Excessive Momentum Indicator and Trading Operation

Excessive Momentum Indicator automatically detects the broken balance between supply and demand in the financial market. Detection of this broken balance provides the great market timing for the entry and exit for our trading. In this short article, we explain some of the controllable inputs in the Excessive Momentum Indicator.

There are the four main inputs, controlling the calculation process of Excessive Momentum Indicator. They are:

* Bars To Scan: amount of candle bars to calculate the indicator. Choose bigger numbers if you want to see the calculation over longer historical period.

* Momentum Strength Factor: Momentum Strength is the strength of Excessive Momentum to detect. It can stay between 0.1 and 0.5. In theory, it can go up to 1.0. However, you will not get many signals to trade. The default setting is 0.1. You can try various Momentum Strength Factor to optimize your trading performance if you wish.

* Equilibrium Fractal Wave Scale: This input controls the size of Fractal Wave when we detect the excessive momentum. If you put bigger number, then you get less signals to trade. The default setting is 0.5.

* Detrending Period: This input controls the statistical calculation in the algorithm. It should stay between 20 and 50.

Above four inputs are important because they can affect the number and quality of trading signals. You can use the default setting most of time. However, it is also possible that you can try different inputs and check how they perform in the historical data. Rest of inputs are probably self-explanatory from their name.

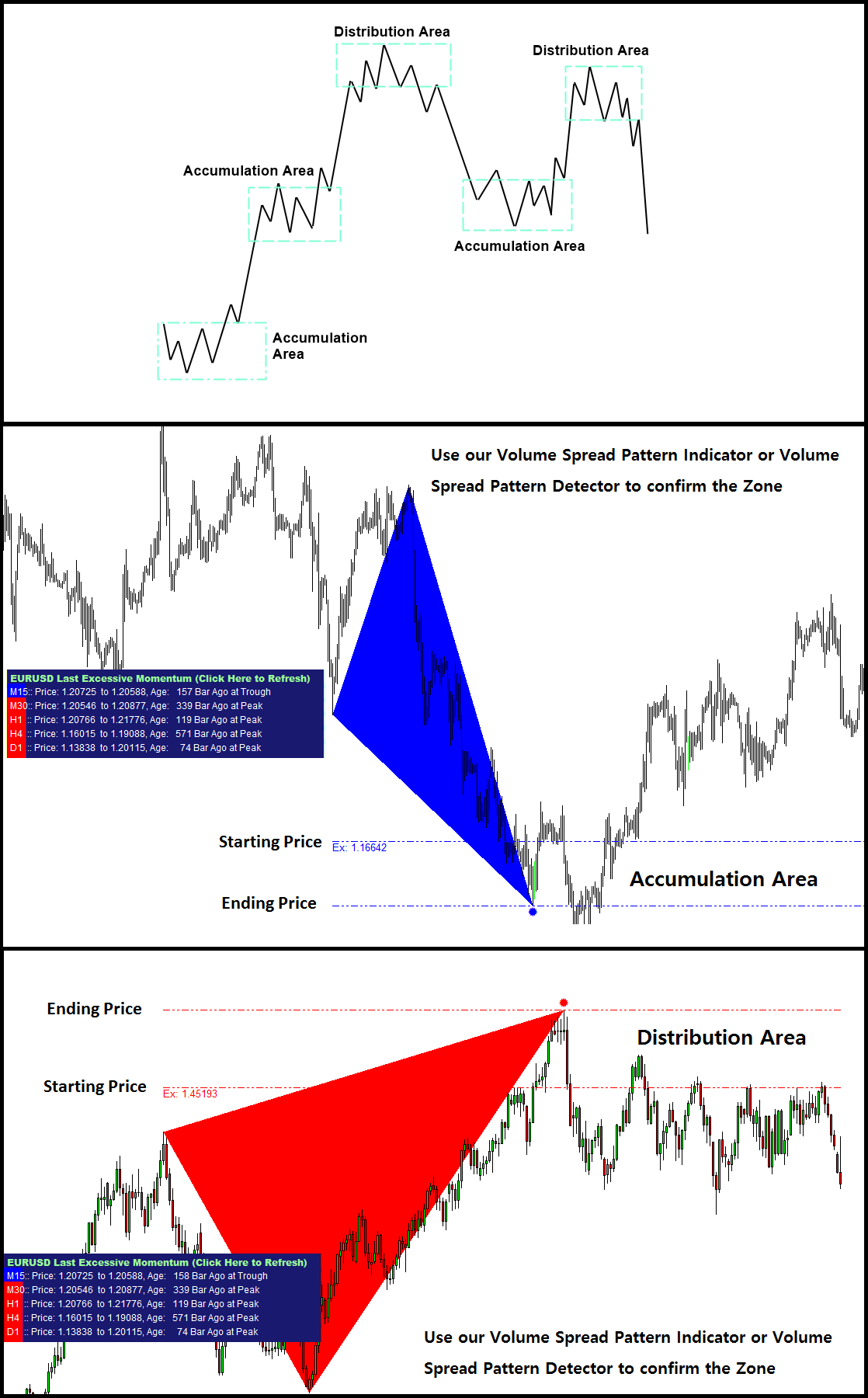

Now, let us cover the trading signals. In the Excessive Momentum indicator, you get two signal alerts. Firstly, you will get alert when the Excessive Momentum is starting in the market. In this case, it will notify you the starting price. At this stage, the excessive momentum is not completely expanded yet.

Secondly, you will get alert when the Excessive Momentum is completed in the market. At this stage, you will be notified both starting price and ending price of Excessive Momentum.

Both starting price and ending price of Excessive Momentum form the Excessive Momentum Zone. At which signal you want to trade is up to your choice. You can use the zone as the breakout trading when the zone is narrow. When the zone is sufficiently large, it might be possible to aim some reversal trading opportunity too.

At the same time, this Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version).

YouTube Video Momentum Indicator: https://youtu.be/oztARcXsAVA

=============================================

Below is the landing page for Excessive Momentum Indicator.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Here is the link to Volume Spread Pattern Indicator (Paid and Advanced Version).

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Here is the link to Volume Spread Pattern Detector (Free and Light Version).

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Related Products