Harmonic Pattern Trading Articles

Harmonic pattern trading articles refer to written content that discusses the concept, techniques, strategies, and practical applications of harmonic pattern in the financial markets, as in Forex and Stock trading. Harmonic patterns are a form of technical analysis that involves the recognition of specific price patterns formed by Fibonacci retracement and extension levels.

These articles may cover various aspects of harmonic pattern trading, including:

- Introduction to Harmonic Patterns: An overview of what harmonic patterns are, how they are formed, and their significance in technical analysis.

- Types of Harmonic Patterns: Detailed explanations of specific harmonic patterns such as the Gartley, Butterfly, Bat, Crab, and Shark patterns, including their characteristics and how to identify them on price charts.

- Fibonacci Ratios and Harmonic Patterns: Exploration of the relationship between Fibonacci ratios (such as 0.382, 0.618, etc.) and harmonic patterns, highlighting how these ratios are used to validate the patterns and identify potential reversal or continuation zones.

- Trading Strategies: Discussion of various trading strategies that incorporate harmonic patterns, including entry and exit techniques, risk management principles, and ways to combine harmonic patterns with other technical indicators for enhanced trading decisions.

- Harmonic Pattern Scanners and Tools: Reviews and comparisons of software tools and indicators designed to automatically detect harmonic patterns on price charts, helping traders streamline their analysis process.

- Real-Life Examples and Case Studies: Illustrative examples of how harmonic patterns have been successfully applied in real trading scenarios, demonstrating their practical utility and potential profitability.

These articles are typically written by experienced traders, technical analysts, educators, or financial journalists who specialize in technical analysis and Forex trading. They aim to provide valuable insights, tips, and strategies to traders interested in incorporating harmonic pattern analysis into their trading approach.

We provide the must read articles for Harmonic Pattern Trading, which are useful if you are using the technical analysis to trade in Forex and Stock. Harmonic Pattern Trading is the powerful way of predicting market turning point. Harmonic Pattern trading is probably the most popular trading strategy last few years. In this article, we introduce some of the articles and automated harmonic pattern indicators might be useful for your technical analysis.

1) Guideline for Harmonic Pattern for Starters

This article provides the quick guide of applying harmonic patterns with risk management for various Harmonic Pattern including Butterfly, Gartley, Bat, Alternate Bat, AB=CD, Shark, Crab, Deep Crab, Cypher, 5-0 Patterns, 3 Drives Pattern and so on. This article is probably good educational material if you are looking to hit the ground with harmonic pattern. We recommend to read this one first before attempting to read any other article.

https://algotrading-investment.com/2018/10/21/quick-guideline-for-harmonic-pattern-plus-for-starter/

