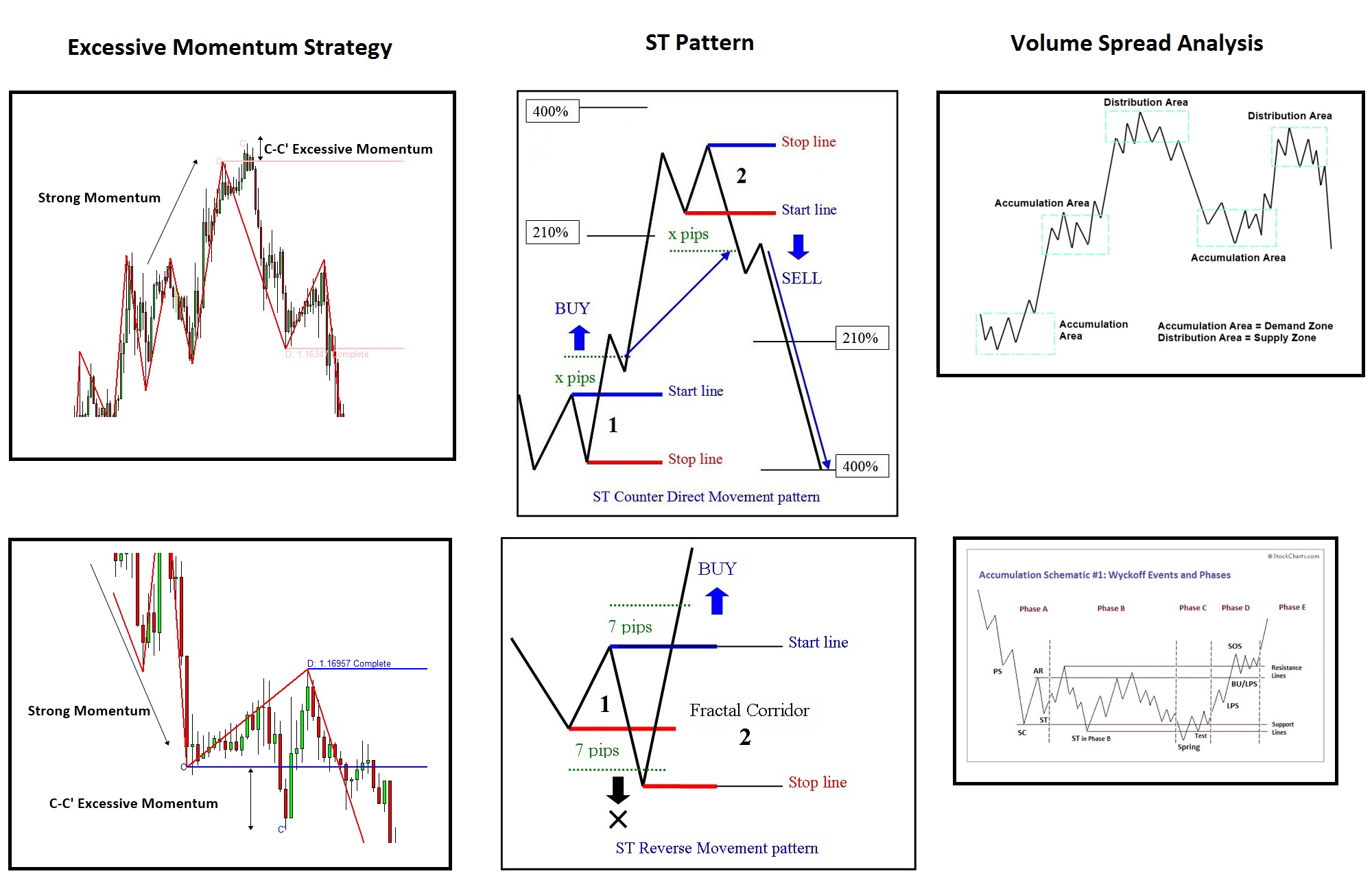

Trading Strategy Comparison – Excessive Momentum

Somehow, I come across ST Pattern Strategy on the internet. I do not know thoroughly about the strategy yet. I only had a quick glance but its described entry and exit seems similar to excessive momentum strategy added in Excessive momentum indicator.

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Why I am so interested in this? Let me explain. The biggest happiness for the creator of strategy is when the strategy is used in practice in well balanced manner and serve the trader to achieve their realistic financial goal.

Especially, excessive momentum strategy was created from the pure math and philosophical point of view. You can check this price pattern and strategy table here released in 2017. Maybe you won’t find out how I created the strategy in just one quick look because this price pattern and strategy table contains really dense piece of information. But you will catch slowly as you read the book.

https://algotrading-investment.com/2019/07/23/trading-education/

When I first created the Excessive momentum strategy, volume spread analysis was the closest practical application (i.e. as well as explanation for excessive momentum) I could find out. Of course, they are not identical. What I am talking about is that the main trading philosophy are similar.

I was really happy that the pure projection of math and philosophy live in real world trading. But I was still looking for another practical way of applying Excessive momentum or similar sort.

Then I come across this ST Pattern strategy and I found the trading framework of entry and exit are pretty close to excessive momentum strategy too. I am sure that they would be some gray area when you get into details. But at least from its look, they are pretty close.

What would be a chance to meet your college friends in the same restaurant situated in the most dense area of Manhattan after you have graduated many years ago ? When I saw ST Pattern strategy, I feel like this exactly.

For your trading, I think the best of the best is where the theory and practice meets. If the person understand the theory as well as practice, this will yield you the best of the best outcome. Most of time, doing like this will take time and practice. Also you have to read a lot too as well as trading a lot. You should not judge the trading strategy in just five minutes and then jump to other strategy like grasshopper.

When you test new strategy, take moment to think. Any trading strategy will stem from these five regularities we know. Slowly find out which regularity the trading strategy is designed to capture. Then you will find out more about the trading strategy thoroughly.

Related Products