Insignificant Turning Point, Local Turning Point and Global Turning Point

If harmonic pattern could predict the potential turning point, we can choose to materialize this opportunity or not. We covered that this prediction is subject to probabilistic nature. Harmonic Pattern is not a bulletproof predictor of the future. If you find someone mentioning 95% or 96% or even 90% prediction accuracy whatsoever, you could just step away from those bullshit. Most of time, its two things, that person does not know what he is talking about or that person might want to cheat on you. Simply let us not involved on that time wasting activities. We have already shown you how to calculate your profits in previous chapter. There is certainly no need to talk about 95% prediction accuracy in our trading.

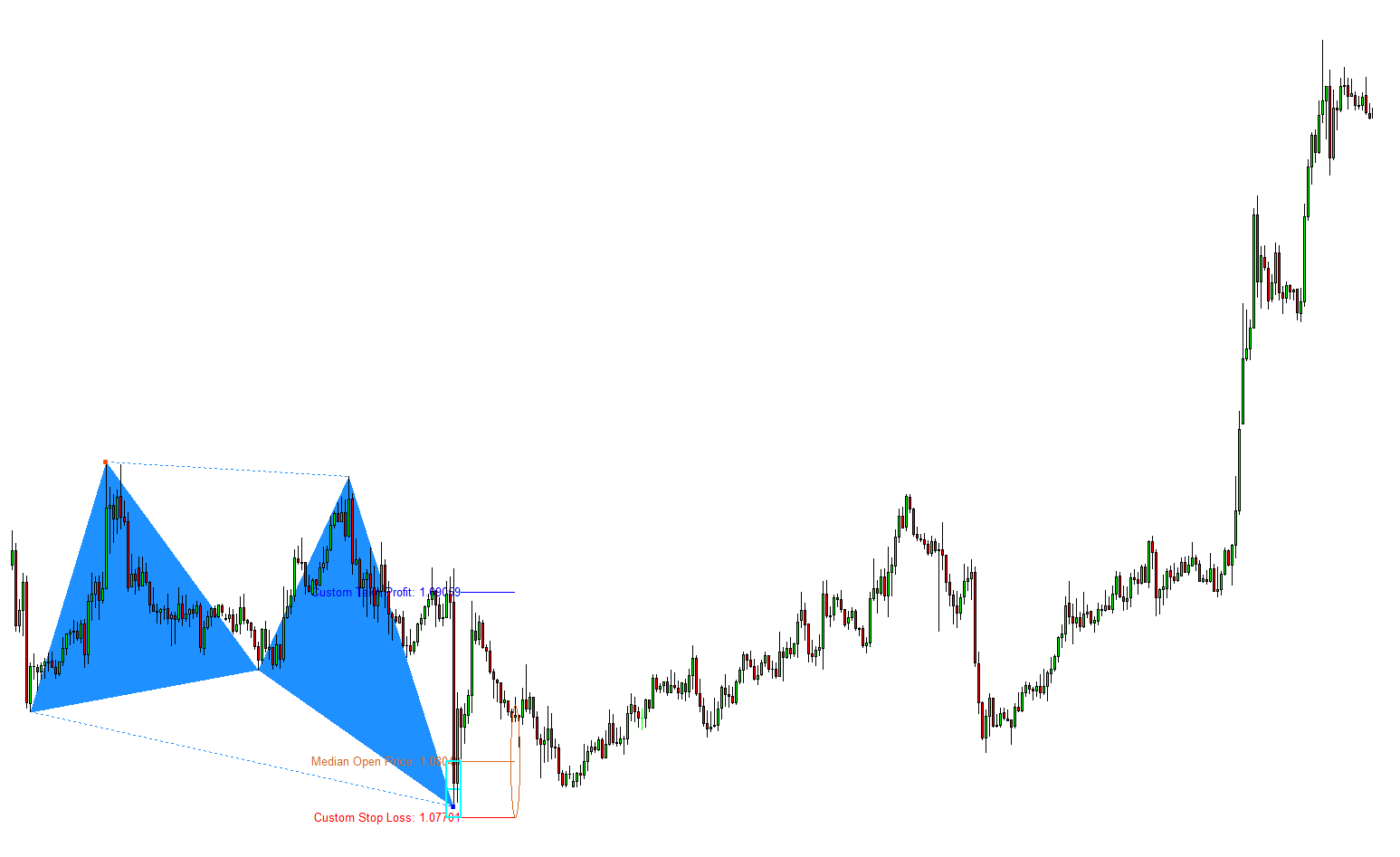

Harmonic Pattern Trader needs to understand that our turning point prediction can end up few distinctive scenarios. Our turning point prediction can spot the global turning point as shown in Figure 7-1. This is the best outcome you can achieve with harmonic pattern trading. Since we can ride the big trend from the start to an end, we can materialize almost the entire trend range for our profits. Considering our stop loss was just 10 to 20 pips, for example, our Reward can be something like 500 or 1000 pips sometimes. Reward/Risk ratio like 30 or 50 is a mega deal to traders. Of course, this is very rare opportunity in real world trading. However, at least, it is not difficult to hear that someone hit the turning point dead accurately and his investment is running almost without any drawdown. To meet such a mega opportunity, we need both luck and discipline for our trading. The good news is that Harmonic Pattern can spot one of these opportunities because it is turning point predictor. In general, many trend based trading strategies will likely enter the market much later after the turning point happens.

