Introduction to Equilibrium Fractal Wave (EFW) Channel

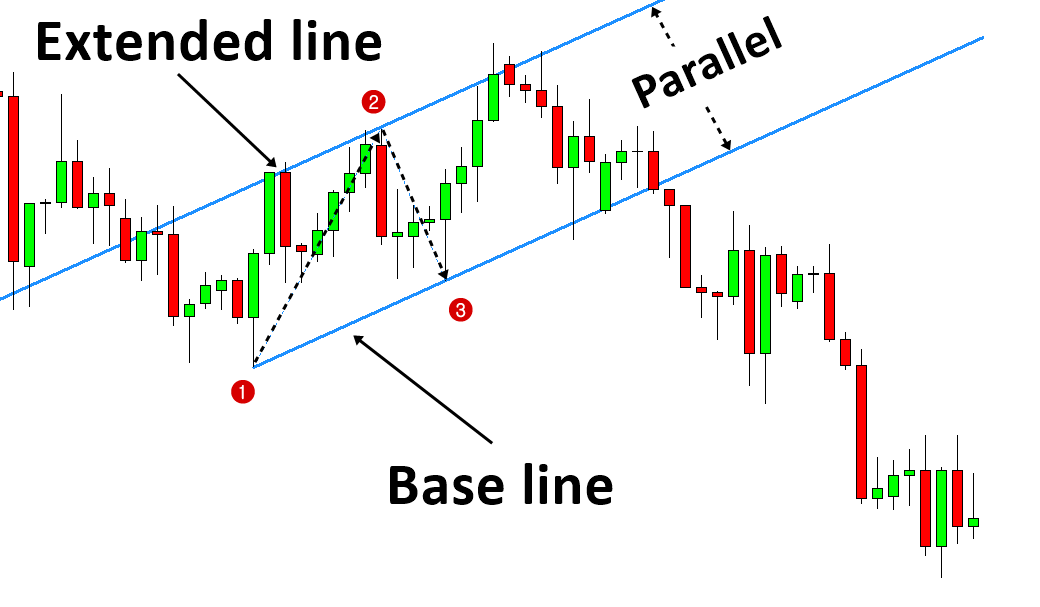

Unlike many other EFW derived patterns including Harmonic patterns and Elliott wave patterns, equilibrium fractal wave is relatively easy to use for our trading. In spite of its simplicity, equilibrium fractal wave can provide an extremely useful insight for our trading. One of the very important usage of equilibrium fractal wave is a channelling technique. The Equilibrium fractal wave channel can be constructed in two steps. In first step, you need to connect the first and third points to draw the base line. Once base line is drawn in your chart, offset the baseline to the middle point of the equilibrium fractal wave to draw the extended line. Since the base line and extended line is parallel to each other, these two lines form a single channel as shown in Figure 3-9.

Figure 3-9: Drawing Equilibrium fractal wave channel.

In the previous chapter, we have spotted that channels are merely a pair of support and resistance lines aligned in parallel. In general, there is various way of drawing channels for your trading. Sometimes, you can draw the channel by connecting several peaks and troughs in your chart. The main difference between the typical channels and EFW channel is that EFW channel is drawn using only three points of a triangle whereas the typical channels are drawn with more than three points.

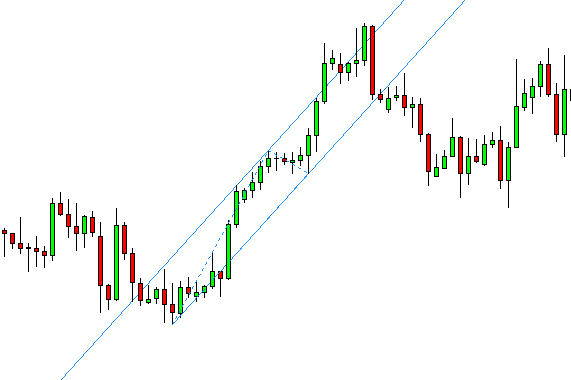

When you want to control the angle of channel, equilibrium fractal wave provide the most efficient way of controlling the angles. For example, sometimes you might prefer to trade with horizontal channel only. Sometimes, you might prefer to trade with a channel with stiff angle. With equilibrium fractal wave, the angle of channel is simply controlled by the shape ratio. The shape ratio close to 1.000 provides near the horizontal channel or a channel with a near flat angle (Figure 3-10). On the other hands, the shape ratio close to 0.000 provides a channel with a stiff angle (Figure 3-11). The shape ratio around 0.500 provides a channel with a moderate angle (Figure 3-12). Especially when you want to build a mechanical rule for your trading, this property of EFW channel becomes useful.

Figure 3-10: Equilibrium fractal wave channel with the shape ratio around 1.000.

Figure 3-11: Equilibrium fractal wave channel with the shape ratio around 0.100.

Figure 3-12: Equilibrium fractal wave channel with the shape ratio around 0.500.

