Harmonic Pattern with Japanese Candlestick Pattern

In this article, we will introduce the trading strategy that combines Harmonic Pattern with Japanese Candlestick Pattern in Forex and Stock Trading. Harmonic Pattern is a trading strategy that uses direct pattern recognition from the price chart to predict potential turning points of the financial market 1. It is a popular trading technique that has been around for a few decades 1. The concept of Harmonic Pattern was first introduced in Gartley’s book “Profits in the Stock Market” in 1935. The Guide to Precision Harmonic Pattern Trading is a book that introduces a new precision concept, Pattern Completion Interval and Potential Continuation Zone, for harmonic pattern trading. Precision Harmonic Pattern Trading also illustrates how to manage orders and risks with Harmonic pattern and how to apply this precision concept for both market order and pending order setup for practical trading.

On the other hands, Japanese candlestick patterns are a popular tool used by the technical traders to analyze the price movements of financial markets. Japanese Candlestick pattern are formed using the open, high, low, and close of the specific time period. The japanese candlestick patterns are used to predict future price movements and identify potential trading opportunities. There are many different types of Japanese candlestick patterns, including bullish, bearish, reversal, and continuation patterns 1. Some of the most common patterns include Doji, Spinning Top, Marubozu, Hammer, Inverse Hammer, Hanging Man, Shooting Star, Bullish Engulfing, Bearish Engulfing, Piercing Line, and Dark Cloud Cover.

Japanese candlestick pattern provides visual insight or guide for buying and selling momentum present in the market. Japanese candlestick pattern can provide both entry and exit signal for traders. At the same time, many traders use them as the confirmation techniques. Japanese candlestick patterns provide both trend continuation and trend reversal patterns as shown in Figure 1-6 and Figure 1-7. The main advantage of Japanese candlestick is that they are simple and universal. Japanese candlestick pattern can be detected visually without need of the sophisticated tool. At the same time, the accuracy of the Japanese candlestick can be quite subjective to traders. Unless you want to hold your trade for one bar or two bar only, sometime Japanese candlestick pattern can predict the direction wrong against long-term price movement. So the caution must be made to use together with other technical indicator or other pattern analysis. From my experience, Japanese candlestick has more values as the confirmation technique rather than main signal for your trading.

Apparently Japanese Candlestick patterns are popular and helpful tools to trader to predict the market direction. It is possible to use Japanese Candlestick patterns in your Harmonic Pattern Trading. These Japanese candlestick patterns include “Hammer”, “Doji Star”, “Harami”, “Inverted Hammer”, “Break away” and so on.

