Practical Trading with Equilibrium Fractal Wave (EFW) Channel

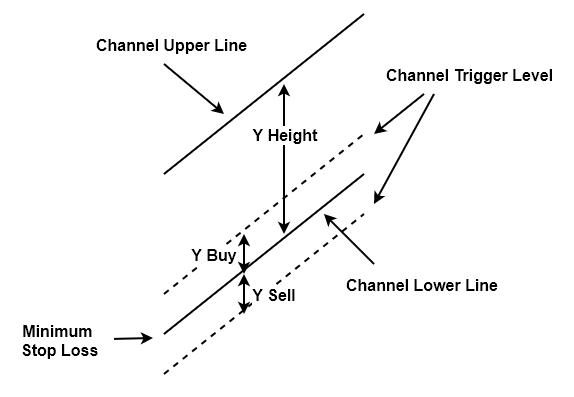

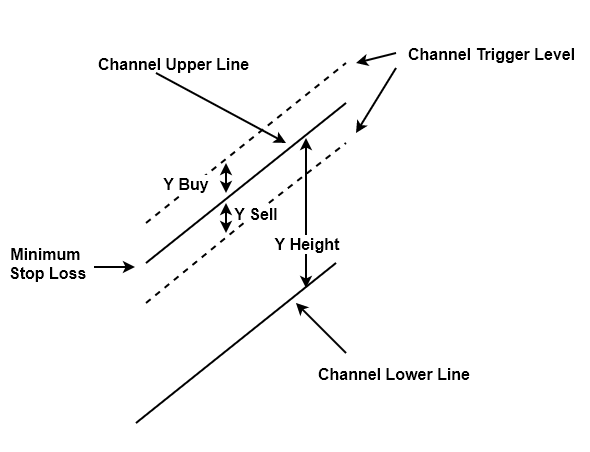

Trading with the EFW channel is almost identical to the support and resistance trading. The main trading principle is that we are betting on the potential size of the equilibrium fractal wave. If the equilibrium fractal wave does not extend, the price will make the reversal movement. If the equilibrium fractal wave extends due to any surprise in the market, then the price will likely to show the breakout movement. To catch either reversal or breakout move, we can apply the threshold approach again from the concept of support and resistance trading in the previous chapter as shown in Figure 3-17 and Figure 3-18. Figure 3-17 shows the trading setup for the bearish turning point. Figure 3-18 shows the trading setup for the strong bullish momentum with the upwards EFW Channel. Trader can use the proportional approach to execute buy and sell. Since we are dealing with angle, it is much easier to use the proportional approach. To calculate the trigger level for buy and sell, we can use the same formula as before:

Y Buy = Proportion (%) x Y Height and

Y Sell = Proportion (%) x Y Height, where Y Height = the height of the channel and Proportion is fraction of the height of the channel expressed in percentage.

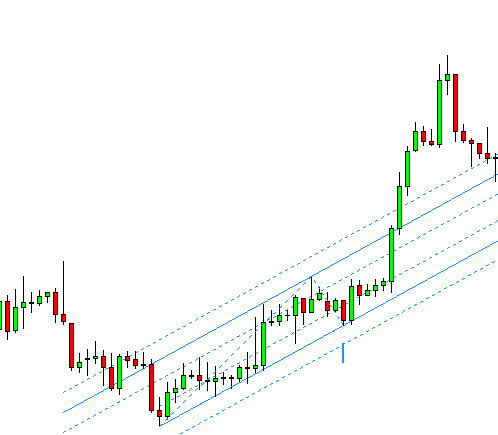

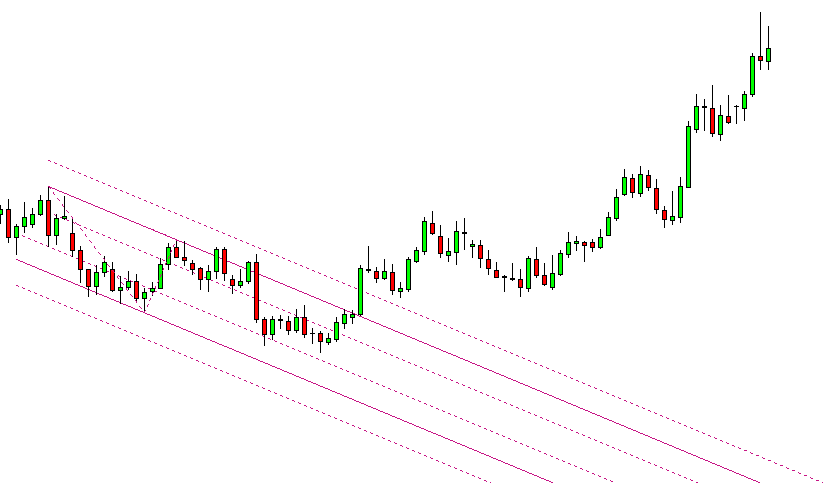

Some proportions you can use include 20% and 30% for your trigger level. You can even use greater proportion like 50% if you wish. The upper and lower channel lines can be used as the minimum stop loss level. To avoid the tight stop loss, you should always have the greater stop loss size than the minimum stop loss level. You can set the take profit according to your preferred rewards/risk level. With the EFW channel, it is possible to achieve Reward/Risk ratio greater than 3. We also show some trading examples in Figure 3-19, 2-20, 2-21 and 2-22.

Figure 3-17: EFW Upwards Channel trading setup for the bearish turning point.

Figure 3-18: EFW Upwards Channel trading setup for strong bullish momentum.

Figure 3-19: EFW Upwards channel sell trading setup on EURUSD D1 timeframe.

Figure 3-20: EFW Upwards channel buy trading setup on EURUSD H4 timeframe.

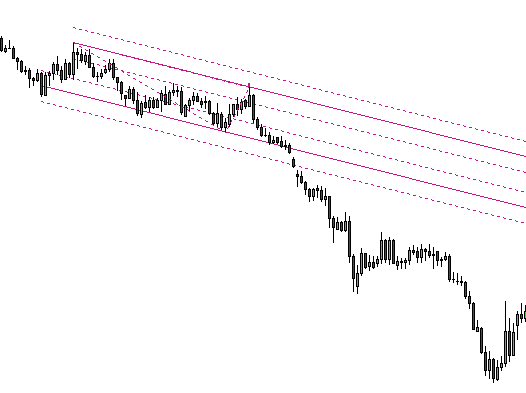

Figure 3-21: EFW Downwards channel buy trading setup on EURUSD D1 timeframe.

Figure 3-22: EFW Downwards channel sell trading setup on EURUSD D1 timeframe.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide To Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). This article is only draft and it will be not updated to the completed version on the release of the book. However, this article will serve you to gather the important knowledge in financial trading. This article is also recommended to read before using Price Breakout Pattern Scanner, Advanced Price Pattern Scanner, Elliott Wave Trend, EFW Analytics and Harmonic Pattern Plus, which is available for MetaTrader 4 and MetaTrader 5 platform.

Below is the landing page for Price Breakout Pattern Scanner, Advanced Price Pattern Scanner, Elliott Wave Trend, EFW Analytics and Harmonic Pattern Plus. All these products are also available from www.mql5.com too.

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Related Products