Identification of Support and Resistance with the Template and Pattern Approach

When you detect the support and resistance in your chart, it is important that you are trading with quality support and resistance. In our 1st training, we have shown how to use the Peak Trough Analysis to study the Equilibrium Fractal Wave patterns in your chart. Once again, the Peak Trough Analysis can be used as a starting template for support and resistance identification. However, the use of template is not compulsory though. In addition, it should be noted that the Peak Trough Analysis could only provide the rough guideline for the identification of the support and resistance. In spite of the fact that the Peak Trough Analysis is not the perfect tool to identify the support and resistance, I found that at least it is extremely useful tool for starters because it provides some starting points. It can be even useful for the experienced trader too. To detect the high quality support and resistance lines, you can consider few things. In detecting the support and resistance, you might use the following general rules:

- Apply Peak Trough Transformation to visualize the important peaks and troughs in your chart.

- Connect peak to peak to detect resistances and connect trough to trough to detect supports (i.e. do not mix peak and trough.)

- There should be at least three touches around the support and resistance

- You can expect that most of time the touching point over support and resistance will not be dead accurate but you can use 5% or 10% margin to detect the support and resistance. 5% and 10% margin can be measured in relative to the triangle height. You can use the same method to calculate Y Buy and Y Sell for 5% and 10% margin calculation.

- Each touching point should have some distance from the adjacent touching point. If two touching points are too close to each other, then count them as one touching point only.

