Controversy in Harmonic Pattern

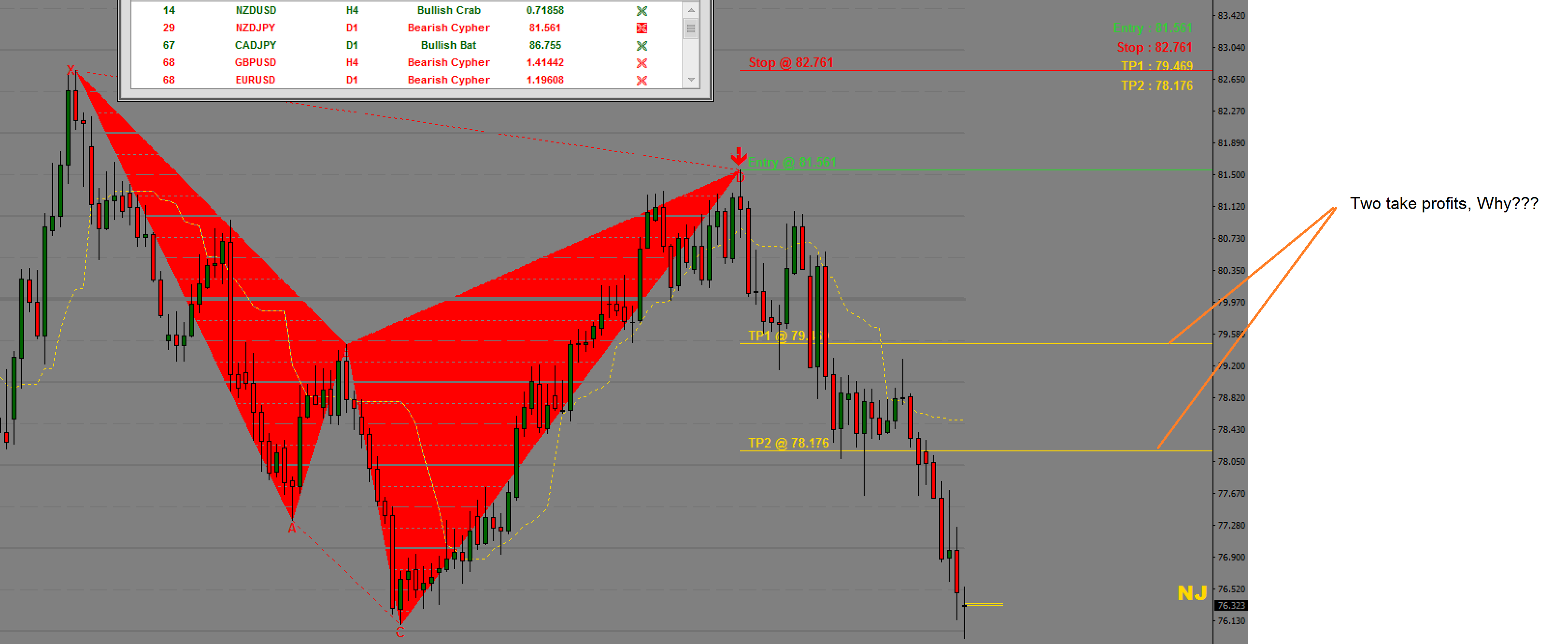

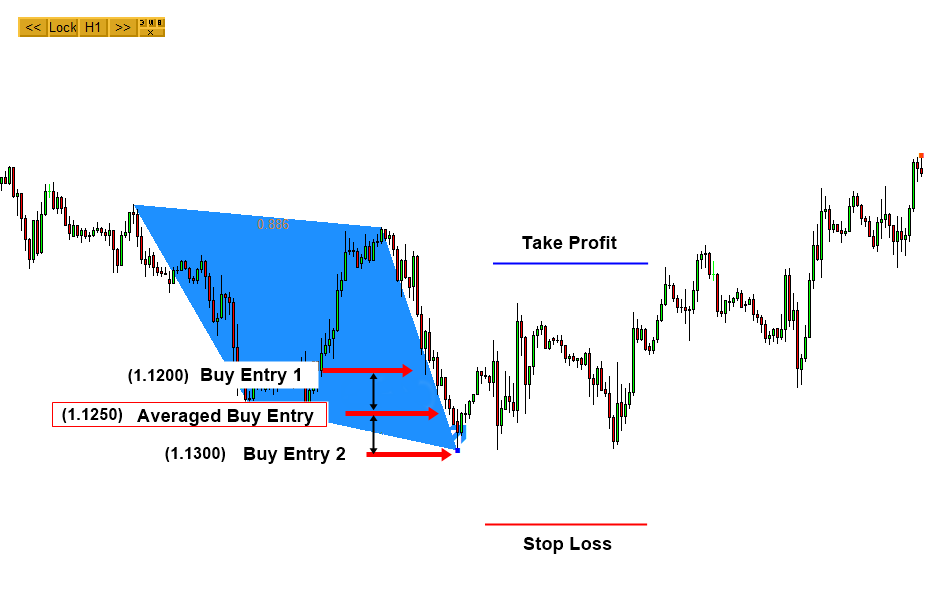

Some piece of information can be widely spread out and being accepted as granted even if they are wrong or highly controversial about Harmonic Pattern. One of this thing in Harmonic Pattern trading is taking the multiple exits as shown in many example pictures on google like below. This is just one example on the net and not exhausted example though. You can find millions of pictures like below.

