Manual For Pairs Trading Indicator

Pairs trading is a market-neutral strategy that involves taking a long position (=buy) in one currency pair and a short position (=sell) in another currency pair. Pairs trading is called a market-neural strategy as its goal is to achieve the hedging effect between the two. The goal of pairs trading is to profit from the difference in performance between the two currency pairs and the difference is called the spread. Pairs trading strategy is based on the assumption that the two currency pairs are cointegrated, meaning that they have a long-term relationship that can be exploited to profit. Typically, the tools to check the state of cointegration between two currency pairs or between two stocks include ADF, PP, KPSS, etc.

In Forex trading, currencies are traded in pairs. The most commonly traded currency pairs are called the majors, which include the US dollar and currencies from other major economies such as the euro, yen, and pound. The majors are the most liquid currency pairs in the world and provide more trading opportunities than other currency pairs. When selecting currency pairs for pairs trading, traders often look for pairs that are highly correlated. This means that the two currency pairs tend to move in the same direction over time. By taking a long position in one currency pair and a short position in another currency pair, traders can profit from the difference in performance between the two pairs. Some of the best currency pairs for pairs trading include the EURUSD, USDJPY, GBPUSD, USDCAD, USDCHF, and AUDUSD. These currency pairs are highly liquid and have tight spreads, making them ideal for pairs trading or hedging.

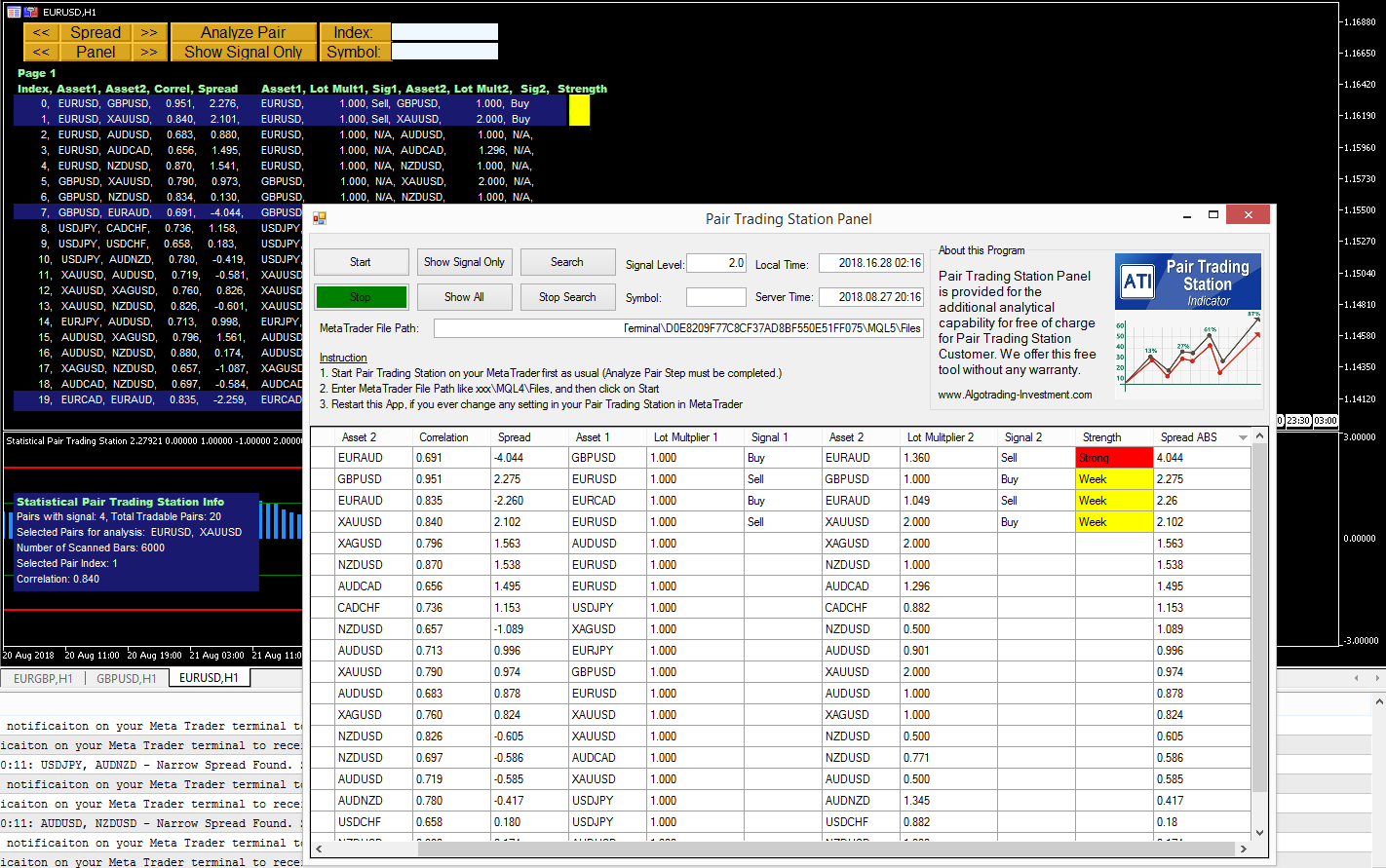

Pair Trading Station is a powerful Pairs Trading Indicator that uses the correlation and spread analysis. Pairs trading is also known as the statistical arbitrage as it involves buying undervalued asset and selling overvalued asset at the same time. Pair Trading in Forex can be best described as taking the hedge position of buying and selling two highly correlated instruments at the same time. However, pairs trading can be used to predict the turning point. For example, it is possible to only take one buy or sell position only. When you take one position, you can use the pair trading signal as the primary confirmation and then you can use other secondary confirmation techniques to accomplish your trading decision. On the other hands, you can use the pair trading signal as the secondary confirmation techniques and then you can use your other technical or fundamental analysis as the primary confirmation. One thing you have to note here is that your other techniques to be used together with our pair trading signal should be based on the mean reversion trading because pair trading is based on the mean reversion trading principle too.

You can have a look at this manual from the link. This manual was written for Pairs Trading Station. This manual focuses on taking the hedging position between buying and selling two highly correlated instruments. The manual includes how to use the basic features of Pairs Trading station like buttons and input settings. In addition, it also teach you how to interpret the spread for your trading. As we have mentioned before, once you can interpret the spread, then you can combine the spread analysis with other secondary confirmation techniques.

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

YouTube Video about Pairs Trading Indicator

YouTube Link: https://www.youtube.com/watch?v=fAE9pByxZDA

Related Products