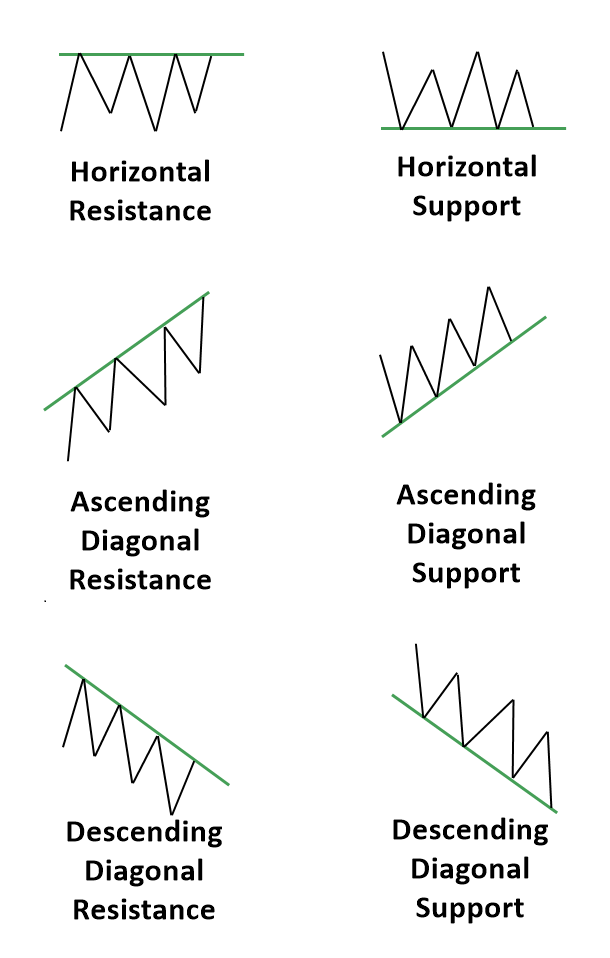

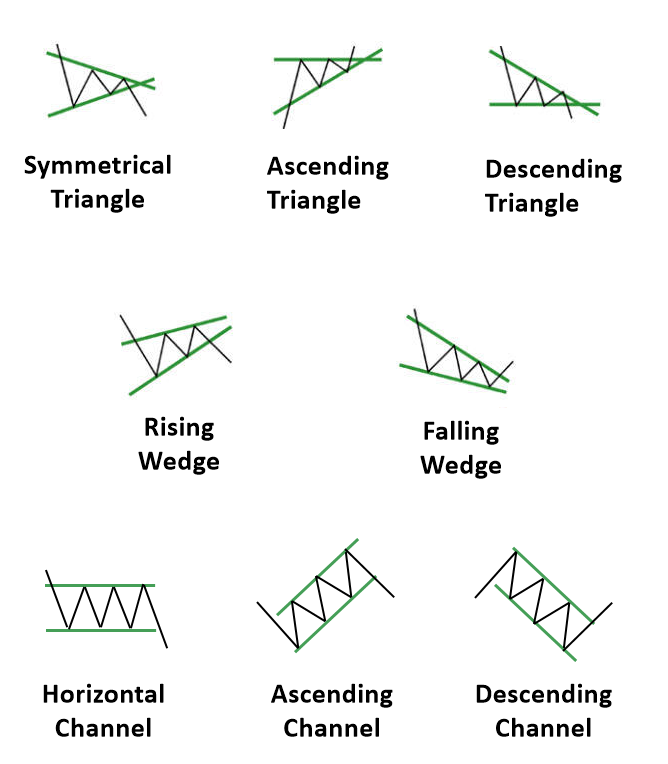

For your convenience, we provide the simplified diagram for each support and resistance patterns in Figure 2-15. In addition, we have listed the twelve support and resistance patterns and their price action in the Table 2-3. These six support and resistance patterns can be used for your trading without any other additional tool. However, it is possible that you can combine these patterns with other trading strategies, which we will discuss in the next chapter. As we will explain in the later chapter, typically the combined trading strategy can provide the powerful entry with higher winning rate. At the same time, these six support and resistance patterns can be the backbone of other price patterns. Most of Triangle, Wedge and Channel patterns shown in Figure 2-16 can be expressed in terms of these six support and resistance patterns in Figure 2-15. For example, the symmetric triangle price pattern can be made from one ascending diagonal support and one descending diagonal resistance. Likewise, other triangle and wedge patterns can be expressed using Support and Resistance patterns too. We list the Triangle, Wedge and Channel patterns and their sub price patterns in Table 2-4.

Figure 2-15: List of six support and resistance patterns.

| Support and resistance | Price Action | Direction | Example |

| Horizontal Support | Reversal | Buy | Figure 2-1 |

| Horizontal Support | Breakout | Sell | Figure 2-2 |

| Horizontal Resistance | Reversal | Sell | Figure 2-3 |

| Horizontal Resistance | Breakout | Buy | Figure 2-4 |

| Ascending Diagonal Support | Reversal | Buy | Figure 2-6 |

| Ascending Diagonal Support | Breakout | Sell | Figure 2-7 |

| Ascending Diagonal Resistance | Reversal | Sell | Figure 2-8 |

| Ascending Diagonal Resistance | Breakout | Buy | Figure 2-9 |

| Descending Diagonal Support | Reversal | Buy | Figure 2-10 |

| Descending Diagonal Support | Breakout | Sell | Figure 2-11 |

| Descending Diagonal Resistance | Reversal | Sell | Figure 2-12 |

| Descending Diagonal Resistance | Breakout | Buy | Figure 2-13 |

Table 2-3: List of support and resistance patterns.

Figure 2-16: List of Triangle, Wedge, and Channel patterns.

| Triangle, Wedge and Channel Pattern | Sub Price Patterns |

| Symmetrical Triangle | Ascending Diagonal Support + Descending Diagonal Resistance |

| Ascending Triangle | Horizontal Resistance + Ascending Diagonal Support |

| Descending Triangle | Horizontal Support + Descending Diagonal Resistance |

| Rising Wedge | Ascending Diagonal Resistance + Ascending Diagonal Support |

| Falling Wedge | Descending Diagonal Resistance + Descending Diagonal Resistance |

| Horizontal Channel | Horizontal Resistance + Horizontal Support |

| Ascending Channel | Ascending Diagonal Resistance + Ascending Diagonal Support |

| Descending Channel | Descending Diagonal Resistance + Descending Diagonal Resistance |

Table 2-4: List of Triangle and Wedge Patterns and their sub price patterns.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide To Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). This article is only draft and it will be not updated to the completed version on the release of the book. However, this article will serve you to gather the important knowledge in financial trading. This article is also recommended to read before using Price Breakout Pattern Scanner, Advanced Price Pattern Scanner, Elliott Wave Trend, EFW Analytics and Harmonic Pattern Plus, which is available for MetaTrader 4 and MetaTrader 5 platform.

Below is the landing page for Price Breakout Pattern Scanner, Advanced Price Pattern Scanner, Elliott Wave Trend, EFW Analytics and Harmonic Pattern Plus. All these products are also available from www.mql5.com too.

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Related Products