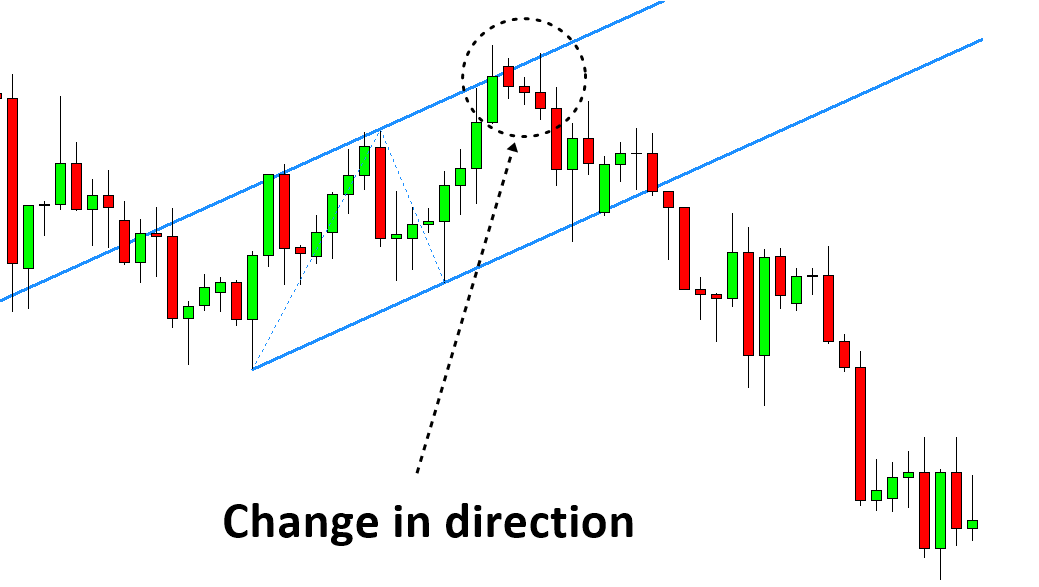

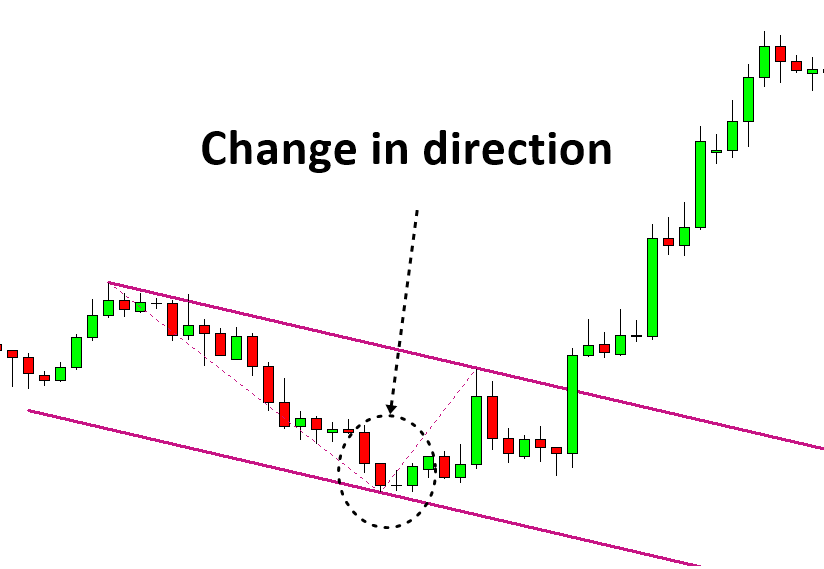

EFW Channel can be used for many different purposes for our trading. Trader can use channel for the reversal trading. At the same time, trader can use channel for the breakout trading. Trader can use channel for market prediction. For example, an experienced trader can predict the short-term or long-term market direction with a channel or with several channels. Typically, you can detect the four-market states with EFW Channel. Firstly, you can detect the turning point when the market changes from bullish to bearish (Figure 3-13). Likewise, you can detect the turning point when the market changes from bearish to bullish too (Figure 3-14). At the same time, you can measure the momentum of the current market. For example, when the price move over the upwards EFW Channel, it indicates the strong bullish momentum in the market (Figure 3-15). Likewise, when the price move below the downwards EFW Channel, it indicates the strong bearish momentum in the market (Figure 3-16). This logic is very similar to the way Gann’s angle (or Fan) works.

Figure 3-13: Detecting the bearish turning point with EFW channel.

Figure 3-14: Detecting the bullish turning point with EFW channel.

Figure 3-15: Measuring the strong bullish momentum with EFW channel.

Figure 3-16: Measuring the strong bearish momentum with EFW channel.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide To Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). This article is only draft and it will be not updated to the completed version on the release of the book. However, this article will serve you to gather the important knowledge in financial trading. This article is also recommended to read before using Price Breakout Pattern Scanner, Advanced Price Pattern Scanner, Elliott Wave Trend, EFW Analytics and Harmonic Pattern Plus, which is available for MetaTrader 4 and MetaTrader 5 platform.

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

Related Products