Impulse Wave Structural Score and Corrective Wave Structural Score

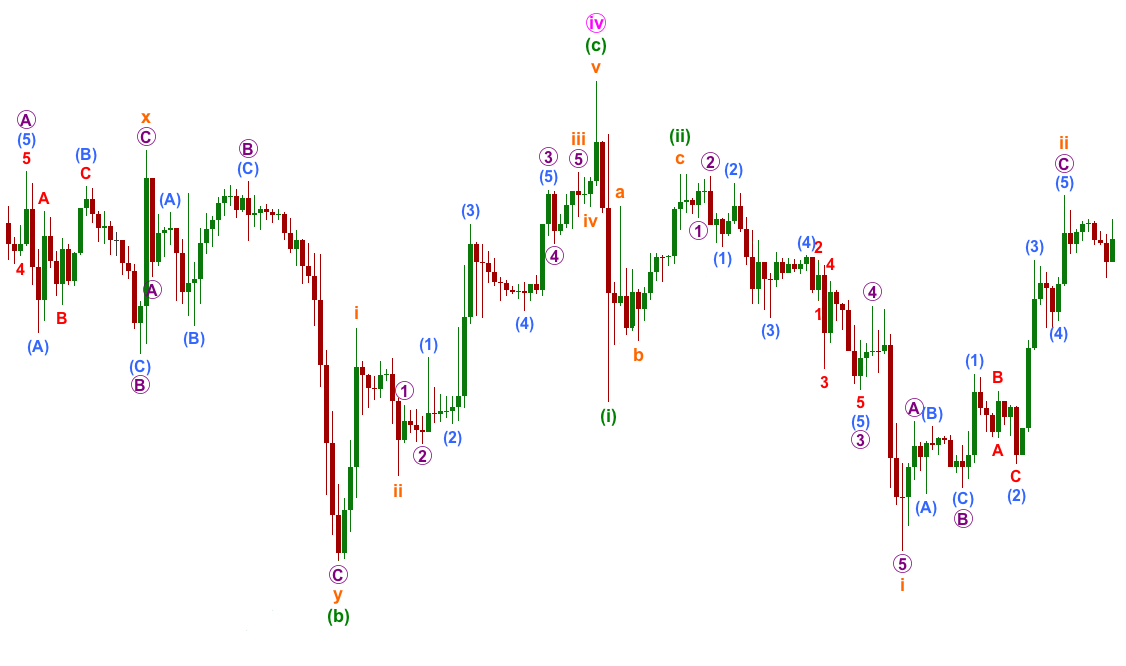

With the three tools including template, Fibonacci retracement and three wave rules, traders can identify the correct patterns to trade from their chart. We have provided six mechanical steps, which anyone can use to count waves in objective manner. Often, there are many traders focus more on fitting the wave counting to their chart. Fitting the wave counting can be useless unless every wave counting is accurate for every single label. For example, Figure 5-11 shows some complex wave labelling. Such a complex labelling can be often attempted by traders. The complex labelling does not results in high accuracy for your trading in general. Often the small error in the wave counting will be amplified later. Therefore, you will likely to override your counting repeatedly when the market does not move according to your wave counting. Complex labelling do not show your intellectual level either. For trading, we should aim to identify accurate pattern and avoid any complexity. Remember that in the financial market, the fractal geometry itself is not strict. In addition, financial market always have decent amount of random process going on. The random fluctuation will always contribute towards some unpredictable portion of the financial market. Therefore, we do not have to attempt labelling the wave for every single candle bar in our chart. Instead, we should try to use the most accurate pattern for our trading.

Figure 5-11: Example of complex wave counting fitted to chart.