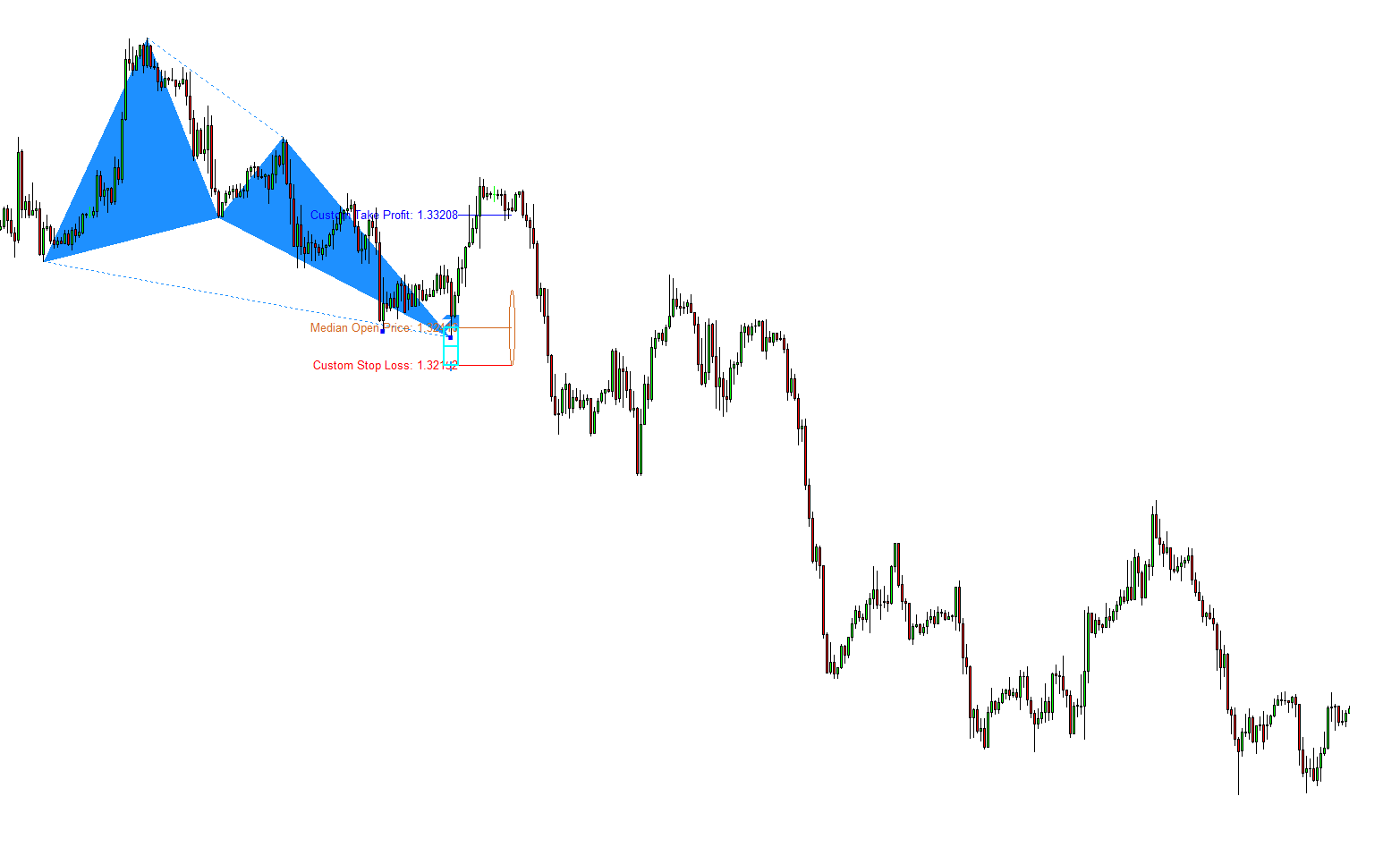

Since the global turning point formation requires huge trading volumes to push the price forwards, we are less likely to catch this movement in the probabilistic sense. Instead, our turning point prediction can spot the local turning point more often as shown in Figure 7-2. In that case, we will only catch correction against the trend. In fact, more often, we will end up with local turning point or we can be wrong with our prediction. If your trading plan involves waiting for the global trend, statistically speaking, you are likely to lose more often. Especially if your stop loss is tight, then you will lose more. This is even true to many seasoned traders. Luckily, in trading, the size of trend does not matter for our profit if we can manage our order in proportion to our trading capital. For example, if your risk is set to 1% of your trading balance and Reward/Risk ratio =5, then it does not matter whether the market moves 200 pips (i.e. global turning point scenario) or 20 pips (i.e. local turning point scenario). As long as the market hits the take profit, we will bank the same amount of profit into our accounts, which is 5% of our trading capital in our example. With some help of fundamental analysis and long term technical analysis, it is not impossible to predict on the global turning point prediction. In addition, it is also possible to catch both local and global turning point by opening multiple of positions for your trading. For example, by sending one order with Reward/Risk ratio = 3 and sending second order with Reward/Risk ratio = 12, you can increase your potential to catch both local and global turning point.

Regardless of the turning point scenarios, the risk formulation with the Pattern completion Interval can help traders to precisely form stop loss and take profit levels within the confined price and time space in your chart. At the same time, the price can move much quicker within the confined price and time space. Some discipline must be accomplished to master the Harmonic Pattern trading in practice. Harmonic pattern trading is not a bulletproof technique. Practically, many times, you will observe that harmonic pattern can predict the insignificant turning point. This means that the reaction at final point D is not significantly large for us to take the profits out. Sometimes, the final point D can be totally ignored by the market and price can just pass through the final point D without making any turning point. For this reason, you have to try to enter the market when there is higher chance of success. In general, you should not rely on harmonic pattern alone to make your trading decision. You have to make use of secondary confirmation with other technical analysis. It is advantageous if you can read the fundamentals of the market but it is not compulsory though. However, for the healthy growth of your trading capital, the right risk management should be in place without exception.

Figure 7-1: Harmonic Pattern predicting global turning point.

Figure 7-2: Harmonic Pattern predicting local turning point.