I have seen this several years but I was watching this over and over on the internet waiting for someone to step up. But no one did. So I decided to step up to stop the spread of wrong information. Having said that, take what I wrote here as the purely knowledge point of view. Many traders already understand this point too. My point will be clearer if you try to understand in the view of grid trading system or any sort of multiple cycle hedging exit strategy. I built countless grid trading system and multiple cycle hedging system in the past. Grid trading or multiple cycle hedging exit strategy is another beast consistently used by multiple spectrum of traders. You will not able to imagine how many times I have backtested this sort of algorithm nearly every day in my life. Hence, reckoning the outcome of these type of trading system are really bread and butter for me.

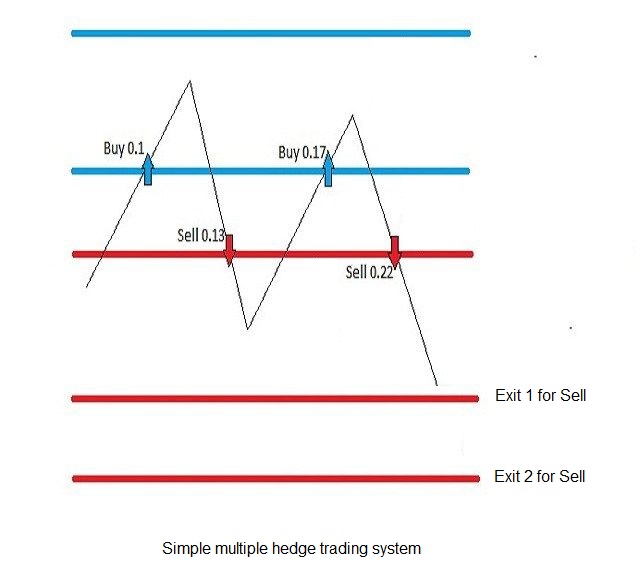

Of course, hedging and grid system are typically involved with dozens of entries and exists. They are a lot more complicated. When we look at two take profits in the Harmonic Pattern example screenshot, in fact, this is very simple and naive multiple exits system with fixed entry in the middle.

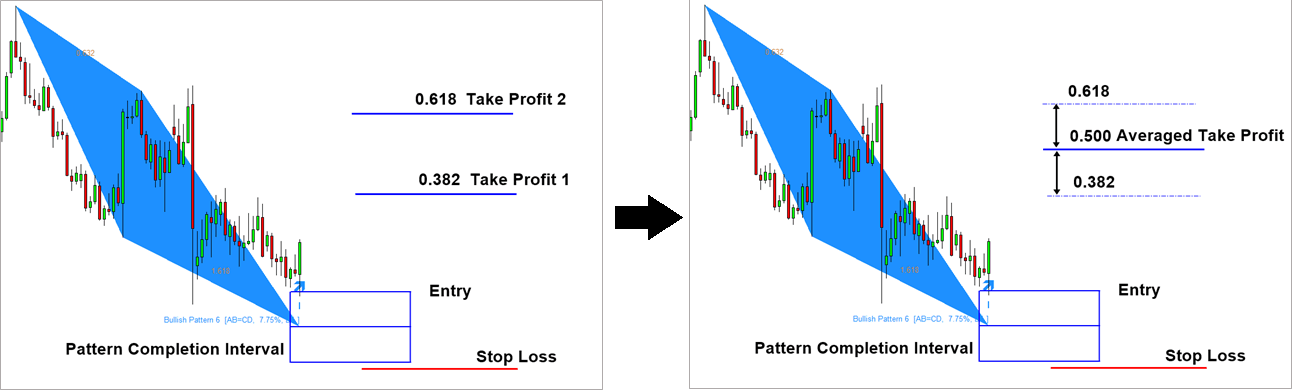

The question is “is it efficient to take two profits target like above harmonic pattern example?” The straight forward answer is “No” with some room for discussion. With all the respects of producing such screenshots, I feel sorry for the over millions of harmonic pattern screenshots like above floating around on the internet. Now let us explain why this is the case. If you are taking the take profit at 0.382 and 0.618 Fibonacci Retracement, this is in fact the same thing as you are taking the take profit at 0.500 Retracement because 0.500 Retracement is in the middle of 0.318 and 0.618. This is to say that your two order of trading volume 1 with take profit at 0.382 and 0.618 target can be replaced with one order of trading volume 2 with take profit at 0.500. When one order can produce more or less similar trading results, then why do you have to take two orders making your life harder?? Probably not so much, I guess.

