We decided to interview Plamen Ivanov as a part of the knowedge discovery project for traders. Just like many of Forex traders, Plamen Ivanov is a keen forex trader for last 4 years. With an open minded attitude, he respects both manual trading and robot trading at the same time. We asked many practical questions to share with other traders. So let’s start and see what we can learn from our conversation.

1. We know that you are from Bulgaria. Can you please compare that forex trading environment in your country to other places in the world?

P: Sadly, the standard of living here is not that high and sometimes people tend to gamble their money instead of investing it. They view trading /in particular Forex/ as gambling. They do not have the patience to invest in proper education and taking the whole thing seriously, which is different in the Western world. That is why the percentage of the so-called “90/90/90” /90% of the traders lose 90% of their money within 90 days/ is even higher here.

2. How long have you been trading currencies?

P: Since 2013. 4 years later I still have a lot to learn, but I think I have learned the most crucial lessons of Forex trading /and trading overall/:

– Being patient, thinking rational, having discipline.

– Do not risk money that you can not afford to lose.

– Invest your money in trading, only when you have a proper education /in my opinion ”Algo Trading and Investment” are a great option for a particular type of trading/ and proven track record with at least one year of testing.

3. Do you trade forex for a living?

P: No. I think you should have a stable income and invest some of the money in trading /if that is your thing/. If you hate your job that much – change it with another job and never depend on trading only. Spending your profits will not grow your account and that is what trading is all about.

4. Do you make money from trading currencies? Do you believe that Forex trading is better than other jobs?

P: Yes, but not much, because my investment is not that big. I prefer a steady growth and I do believe that the best approach is long-term trading based on:

– Higher time frames.

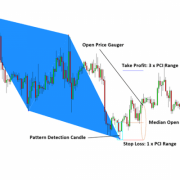

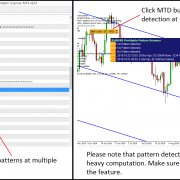

– Proven strategies like harmonic and breakout trading /“Algo Trading and Investment” provides one of the best tools/.

– Respecting fundamental analysis.

There are a million ways to make a million dollars and trading is just one of them. Do not force yourself into the idea that particular type of trading or trading overall is the only way to make money.

5. What trading platform or charting package do you use and why do you use them?

P: Metatrader 4 has a pretty good functionality and I use several charting packages. I am amazed by your “Harmonic Pattern Plus” and I am sure that it will be very helpful for me.

6. What are your favorite currency pairs to trade? In addition, why they are your favorite?

P: If you take trading seriously, you should be able to trade all currency pairs and all time frames. Nevertheless, I can not recommend that approach for novice traders, especially when it comes to fundamental analysis /information overload/.

7. Do you use Fundamental Trading or Technical Trading? Which one do you think more profitable?

P: The best way for me is to combine fundamental analysis and use technical analysis for entries and exits, but for sure there is a way to make money from technical analysis only and I do believe that harmonic and breakout trading is a great option.

8. What is your favorite technical analysis and why do you think they are best for your trading?

P: Harmonic and breakout trading. The most important reason is that they are both based on reading a price chart and not depending on lagging indicators. Harmonic and breakout trading predict future movements with or against the trend.

9. Describe your best trade, what currency pair, why you placed it, and how much profit did you make?

P: I consider every trade as “best” if it was placed according to my entry rules. Losses are part of trading, but probably another good lesson that I have learned so far is that you always have to use hard stop and floating take profit, which means that you always have to trade with “Stop-loss” and never use a fixed take profit. This way you can achieve much bigger profits.

10. What was your biggest mistake ever in Forex trading? Do you have some lesson for starters in Forex Trading?

P: Not following my rules and letting emotions take action. The Even bigger mistake is not knowing what you are doing, so you have to back- and forward test your strategy before you put your own money at risk.

11. As far as we know, you use both manual trading and automated trading. Which one is more powerful from your point of view? Do you believe that automated trading has the long-term future?

P: A combination of both. Some automated strategies can be profitable long-term, but most of them are focused on short-term trading/scalping, which is profitable in an ideal environment, which does not exist. I think automated trading can be useful for the so-called “trailing stop”, which can radically improve your Profit: Loss ratio.

12. If you want to give some advice to other forex traders, can you please share with them?

P:- Invest in proper education.

– Be patient and think long-term.

– Invest money that you can afford to lose.

Thanks Plamen for sharing your view on forex trading. I am sure that many forex traders do trade part time while they are having their full time job. I think your interview can offer the useful insight for those part time traders. We wish the best success for your manual trading and auto trading.

Leave a Reply

Want to join the discussion?Feel free to contribute!