Diagonal Support and Resistance

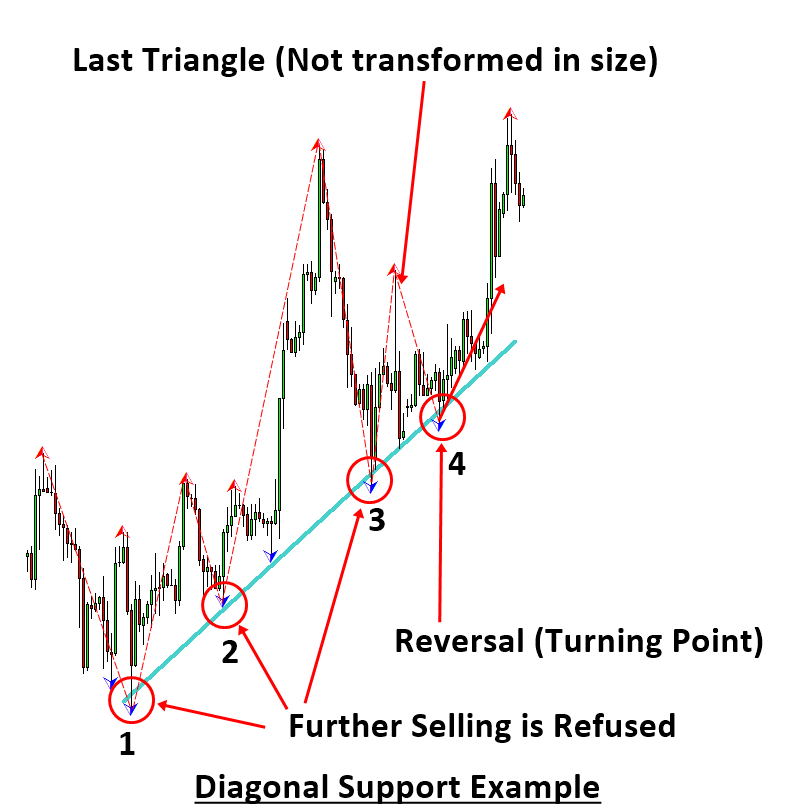

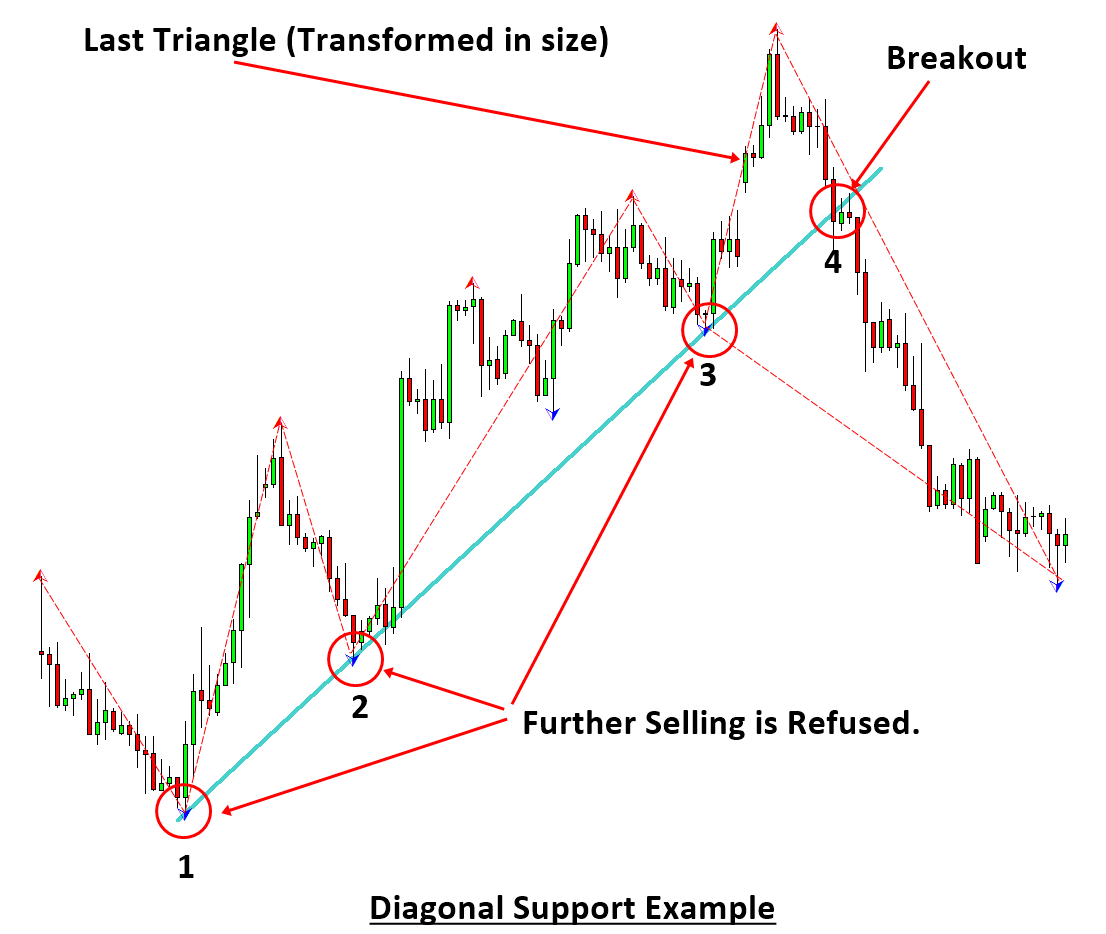

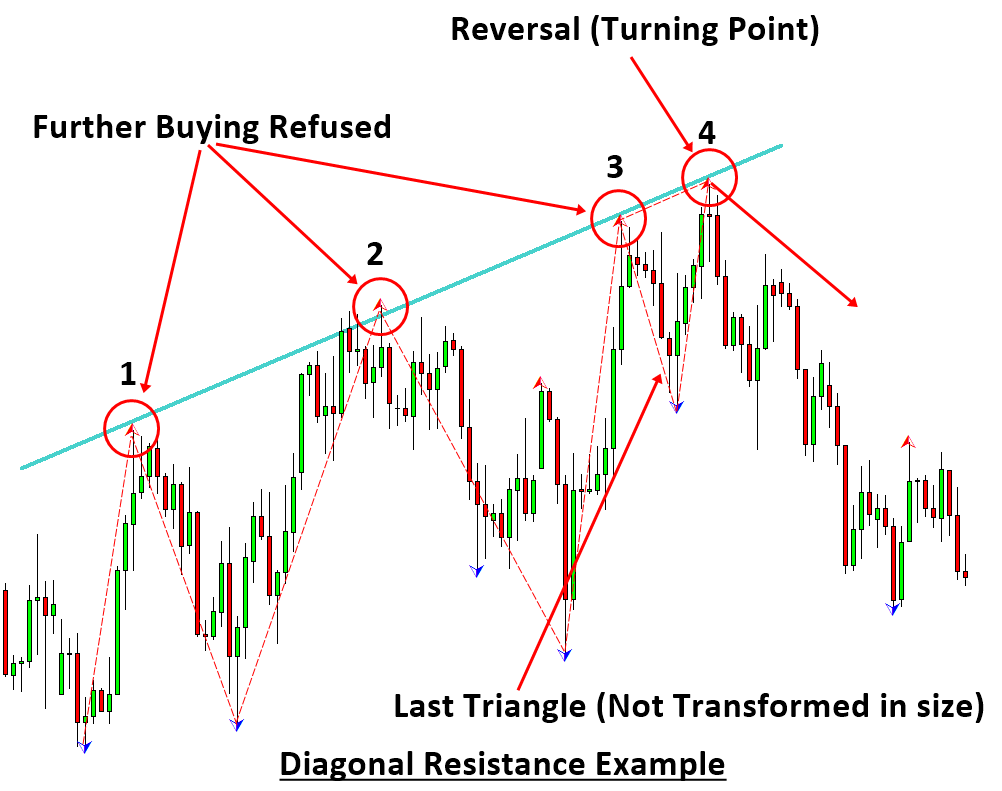

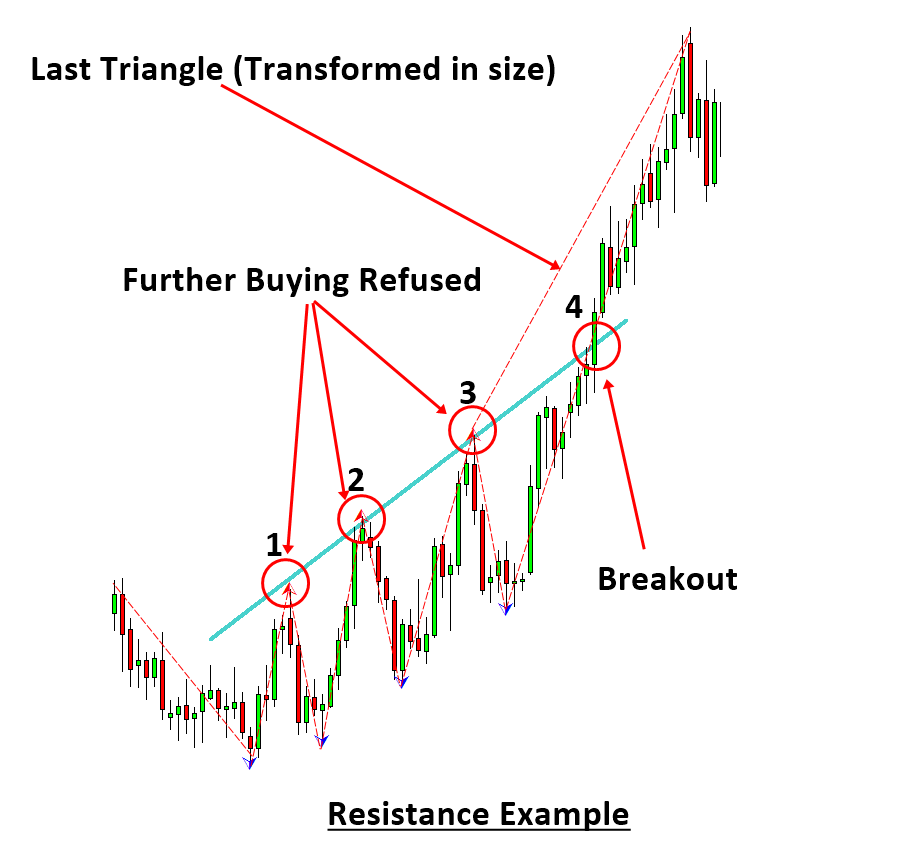

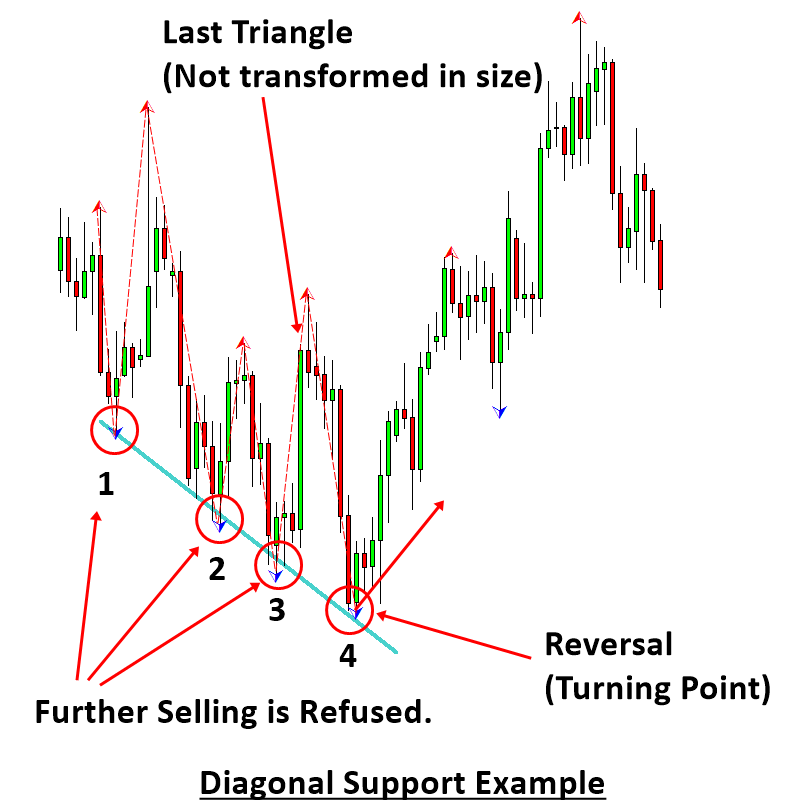

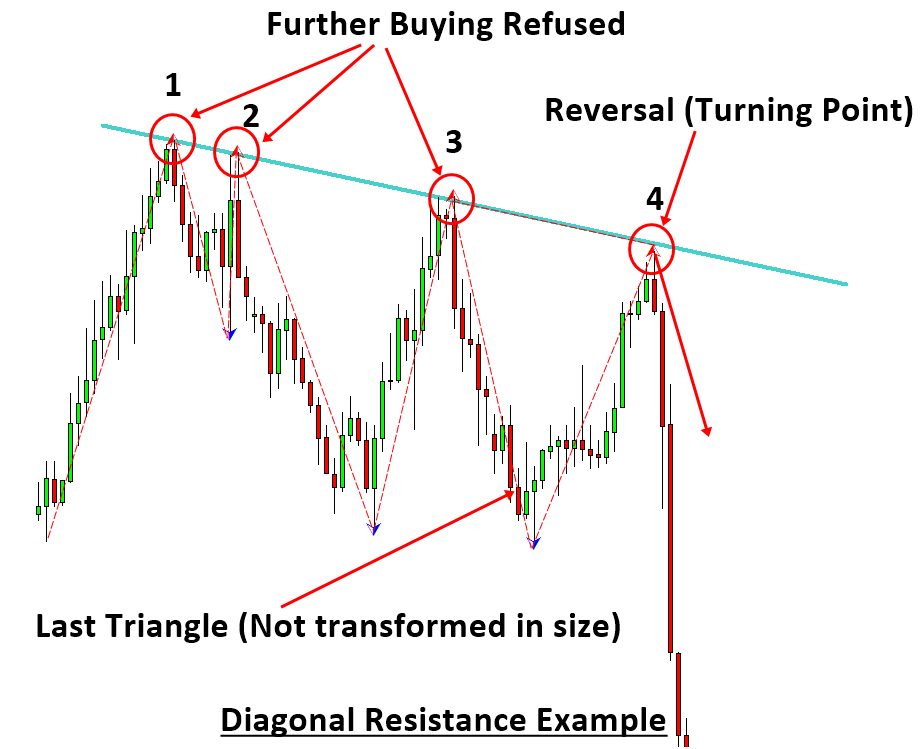

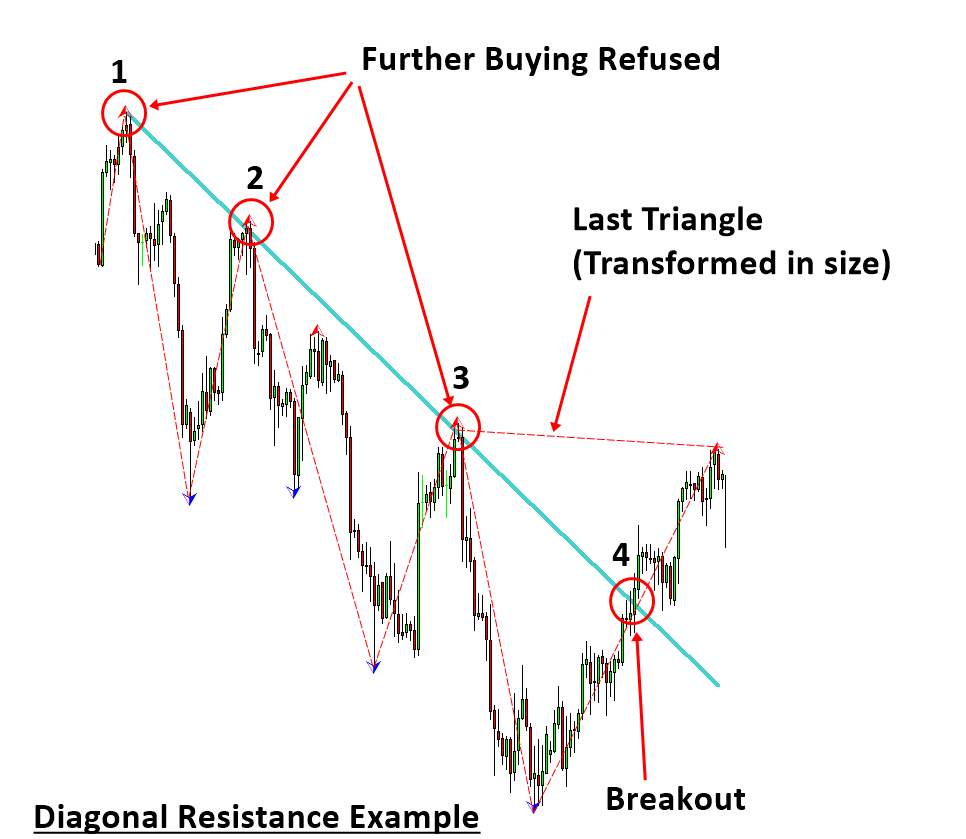

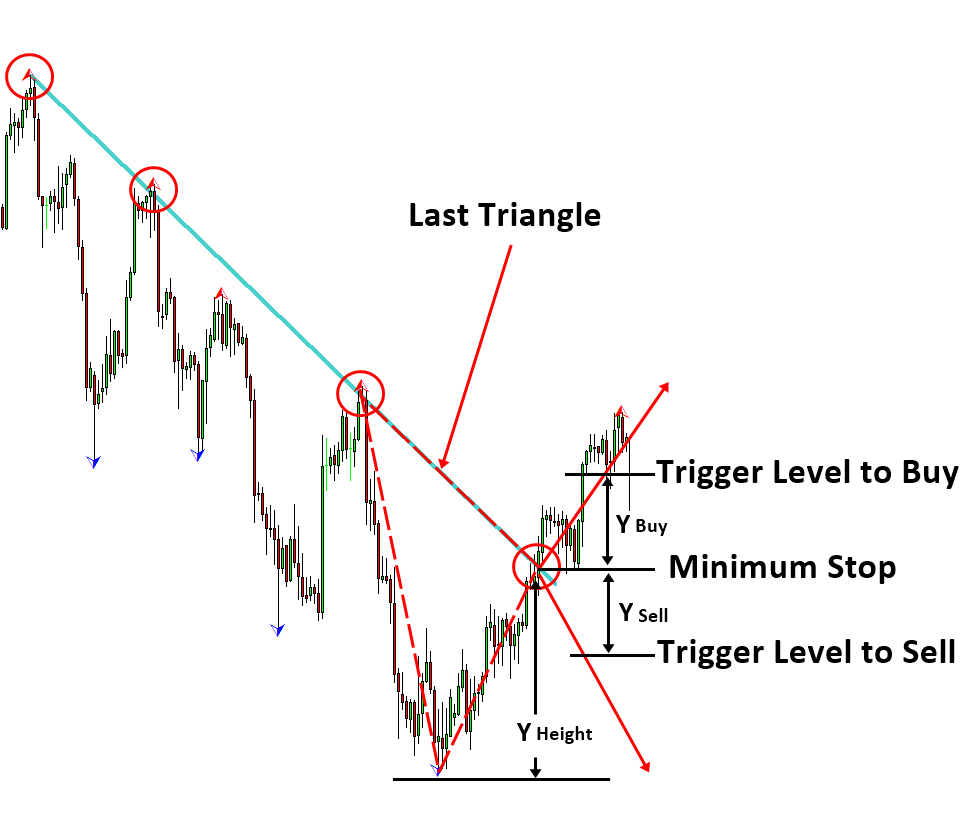

In the financial market, we can observe the diagonal price patterns frequently. Diagonal support and resistance are the typical price patterns we can observe as the results of the combined effect of Equilibrium and Fractal Wave process. Diagonal support and resistance are not different from the horizontal support and resistance. When the connected peaks and troughs provide the diagonal slope rather than the horizontal line, then that slope can be