Corrective Wave in Elliott Wave

In this article, we will discuss how to identify the Corrective Wave in Elliott Wave to trade in Forex and Stock market as well as some underlying principle in Elliott Wave. Before we go on to the Corrective Elliott Wave, we need to understand what is Elliott Wave first. The Elliott Wave Principle states that the crowd or social behaviour follows a certain wave patterns repeating themselves. The Wave Principle identifies two wave patterns. They are impulse and corrective wave. Often, the term impulse wave is interchangeably used with the motive wave. Both motive and impulse wave progress during the main trend phase whereas the corrective wave progress during the corrective phase against the main trend. In general, the Impulse Wave has a five-wave structure, while the Corrective Wave have a three-wave structure. It is important to understand that these wave structures can override on smaller wave structure to form greater wave cycle. Elliott Wave theory is useful in identifying both trend market and correction market. As the Elliott Wave Theory already assumes that price progresses in the Fractal-Wave form, they do not suffer from lagging of price like the smoothing algorithm based technical indicators do.

Now let us have a look at the practical part to identify the corrective wave in the Forex chart. We introduce the Elliott Wave indicator called Elliott Wave Trend. Elliott Wave Trend was designed for the scientific wave counting. This tool focuses to get rid of the vagueness of the classic Elliott Wave Counting using the guideline from the template and pattern approach. In doing so, firstly Elliott Wave Trend offers the template for your wave counting. Secondly, it offers Wave Structural Score to assist to identify accurate wave formation. It offers both impulse wave Structural Score and corrective wave Structure Score. Structural Score is the rating to show how good your Elliott Wave pattern is. 100% means that it is good wave pattern. The score below 80% or negative values means that you might have some mistakes in your analysis. Elliott Wave Trend will correct some obvious mistake in your wave counting if the counting goes against the three Wave rules proposed by Ralph Elliott. With Wave structural score, you can turn your Elliott Wave counting into Elliott Wave Pattern. To use Elliott Wave Trend, it is better to have some basic knowledge of using Elliott Wave Theory. The good news is that Elliott Wave Trend is the exclusive Elliott Wave tool for Forex trading.

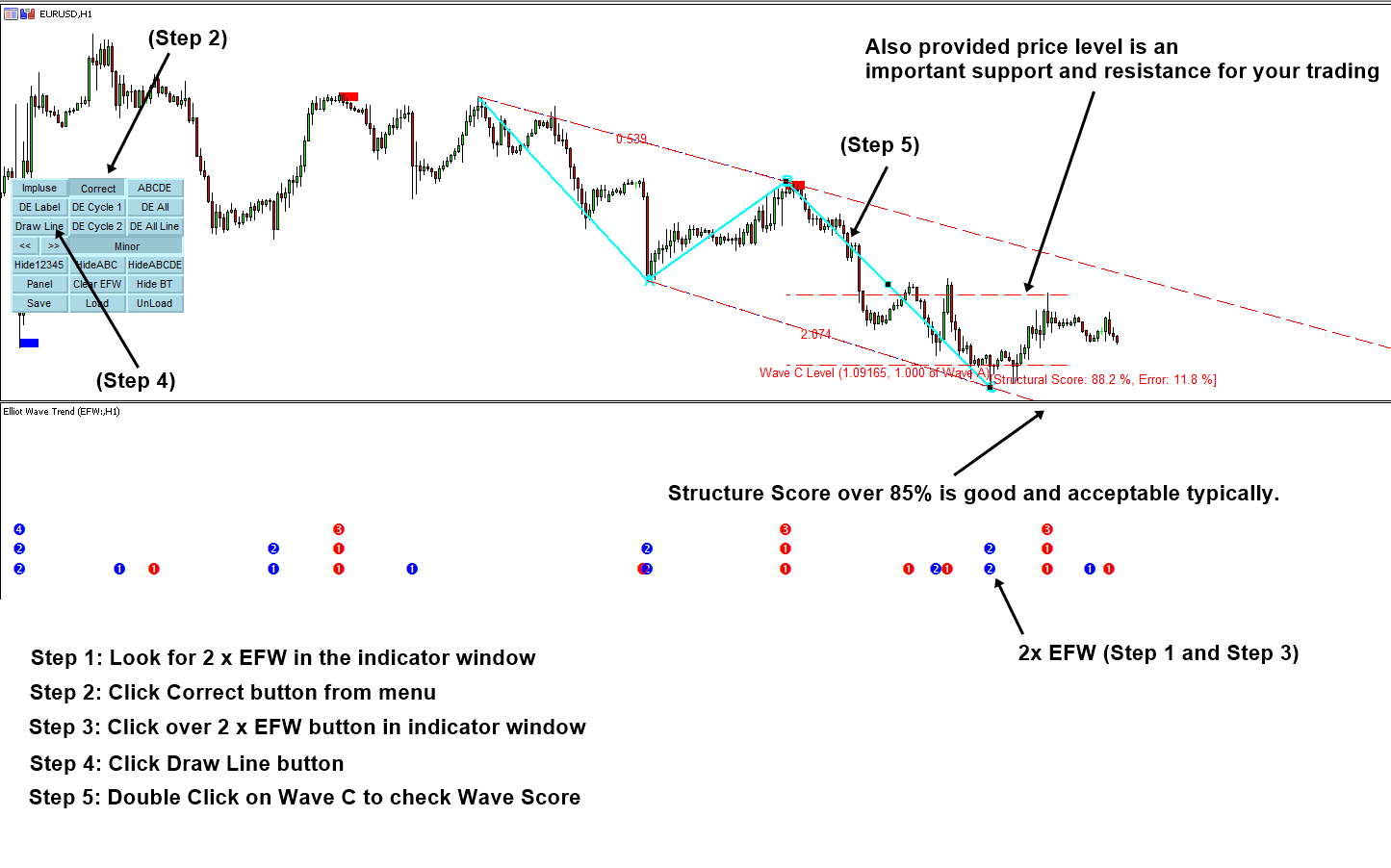

This is really quick guide on how to identify Corrective Wave using Elliott Wave Trend indicator in MetaTrader platform. In Elliott wave, the corrective wave has the structure of Wave abc. We can have simple five steps to identify Elliott wave ABC with Structural Score in your MetaTrader.

Step 1: Look for 2 x EFW in the indicator window

Step 2: Click Correct button from menu

Step 3: Click over 2 x EFW button in indicator window

Step 4: Click Draw Line button

Step 5: Double Click on Wave C to check Wave Score

Also note that Structure Score over 85% is good and acceptable typically.

Also provided price level is an important support and resistance for your trading.

This is really quick guide line on how to use Elliott Wave Trend. We provide more articles and manuals on our product page.

Visit below link for more information about how to use the powerful features of Elliott Wave Trend.

https://algotrading-investment.com/2018/10/25/how-elliott-wave-can-improve-your-trading-performance/

Here is the links to our Elliott Wave Trend:

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Related Products