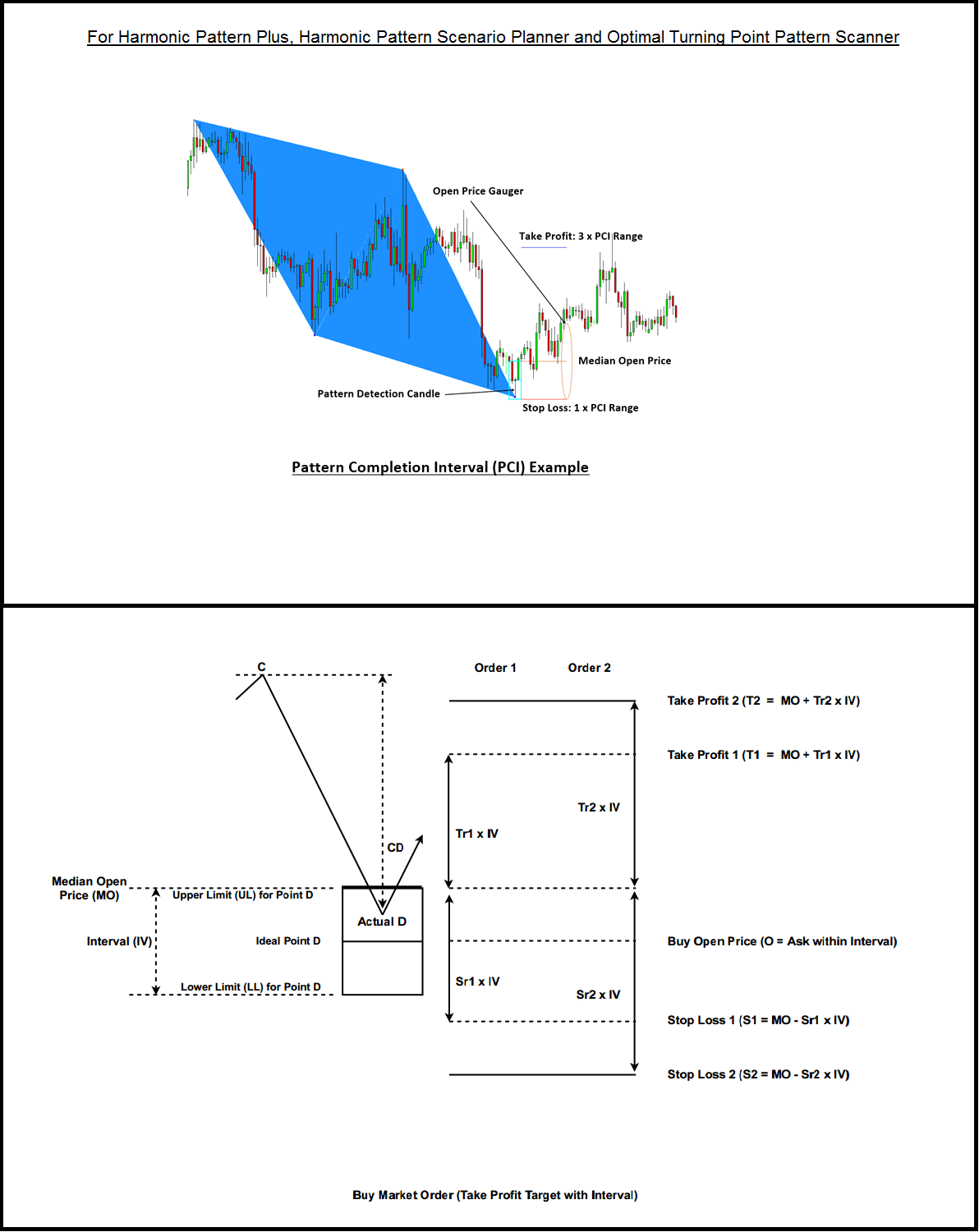

2) Pattern Completion Zone (also known as Pattern Completion Interval)

Pattern Completion Zone is one of the fundamental element for harmonic pattern detection. Pattern Completion Zone is the important element for decision making and money management part as well as for various straetgy concerend with Harmonic Pattern. You will be not able to trade Forex and Stock properly if you do not understand what is Pattern Completion Zone. Especially, this article introduce the tactical use of Pattern Completion interval in your harmonic pattern trading.

https://algotrading-investment.com/2018/10/26/pattern-completion-interval/

3) Turning Point and Trend

If you want to become profitable trader, the first thing you need to understand is the difference between turning point and trend in the financial market. If you read many trading articles and books, you will find the diverse opinion over turning point and trend. This article provides short but essential description of turning point and trend in the financial market. Why do you need to understand turning point and trend for harmonic pattern or for other technical analysis ? It is simply because Harmonic Pattern are working the best when you are using them as semi turning point strategy. That is the hybrid strategy between turning point and trend strategy. Read the article below to get the invaluable insight using Harmonic Pattern Trading.

https://algotrading-investment.com/2019/07/06/turning-point-and-trend/

4) Harmonic Pattern Plus

Harmonic Pattern Plus is one of the first automated Harmonic Pattern detection tool released in 2014. Harmonic Pattern Plus can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Harmonic Pattern Plus is a repainting indicator. However, because of affordable price, this harmonic pattern detection indicator is loved by many traders.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

5) Harmonic Pattern Scenario planner

Harmonic Pattern Scenario planner is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation with Harmonic Pattern Scenario planner. Harmonic Pattern Scenario planner is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Harmonic Pattern Scenario planner is a repainting indicator. However, the advanced prediction feature might be useful to trade without repainting in Harmonic Pattern Scenario planner.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

6) X3 Chart Pattern Scanner

X3 Chart Pattern Scanner is our next generation Harmonic Pattern and Elliott Wave Pattern Scanner. X3 Chart Pattern Scanner is non-repainting and non-lagging Harmonic Pattern Indicator. On top of that, X3 Chart Pattern Scanner can detect Elliott Wave Pattern and X3 Chart Patterns. X3 Chart Pattern Scanner can detect over 20 profitable chart patterns. The bonus is that you can also detect around 52 Japanese candlestick patterns as well as advanced Channel with X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Related Products