considered as the diagonal support and resistance. However, there can be more variations comparing to the horizontal case. Firstly, we can have the ascending diagonal support and resistance. Secondly, we can also have the descending diagonal support and resistance. For your convenience, we have listed all the possible diagonal support and resistance patterns in Table 2-2. We have also listed the corresponding example for each pattern from Figure 2-6 to Figure 2-13. How to trade diagonal support and resistance levels are the same as the horizontal support and resistance. You can apply the proportional threshold method and the Fibonacci threshold method for your entry for the case of diagonal support and resistance too. The trading example is shown in Figure 2-14. How to calculate the threshold level for Y Buy and Y Sell are identical to the case of horizontal support and resistance. As in the horizontal support and resistance, it is sensible to set your stop loss level greater than the minimum stop level.

| Support and resistance | Price Action | Direction | Example |

| Ascending Diagonal Support | Reversal | Buy | Figure 2-6 |

| Ascending Diagonal Support | Breakout | Sell | Figure 2-7 |

| Ascending Diagonal Resistance | Reversal | Sell | Figure 2-8 |

| Ascending Diagonal Resistance | Breakout | Buy | Figure 2-9 |

| Descending Diagonal Support | Reversal | Buy | Figure 2-10 |

| Descending Diagonal Support | Breakout | Sell | Figure 2-11 |

| Descending Diagonal Resistance | Reversal | Sell | Figure 2-12 |

| Descending Diagonal Resistance | Breakout | Buy | Figure 2-13 |

Table 2-2: List of diagonal support and resistance patterns for your trading.