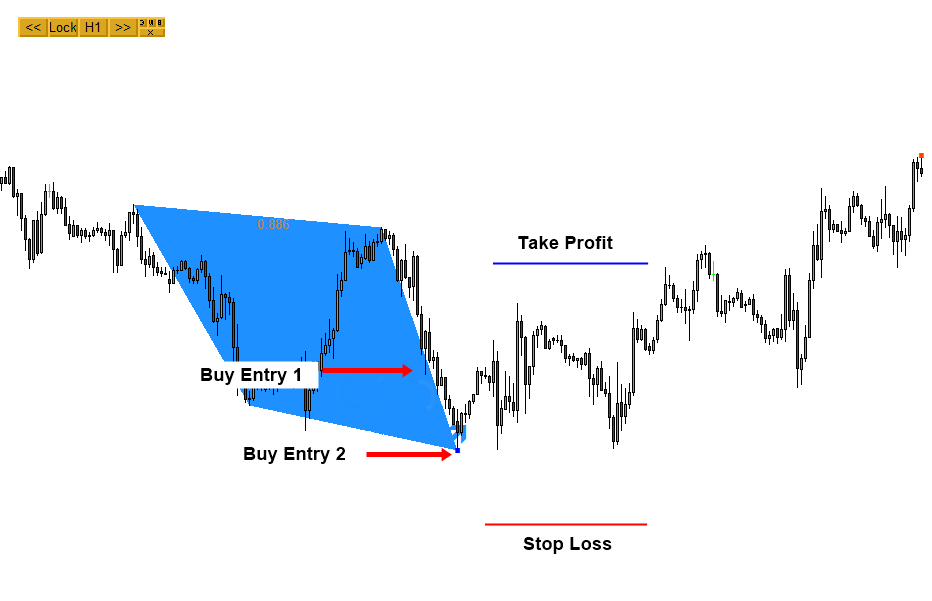

Up to this point, if you are convinced, then it is good. If not, do not worry. We will take a look at another opposite example here. In next example, we will be looking at multiple entries instead of multiple exits. Consider we had AB=CD pattern signal early at 1.1300. So we made our entry. However, price made continuous bearish move but without breaking the AB=CD pattern formation. Now you made second entry at 1.1200. This kind of scenario is possible in real world trading. What is the second entry doing here? In fact your second entry is correcting your mistake to enter too high price level at 1.1300 (i.e. the first entry.)

Now, your true entry become 1.1250, the averaged value between 1.1300 and 1.1200 if you had same trading volume for entry 1 and entry 2. This might ring you bell at some point, I guess. That is correct. This is what we called averaging algorithm. This is the basis of many of pyramid trading, grid trading and multiple cycle hedging trading system. If you want to lower down your first entry more, then keep open third entry and fourth entry and, etc as price goes down. However, correcting your first entry does not come at free but they come with the increased trading volume. So you need more money to lower down your entry (i.e. correcting your mistake). Hence your risk increases. Therefore, never abuse this sort of averaging algorithm. Only one or two additional entries are the recommended maximum.

The point about multiple entries and exits are that you could produce more or less similar trading results at the averaged entry and averaged exit. Many trader uses multiple entries to make some adjustment on their first entry to adapt unexpected price movement comes after. This makes good sense because you split your orders to be prepared for the uncertainty in the future. As long as you don’t abuse, this is tactical timing adjustment tool.

Unlike the benefit of the multiple entries, the benefit in multiple exits is not so much. The two take profits in the example Harmonic pattern only move your true take profit to the the averaged price level between two take profits. Because you open these two orders at the same time, there is no timing benefits but you have to work harder to manage two orders instead of one order. You can simply produce the similar trading results by opening one order with averaged take profit in long run. Opening one good order with sensible take profit and stop loss size makes much more sense since you have the full control over your risk and your trading capital. What is even better is that your harmonic pattern trading is simple and easy. Let us be simple and profitable.

I have explained the point in this article rather simple and straight forward manner. To understand this topic in depth, it is better to understand the rolling ball effect of the market. If you need to have more in depth understanding, I have outlined everything you need to know in open attitude for Harmonic Pattern Trading in this book: Guide to Precision Harmonic Pattern Trading.

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

As you know, we have made a lot of contribution to Price Action and Pattern Trading last 10 years. Another inspirational news is that now we even have non repainting and non lagging Harmonic Pattern and Elliott Wave pattern scanner just as everyone dreamed of. This is the first non repainting and non lagging Harmonic Pattern system. Now you can fully incorporate your strategy with Harmonic Pattern and Elliott Wave pattern since they are non repainting. Please check our Optimal Turning Point Pattern Scanner from the link below:

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Please continue to love our Harmonic Pattern Plus and Harmonic Pattern Scenario Planner too. These two tools will provide the great value for money with tons of powerful features. For your information, I have only wrote this article to correct some misleading information on the internet. I hope this article benefit many traders. As we have mentioned above, this is a controversal topic to discuss.

Related Products