Objective Elliott Wave

Objective Elliott Wave (OEW) is an approach to Elliott Wave analysis that seeks to provide a systematic and rule-based method for identifying and interpreting Elliott Wave patterns in financial markets. Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a form of technical analysis that attempts to forecast market trends by identifying repetitive wave patterns in price movements. These patterns are said to reflect the underlying psychology of market participants. Traditional Elliott Wave analysis can be subjective and open to interpretation, as it relies heavily on the analyst’s judgment to identify wave patterns and determine their significance. Objective Elliott Wave, on the other hand, aims to minimize subjectivity by establishing specific rules and guidelines for identifying and interpreting wave patterns.

Key principles of Objective Elliott Wave analysis may include:

- Wave Counting Rules: Objective Elliott Wave typically follows specific rules for counting waves, such as guidelines for wave retracements, wave proportions, and wave relationships. These rules help to standardize the process of identifying wave patterns.

- Fibonacci Ratios: Objective Elliott Wave often incorporates Fibonacci ratios to identify potential reversal or extension levels within wave patterns. Fibonacci ratios, such as 0.618, 1.618, and 2.618, are commonly used to measure the magnitude of price moves within Elliott Wave patterns.

- Wave Validation Criteria: Objective Elliott Wave may utilize validation criteria to confirm the validity of wave patterns. These criteria could include requirements for wave structure, momentum indicators, or volume analysis to support the identified wave count.

- Trend Confirmation: Objective Elliott Wave analysis typically seeks confirmation from other technical indicators or chart patterns to validate the direction of the trend indicated by the wave count. This helps to reduce the likelihood of misinterpretation or false signals.

By applying a systematic and rule-based approach, Objective Elliott Wave aims to provide more objective and reliable insights into market trends and potential price movements. However, it’s important to note that like any technical analysis method, Objective Elliott Wave is not foolproof and should be used in conjunction with other analytical tools and risk management strategies. Additionally, different practitioners may have variations in their interpretation and application of Objective Elliott Wave principles.

In this article, we will explain how to turn the general Elliott Wave Theory to objective trading strategy, so called Objective Elliott Wave, for the technical analyst working in Forex and Stock market. Elliott Wave is popular Trading strategy in the trading world. The Elliott Wave Theory was originally developed by Ralph Nelson Elliott. It was populated by Robert Prechter.

In the original Elliott Wave Theory, Ralph Nelson Elliott left three Wave rules in counting Elliott Wave. A correct Elliott Wave counting must observe three rules:

- Wave 2 never retraces more than 100% of wave 1.

- Wave 3 cannot be the shortest of the three impulse waves, namely waves 1, 3 and 5.

- Wave 4 does not overlap with the price territory of wave 1, except in the rare case of a diagonal triangle formation.

These three rules are the very general statement about the movement of the financial market. There are a lot of subjectivity when we apply these original rules in trading. Hence, we do not recommend you to trade with these general rules.

The wave principle is rather general theory. As you will learn practical knowledge at work place after your school, we also need to develop practical knowledge after we have learnt the wave principle too. People who try to use the raw Wave principle may start with big disappointment because its complexity and frustrating results at the beginning.

To apply the Wave principle in practice, we can have two alternative approaches. One is pattern approach and the other is wave-counting (or labelling) approach. In pattern approach, we can create Elliott Wave patterns with specific ratio sets based on the Wave principle. After we have figured out the sensible ratios for each pattern, we can test the pattern through data. We can also learn how to apply each pattern through the data too.

In wave –counting approach, you will start with the current chart and try to label minor and major cycles in your chart according to the wave principle. The outcome is to try to label each peak and trough as accurately as possible according to the Wave principle. Wave counting always involves the nested wave counting, which is open for the subjectivity of the practitioner.

Comparing to the pattern approach, wave-counting approach is hard to test its trading outcome in real world trading for two reasons. Firstly, getting the agreement on wave cycle in Forex and Stock market is hard among the wave-counting practitioners. Secondly, chart data is always unique when you try to fit several nested wave cycles in wave counting. Hence, we are not able to copy and paste our past wave counting for the current market data because they do not fit simply. If we have to create unique counting every time, there is high chance of subjectivity. In Pattern approach, once the specific ratio set is provided, whoever used the patterns, you will get the pattern signal at the same time as long as you use the same data with the other traders. Pattern approach is more close to the mechanical signal what every trader is looking for.

In practice, we need more specific and objective rules instead of the general rules. Yes, we will follow the general rules but we will measure the accuracy of Wave Pattern Structure to eliminate bad Elliott Wave patterns in trading.