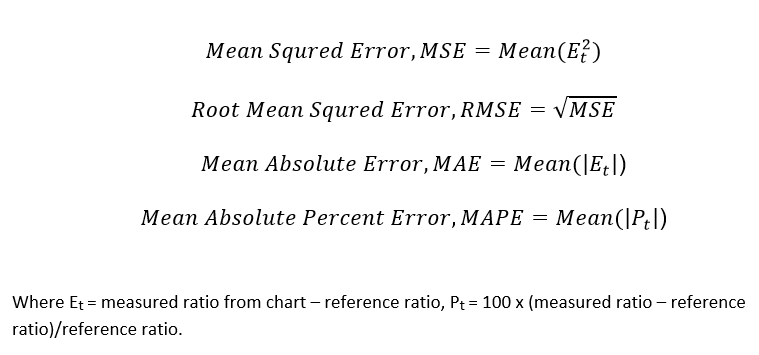

Therefore, for better trading practice, we recommend “approach of the pattern detection” rather than “approach of fitting the wave counting”. We strongly emphasize not to use inaccurate wave counting for your decision-making. Instead, you can only rely on the wave patterns meeting certain quality for your trading. The question is how do we differentiate accurate pattern from inaccurate patterns? In order to assess the accuracy of wave patterns, we can revisit the pattern matching accuracy from the Harmonic Pattern. To recap what is the pattern matching accuracy in the case of Harmonic Pattern, it is the metrics showing how close our detected harmonic pattern matches to the perfect pattern made up from the ideal Fibonacci ratios. The concept of the pattern matching accuracy can be extended for the case of Elliott Wave counting too. Since three wave rules and the Fibonacci ratios provide the guideline for the quality of the pattern, we can incorporate such information into these error metrics as we did in the case of harmonic patterns:

Figure 5-12: Some possible Error Metrics for Elliott Wave pattern matching.

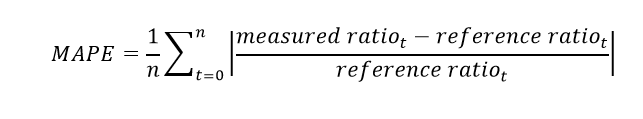

Once again, we can use the Mean Absolute Percent Error to quantify the pattern matching error for each Elliott Wave pattern.

Pattern matching accuracy can be calculated simply using the following formula:

Pattern matching accuracy (%) = 100 – Pattern matching error (%).