Figure 2-6: Support example as in the direct pattern recognition on EURUSD H4 timeframe.

Figure 2-7: Support example as in the direct pattern recognition on EURUSD H4 timeframe.

Figure 2-8: Resistance example as in the direct pattern recognition on EURUSD H4 timeframe.

Figure 2-9: Resistance example as in the direct pattern recognition on EURUSD D1 timeframe.

Figure 2-10: Support example as in the direct pattern recognition on EURUSD H4 Timeframe.

Figure 2-11: Support example as in the direct pattern recognition on EURUSD H4 Timeframe.

Figure 2-12: Resistance example as in the direct pattern recognition on EURUSD H4 timeframe.

Figure 2-13: Resistance example as in the direct pattern recognition on GBPUSD H4 timeframe.

Figure 2-14: Resistance Trading example as in the direct pattern recognition on GBPUSD H4 timeframe.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

Advanced Price Pattern Scanner is the non repainting pattern scanner designed for both MetaTrader 4 and MetaTrader 5. It can detect many important price patterns for your trading like rising wedge, falling wedge, head and shoulder patterns, Cup and Handle, etc. Here is an intro video for Advanced Price Pattern Scanner from YouTube. Please check the YouTube Video titled as “Intro Video to Advanced Price Pattern Scanner”. This video covers some basic operation with Advanced Price Pattern Scanner in MetaTrader.

Advanced Price Pattern Scanner YouTube Video: https://www.youtube.com/watch?v=A1-IUr6u5Tg

Here are the links for Advanced price Pattern Scanner for Metatrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

https://www.mql5.com/en/market/product/24679

https://www.mql5.com/en/market/product/24678

Price Breakout Pattern Scanner is the popular Breakout Pattern Scanner with affordable price with many powerful features. It can detect Triangle, Falling Wedge, Rising Wedge pattern, Head and Shoulder Pattern, Double top and Double Bottom. As a added bonus, you have access to 52 Japanese candlestick pattern + Smart Renko. However, this scanner can repaint. It does not support multiple timeframe pattern scanning. Below are the links to Price breakout Pattern Scanner for MetaTrader 4 and MetaTrader 5.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

The main difference is that Price Breakout Pattern Scanner is repainting pattern scanner whereas Advanced Price Pattern Scanner is non-repainting pattern scanner.

Related Products