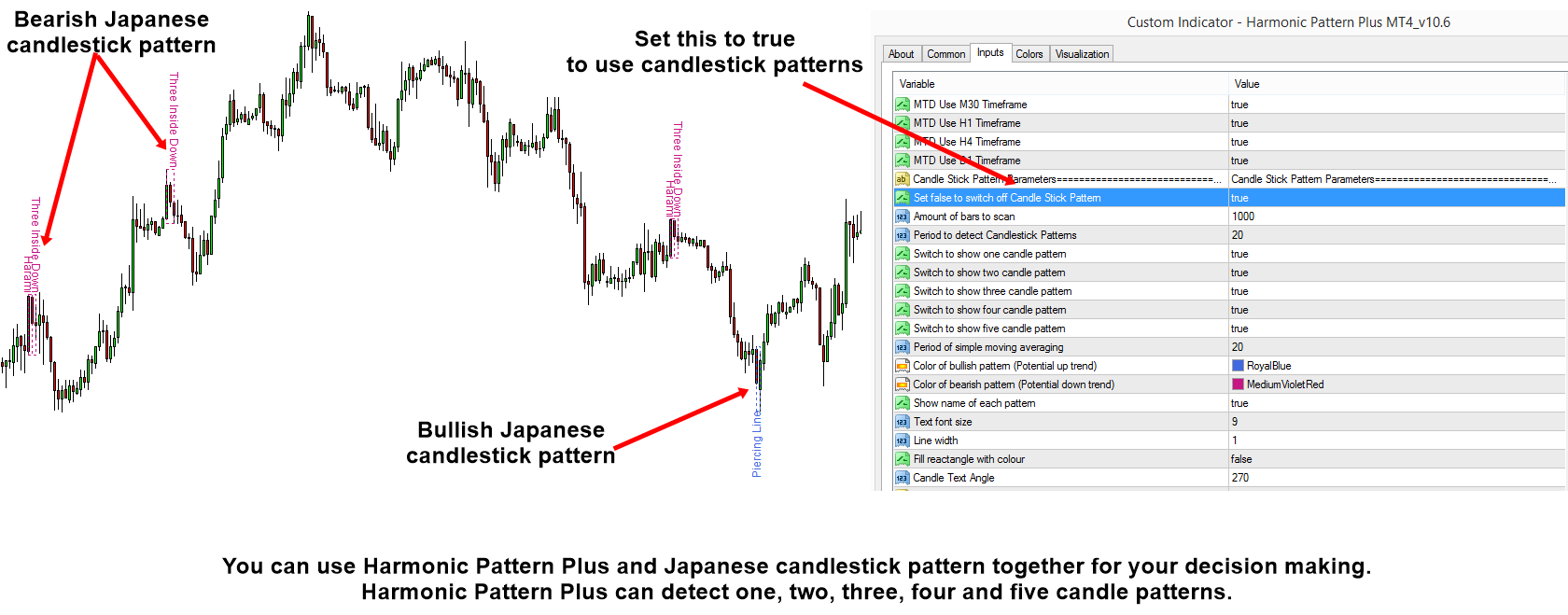

Here is a article on how to use Japanese candlestick pattern with Harmonic Pattern Plus. This article meant to be quick guideline on enabling Japanese Candlestick pattern together with Harmonic Pattern. In addition, you can use the Japanese Candlestick Patterns from X3 Chart Pattern Scanner too.

Link to Harmonic Pattern Plus

(Repaintng Harmonic Pattern Indicator, Addordable but Powerful)

Harmonic Pattern Plus is a trading indicator that automates the process of detecting harmonic patterns in the financial market 1. It provides many harmonic patterns that have been tested in research, including Butterfly, Gartley, Bat, Crab, Cypher, and 5-0 patterns 1. The indicator also includes three important trading elements: Pattern Completion Interval (PCI), Potential Reversal Zone (PRZ), and Potential Continuation Zone (PCZ) to improve the accuracy of your trading. The Harmonic Pattern Plus MT4 indicator can detect up to 11 harmonic patterns automatically and supports multiple timeframe pattern scanning. It also provides historical pattern forward and backward reply function to create new trading strategies. The indicator can be used to detect 52 different bullish and bearish candlestick patterns, including hanging man, shooting star, engulfing, doji, harami, kicking, etc.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

(Non Repainting Harmonic Pattern Indicator + Historical Harmonic Pattern Testable, Advanced and Highly customizable)

X3 Chart Pattern Scanner is the non-repainting and non-lagging indicator detecting X3 chart patterns including Harmonic pattern, Elliott Wave pattern, X3 patterns, and Japanese Candlestick patterns. Historical patterns match with signal patterns. Hence, you can readily develop the solid trading strategy in your chart. More importantly, this superb pattern scanner can detect the optimal pattern of its kind. In addition, you can switch on and off individual patterns according to your preferences. For example, if you only want to trade harmonic patterns, then just switch off all Elliott Wave and X3 price patterns. Also, note that each pattern is customizable with RECF notation. Japanese candlestick patterns are kind of bonus package added in the indicator. Japanese candlestick patterns can be used as the secondary confirmation for harmonic patterns, Elliott wave and X3 patterns. You can also switch on and off Japanese Candlestick patterns.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Related Products