Volume Spread Analysis

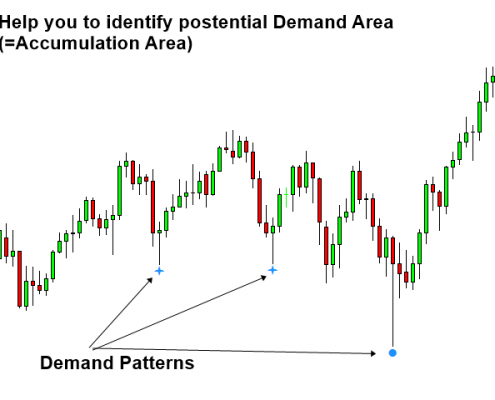

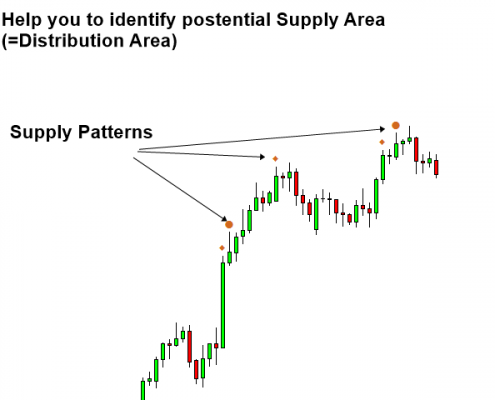

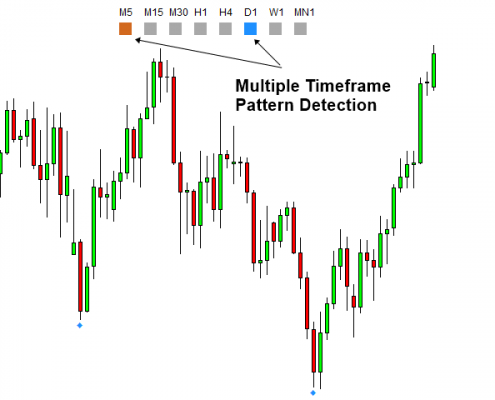

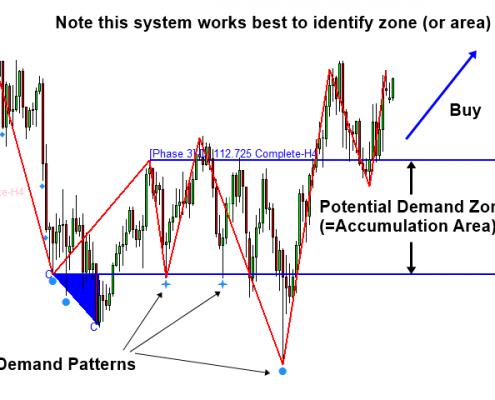

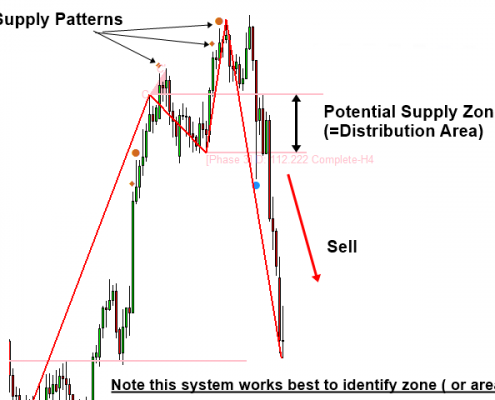

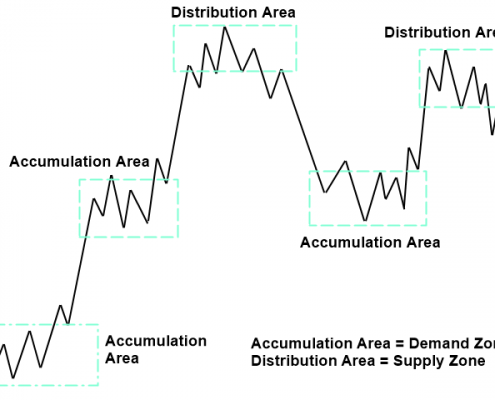

Volume Spread Analysis seeks to identify the imbalances of Supply and Demand using candle pattern and volume to predict the future direction of prices. This indicator detects volume spread patterns for potential buy and sell opportunity. The candle patterns include demand and supply patterns. You might use each pattern for your trading. However, these patterns are best used to detect the demand zone (=accumulation area) and supply zone (=distribution area). Demand pattern indicates generally potential buying opportunity. Supply pattern indicates generally potential selling opportunity. These are the underlying patterns rather than direct price action. The effect of buy and sell market may come after observing several of these patterns sometimes. Therefore, these patterns are useful in detecting possible demand zone (=accumulation area) or supply zone (=distribution area). In overall this is easy and simple indicator to support your trading operation. Trading principle is based on the modified volume spread analysis. We do not use sub phase A, B, C, D and E of Wyckoff phases due to the high subjectivity in detecting them. Instead, we focus on identifying accumulation and distribution area using demand and supply patterns. This is simpler and more effective approach.

Volume Spread Analysis Setting

Most of time you can use default setting for this volume Spread Indicator. However, you might want to change some inputs for your specific needs. Here is the complete description of input settings.

Calculation Setting

- Bars to scan: Amount of bars to calculate demand and supply pattern.

- Indicator Period: Calculation period to generate each supply and demand patterns.

- Lookback Factor: 1.0 as default

- Signal to Noise Ratio: from 0.4 to 1.0 only. (Input used to filter random fluctuations in data.)

Indicator Setting

- Use white background for chart: Set this to false if you just want to use default black background color.

- Supply Pattern Color: color of supply patterns.

- Demand Pattern Color: color of demand patterns

- Neutral Pattern Color: color of neural patterns or no patterns.

Compatibility with Other Trading System

Volume Spread Pattern Indicator can run best to identify Demand zone (=accumulation area) and supply zone (=distribution area). When you run with Excessive Momentum Indicator, C point of Excessive Momentum become the selling climax (SC) or the buying climax (BC). Then you will use demand and supply patterns to confirm the accumulation area and distribution area for your trading. Both short term and long term trading is possible.

You can use also our Harmonic Pattern System together with Volume spread pattern indicator.

When you are using our Harmonic Pattern System with volume spread pattern indicator, supply and demand patterns will appear around Point D of our Harmonic Pattern System. In addition, you might confirm it with Background signal strength together. For compatibility, use our Trading system together with Volume Spread Pattern Indicator.

Further Note

Volume Spread Pattern Detector is light version (or demo version) of Volume Spread Pattern Indicator. Therefore, you can only access the limited feature in Volume Spread Pattern Detector. In Volume Spread Pattern Detector, you can not use any of alert features and the powerful background signal as the part of your trading. However, you can still use this volume spread pattern detector to get the feel of how this tool can go or fit with your existing system. If you want the full feature, here is the link to Volume Spread Pattern Indicator.

Trading Book in Forex and Stock market

1. Profitable Chart Patterns in Forex and Stock Market

2. Scientific Guide to Price Action and Pattern Trading

Important Note

This product is the off the shelf product in the store. Therefore, we do not take any personal modification or personal customization request. For our products, we do not provide any code library or any support for your coding.