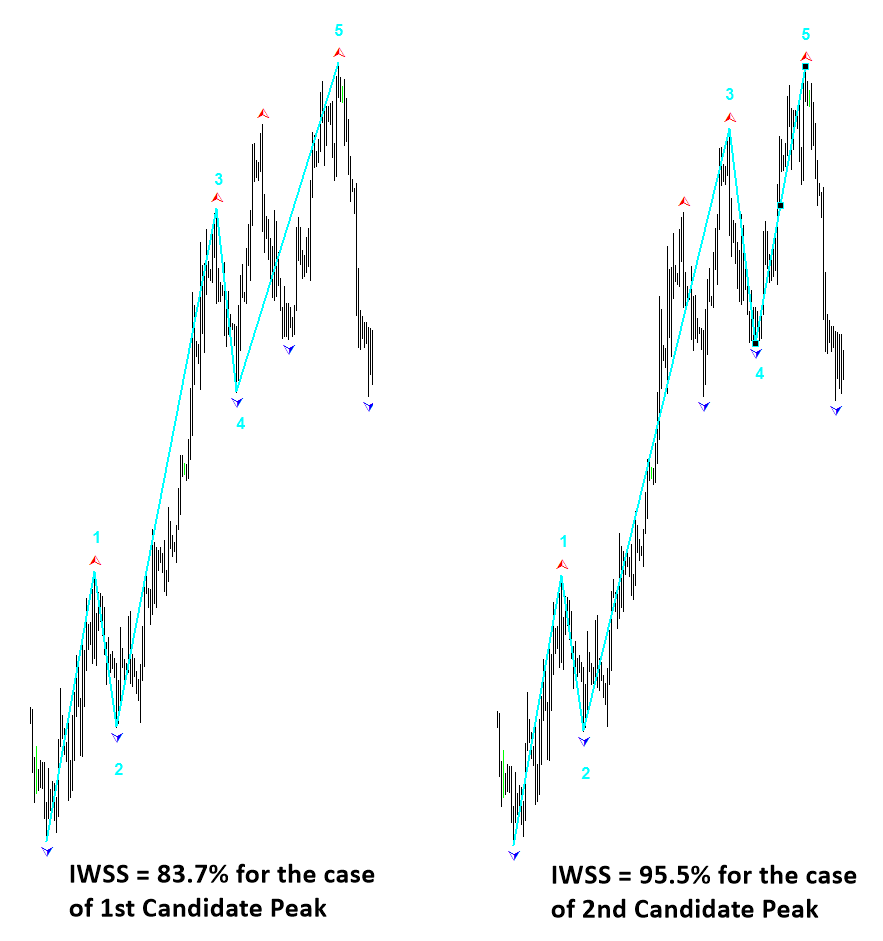

For both impulse wave and corrective wave, we can name the pattern matching accuracy as the Impulse Wave Structural Score (IWSS) and Corrective Wave Structural Score (CWSS). Since the term “impulse” and “motive” are used interchangeably. One can call the Impulse Wave Structure Score to Motive Wave Structural Score too. Simply speaking, Impulse Wave Structural Score tells you how closely the identified impulse wave pattern matches to the structure of the ideal impulse wave pattern. Likewise, Corrective Wave Structural Score tells you how closely the identified corrective wave pattern matches to the structure of the ideal corrective wave pattern. To give you working example on using the impulse Wave Structural Score and Corrective Wave Structural Score, consider our previous example with two candidate peaks for wave 3. With first candidate peak, our calculation for impulse Wave Structural Score was 83.7%. With second candidate peak, our calculation for impulse Wave Structural Score was 95.5%. This number support our conclusion made from our six steps. From our experience, Wave Structural Score below 80% considered as poor quality. For the decision making for trading, it is advised to use the Wave Structural Score over 80%. If you have two or three alternative scenarios for your wave counting at least satisfying three wave rules, then you can always choose the scenario with maximum Wave Structural Score. What if you never find any wave patterns that meet over 80% of Wave Structural Score at best, then you should not trade. It is always much better not to trade than trading with inaccurate pattern.

Figure 5-13: Impulse Wave Structural Score comparison. Impulse Wave Structural Score on the left was calculated when the first peak is considered as wave 3. Impulse Wave Structural Score on the right was calculated when the second candidate peak is considered as wave 3.

Some More Tips about Impulse Wave Structural Score and Corrective Wave Structural Score

In Elliott Wave Theory, the Impulse Wave Structural Score (IWSS) and the Corrective Wave Structural Score (CWSS) are advanced analytical tools that help traders evaluate the quality and reliability of impulsive and corrective wave patterns. These scores aim to quantify the structural integrity of the waves, aiding in accurate wave identification and forecasting.

Impulse Wave Structural Score (IWSS)

Concept

The IWSS measures the structural integrity and adherence of an impulsive wave (waves 1, 3, 5) to Elliott Wave principles. It assesses how well the wave sequence fits the characteristics of a typical impulsive wave.

Components

- Wave Formation: Consistency with the 5-wave structure (1, 2, 3, 4, 5).

- Wave Relationships: Fibonacci relationships between waves, especially between Wave 2 and Wave 4 retracements and Wave 1, 3, and 5 extensions.

- Wave Proportions: Proportionality and symmetry among waves.

- Wave Behavior: Price action and momentum characteristics typical of impulsive waves.

Calculation

The IWSS can be calculated by scoring each component on a scale (e.g., 0 to 10) and then combining these scores to derive a total score. Higher scores indicate a stronger and more reliable impulsive wave structure.

Example Scoring Criteria:

- Wave Formation:

- Perfect 5-wave structure

- Minor deviations

- Significant deviations

- Wave Relationships:

- Close adherence to Fibonacci levels

- Moderate adherence

- Poor adherence

- Wave Proportions:

- Well-proportioned waves

- Moderately proportioned waves

- Poorly proportioned waves

- Wave Behavior:

- Strong momentum and clear price action

- Moderate momentum and price action

- Weak momentum and unclear price action

Application

- High IWSS: Indicates a strong and reliable impulsive wave, suitable for trading continuation strategies.