Some More Tips about Insignificant Turning Point, Local Turning Point and Global Turning Point in Forex Trading

In forex trading, turning points refer to moments when the market changes direction. These can be categorized into insignificant, local, and global turning points based on their impact and duration. Understanding these turning points can help traders make more informed decisions. Here’s an explanation of each type:

Insignificant Turning Point

- Description:

- An insignificant turning point is a minor fluctuation in price that does not significantly alter the overall trend.

- These are short-term reversals that occur frequently and are often caused by temporary market factors such as minor news events, low liquidity, or intraday trading activities.

- Characteristics:

- Short-lived and typically do not impact the broader market trend.

- Can be seen as noise in the market, often within a range-bound or consolidating market.

- Application:

- Traders may choose to ignore insignificant turning points if they are focused on longer-term trends.

- Scalpers and day traders might exploit these minor fluctuations for quick profits but must be cautious of false signals.

Local Turning Point

- Description:

- A local turning point is a more significant change in direction within a defined period or range.

- These points are notable on shorter timeframes (e.g., hourly or daily charts) and indicate a temporary reversal or retracement within the larger trend.

- Characteristics:

- More pronounced than insignificant turning points, but still within the context of the prevailing larger trend.

- Often associated with technical signals such as overbought/oversold conditions, support/resistance levels, or short-term chart patterns (e.g., head and shoulders, double top/bottom).

- Application:

- Swing traders and short-term traders monitor local turning points to enter or exit trades based on anticipated short-term movements.

- Can provide opportunities to trade retracements or pullbacks within the larger trend.

Global Turning Point

- Description:

- A global turning point represents a major reversal in the overall market trend.

- These turning points are significant and often mark the beginning of a new long-term trend or the end of a previous one.

- Characteristics:

- Seen on longer timeframes (e.g., daily, weekly, or monthly charts).

- Usually driven by major economic events, policy changes, significant geopolitical developments, or shifts in market sentiment.

- Application:

- Long-term traders and investors pay close attention to global turning points to adjust their portfolios and strategies.

- These turning points are critical for identifying major market cycles and positioning for extended trends.

Identifying Turning Points

- Technical Analysis:

- Indicators: Moving Averages, MACD, RSI, and Bollinger Bands can help identify potential turning points.

- Chart Patterns: Patterns such as head and shoulders, double tops/bottoms, and triangles can signal reversals.

- Fundamental Analysis:

- Economic Data: Key economic indicators (e.g., GDP, employment data, inflation) can trigger significant turning points.

- Central Bank Policies: Interest rate decisions, monetary policy changes, and statements from central bank officials can influence major market reversals.

- Sentiment Analysis:

- Market Sentiment: Tools like the Commitment of Traders (COT) report, sentiment surveys, and news sentiment can provide insights into potential turning points based on trader and investor behavior.

Practical Example

- Insignificant Turning Point: A minor price drop in the EUR/USD pair during a strong uptrend due to a temporary news event. Day traders might trade the dip, but it does not affect the overall uptrend.

- Local Turning Point: The EUR/USD pair reaches an overbought level on the RSI, prompting a short-term pullback within the larger uptrend. Swing traders might short the pair for a quick profit before it resumes the uptrend.

- Global Turning Point: The EUR/USD pair reverses from a long-term uptrend to a downtrend after a significant ECB policy change indicating lower interest rates ahead. Long-term investors adjust their positions accordingly.

By understanding and identifying these turning points, traders can better navigate the forex market, optimize entry and exit points, and enhance their overall trading strategy.

About this Article

This article is the part taken from the draft version of the Book: Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading). This article is only draft and it will be not updated to the completed version on the release of the book. However, this article will serve you to gather the important knowledge in financial trading. This article is also recommended to read before using Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and Profitable Pattern Scanner, which is available for MetaTrader or Optimum Chart.

Below is the landing page for Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and Profitable Pattern Scanner in MetaTrader. All these products are also available from www.mql5.com too.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Related Products