candle bar in Daily chart, we do not get the same good 45-degree dividing price and time as we have seen in H1 timeframe.

What is even worse? There is also possibility of your monitor screen resolution could play some roles in this inconsistency. For example, say that you found that good 45 degree angle in the monitor resolution of 1000 x 780, this can look different if someone is using the monitor with 2000 x 1400 resolution. For example, some good 45 degree in one resolution can look stretched or squeezed in another resolution in other monitors. Try to draw circle in one monitor, then you will see that the circle looks eclipse in another monitor as an example.

All this inconsistency will provide you room for subjectivity in your trading. Many of us have learnt that subjectivity is bad for trading through expensive practical lesson, for example, losing a lot of money in the market. Now we will show you how to overcome this inconsistency and subjectivity in using Gann’s Angles (aka Gann’s Fans).

Gann’s Angles with Probability

In spite of this inconsistency issues in Gann’s Angle, it is hard to give up the idea of equating price and time. Gann’s Angles is one of few ideas trying to relate price and time directly in the world of trading. As a trader, we know that it could be helpful if one can really equate price and time in more consistent manner. However, this has to be done with much smaller room or no room for subjectivity because we can not trade with inconsistency.

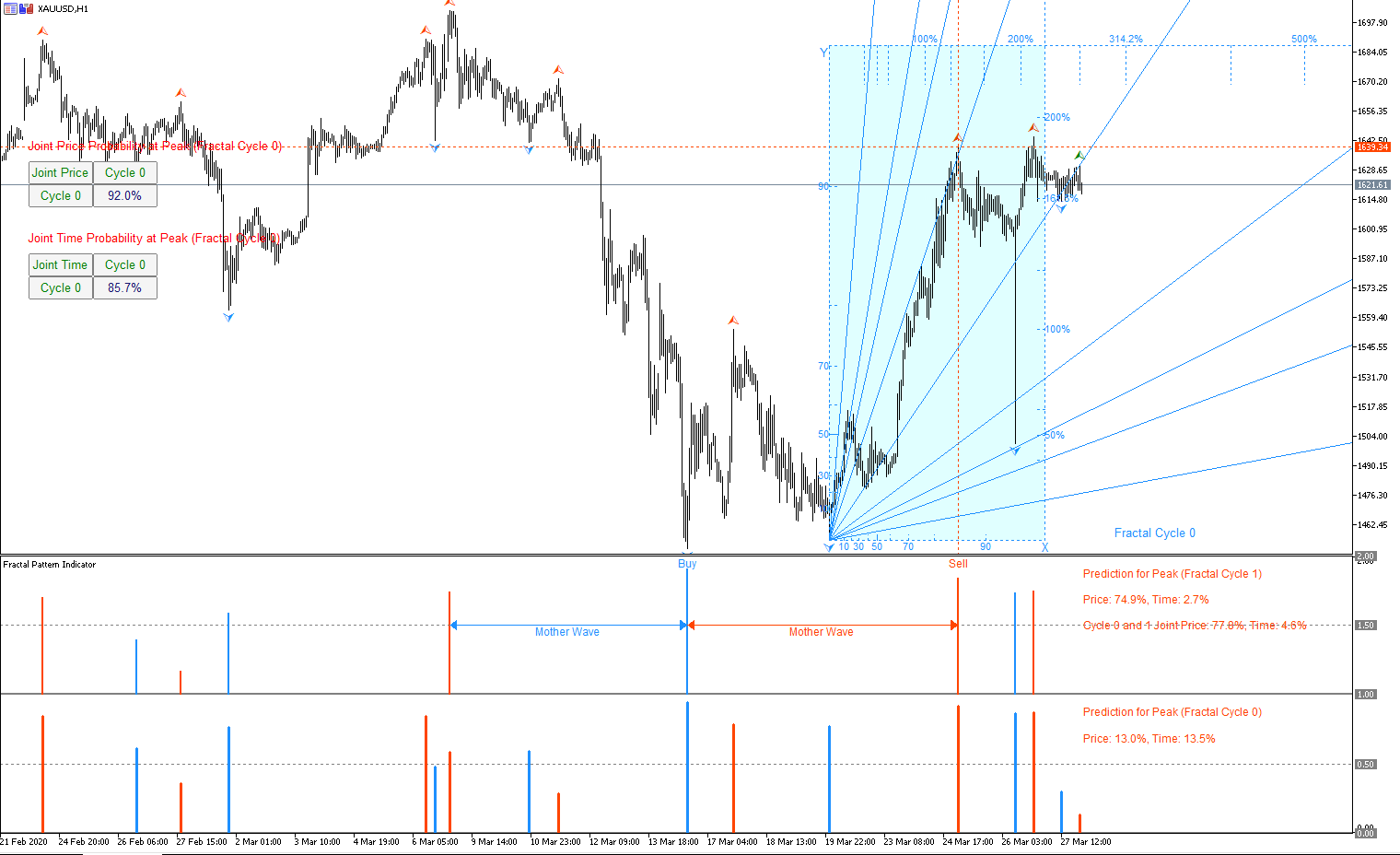

In this end, we made extensive research with many trials and errors, to find out the better way of equating price and time. In doing so, we need to find the common factor between price and time. For example, we need the same language which could be understood, in the point of price and time. The solution we find to reduce or to remove this inconsistency is using probability. Probability is universal language. Using probability, we can make sense out of both price and time. For example, 90% probability for price is equal to the 90% probability in time. In another words, we can equate price and time in fair manner using probability. This is something we can feel it much more than trying to equate some pips to candle bar or some dollar values to candle bar blindly.

This idea works across different timeframe and different symbols with consistency. In practice, we use empirical probability based on available price data. Hence, there could be some discrepancy in our probability measurement. This is fact too. Yes, we know there is no perfect being in this world. However, this is minor problem in comparing to the huge roller coast experience using the angle of 10 pips per candle bar or 10 dollar per candle bar. When you use probability, you do not have to worry about picking up new value for your angle every time. You can just use one setting for every different cases. They will divide price and time with sensible space for your trading. Hence, applying Gann’s Angle is automatic with probability.

What is even better? The probability measured is basically turning point probability telling you when market will reverse in price and time. Hence, you can use Gann Angles together with this probability information on your hands. Gann’s Angle will help you to measure the trend strength whereas probability will tell you the possible reversal point. In fact, you would be interesting to see how these angled lines interact together with this turning point probability in price and time dimension. Gann’s Angle with Probability is the brand new invention after our extensive research with Gann’s Angle in financial market. Fully featured Gann’s Angles with Probability is implemented and available inside Fractal Pattern Scanner.

Landing Page to Fractal Pattern Scanner

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Related Products