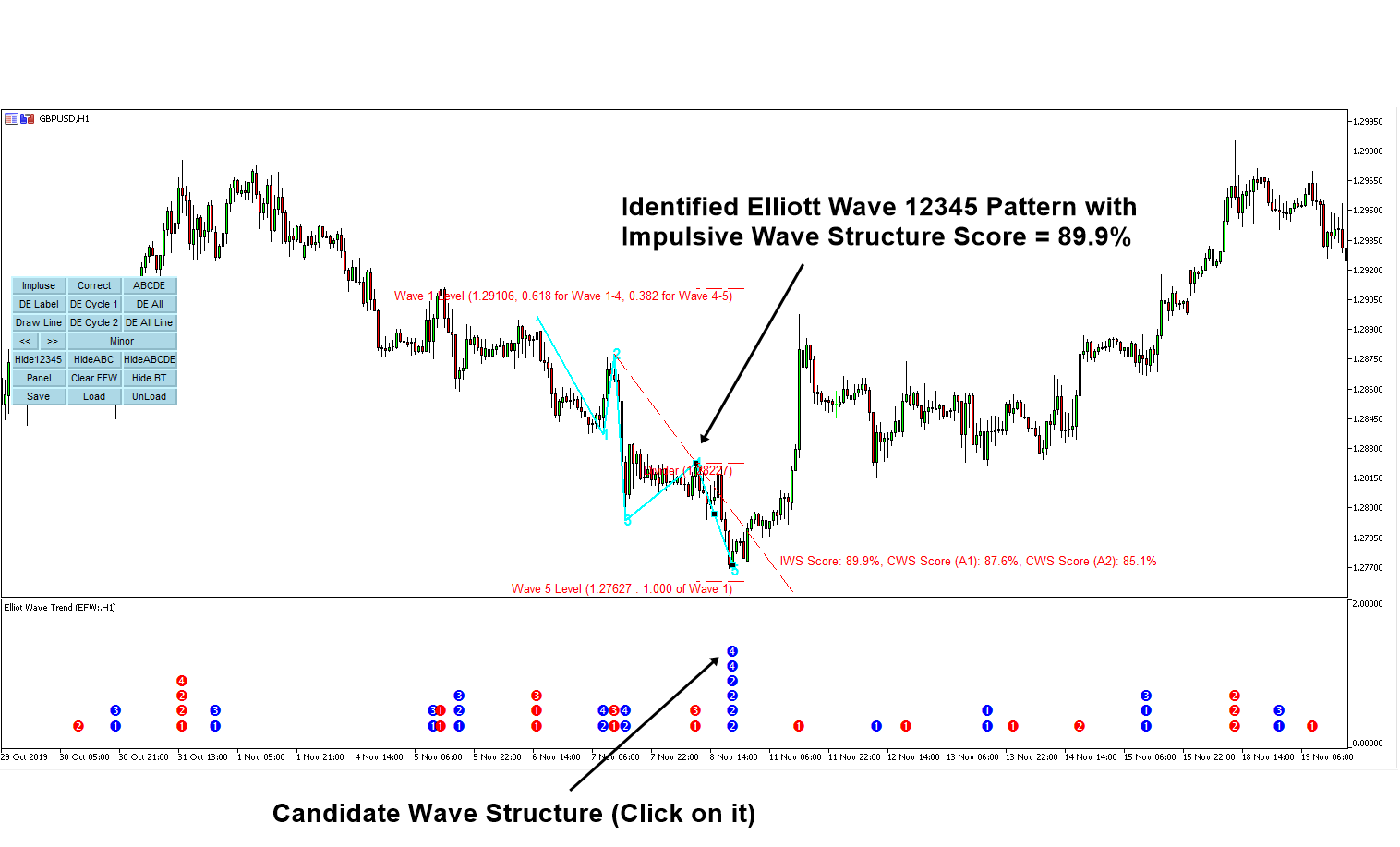

Elliott Wave Trend is the first indicator that provides the objective measurement around the Elliott Wave pattern structure. Wave structural score will guide you to trade with more accurate and defined Elliott Wave pattern structure. Two Wave structural scores we are using are:

1) Impulse Wave Structure Score (IWS Score) – measure the accuracy of Impulsive Elliott Wave in percents. For example, IWS Score can be used to detect Elliott Wave 123, Elliott Wave 1234 or Elliott Wave 12345 patterns.

2) Corrective Wave Structure Score (CWS Score) – measure the accuracy of Corrective Elliott Wave in percents. For example, CWS Score can be used to detect Corrective Wave ABC patterns.

With these two Wave Structure Score, you can identify the correct Elliott wave patterns from many candidate Wave patterns.

Of course, in Elliott Wave Trend, these two Wave Score will be automatically calculated and presented for your trading. In addition, Elliott Wave Trend presents you candidate Wave patterns automatically so that you do not have to spend time on drawing these patterns manually.

In the screenshot below, we shows the Elliott Wave 12345 pattern with IWS Score of 89.9% (IWS Score > CWS Score). With this high Wave Structure score for Elliott Wave 12345 pattern, you have a high chance to spot the market turning point correctly.

Elliott Wave Trend is the Advanced Elliott Wave Indicator for your trading. Stay with Objective Elliott Wave Trading for the best possible trading performance.

Here are the links for Elliott Wave Trend for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

https://www.mql5.com/en/market/product/16479

Related Products