- Low IWSS: Suggests potential wave misidentification or weak impulsive structure, warranting caution or re-evaluation.

Corrective Wave Structural Score (CWSS)

Concept

The CWSS measures the structural integrity of a corrective wave (waves A, B, C) within the Elliott Wave framework. It evaluates how well the wave sequence conforms to typical corrective wave patterns.

Components

- Wave Formation: Adherence to the 3-wave structure (A, B, C).

- Wave Relationships: Fibonacci relationships and retracement levels.

- Wave Patterns: Common corrective patterns (e.g., zigzag, flat, triangle).

- Wave Behavior: Price action and momentum characteristics typical of corrective waves.

Calculation

Similar to IWSS, the CWSS can be calculated by scoring each component and deriving a total score. Higher scores indicate a stronger and more reliable corrective wave structure.

Example Scoring Criteria:

- Wave Formation:

- Perfect 3-wave structure

- Minor deviations

- Significant deviations

- Wave Relationships:

- Close adherence to Fibonacci retracements

- Moderate adherence

- Poor adherence

- Wave Patterns:

- Well-defined corrective patterns

- Moderately defined patterns

- Poorly defined patterns

- Wave Behavior:

- Typical corrective behavior

- Moderate corrective behavior

- Atypical corrective behavior

Application

- High CWSS: Indicates a strong and reliable corrective wave, suitable for trading reversal or continuation strategies.

- Low CWSS: Suggests potential wave misidentification or weak corrective structure, warranting caution or re-evaluation.

Practical Example: Applying IWSS and CWSS in Trading

Scenario: Analyzing EUR/USD on a 4-Hour Chart

- Identify Impulsive Wave (1, 2, 3, 4, 5):

- Wave Formation: Confirm a clear 5-wave structure.

- Wave Relationships: Check Fibonacci levels for Wave 2 retracement (38.2% to 61.8%) and Wave 3 extension (161.8%).

- Wave Proportions: Ensure proportionality among waves.

- Wave Behavior: Evaluate momentum and price action.

- Calculate IWSS:

- Assign scores for each component.

- Sum the scores to get the IWSS.

- Trading Decision Based on IWSS:

- High IWSS: Enter long position at the start of Wave 3 or Wave 5, with stop-loss below Wave 2 or Wave 4, respectively.

- Low IWSS: Re-evaluate the wave structure or wait for further confirmation.

- Identify Corrective Wave (A, B, C):

- Wave Formation: Confirm a clear 3-wave structure.

- Wave Relationships: Check Fibonacci retracement levels for Wave B and extension levels for Wave C.

- Wave Patterns: Identify the type of corrective pattern.

- Wave Behavior: Evaluate momentum and price action.

- Calculate CWSS:

- Assign scores for each component.

- Sum the scores to get the CWSS.

- Trading Decision Based on CWSS:

- High CWSS: Enter position at the end of Wave C, anticipating a new impulsive wave, with stop-loss below the end of Wave C.

- Low CWSS: Re-evaluate the corrective wave or wait for further confirmation.

Conclusion

The Impulse Wave Structural Score (IWSS) and Corrective Wave Structural Score (CWSS) are valuable tools for enhancing the application of Elliott Wave Theory in forex trading. By quantifying the structural integrity of impulsive and corrective waves, traders can make more informed decisions, improve wave identification accuracy, and manage trades more effectively. These scores provide a systematic approach to evaluating wave structures, helping traders navigate the complexities of the forex market with greater confidence.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

Elliott Wave Trend is the powerful metatrader indicator. It allows you to perform Elliott wave counting as well as Elliott wave pattern detection. On top of them, it provides built in accurate support and resistance system to improve your trading performance. You can watch this YouTube Video to feel how the Elliott Wave Indicator look like:

https://www.youtube.com/watch?v=Oftml-JKyKM

Here is the landing page for Elliott Wave Trend.

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Related Products