Fibonacci Volatility Indicator with the Z score Configuration

<<>>

Some contents omitted

<<>>

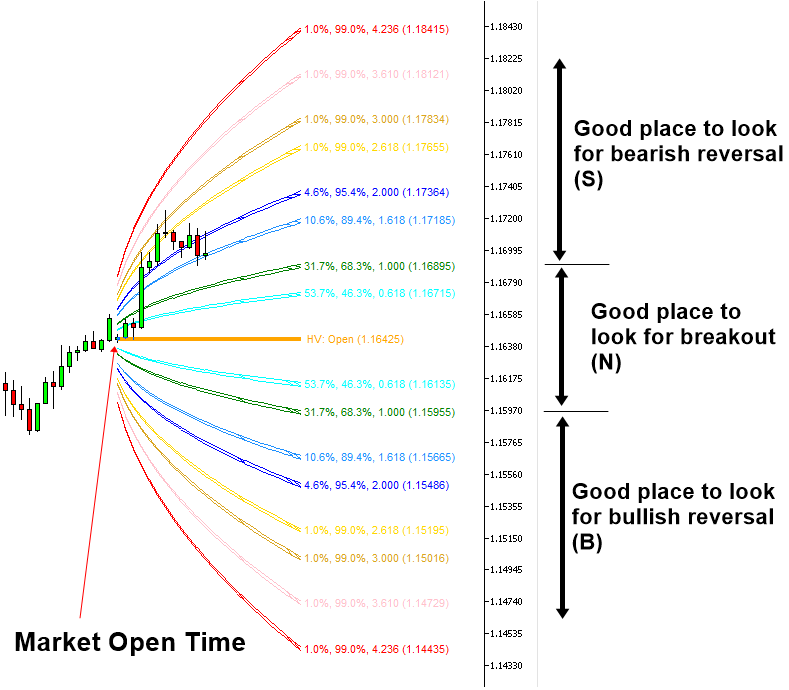

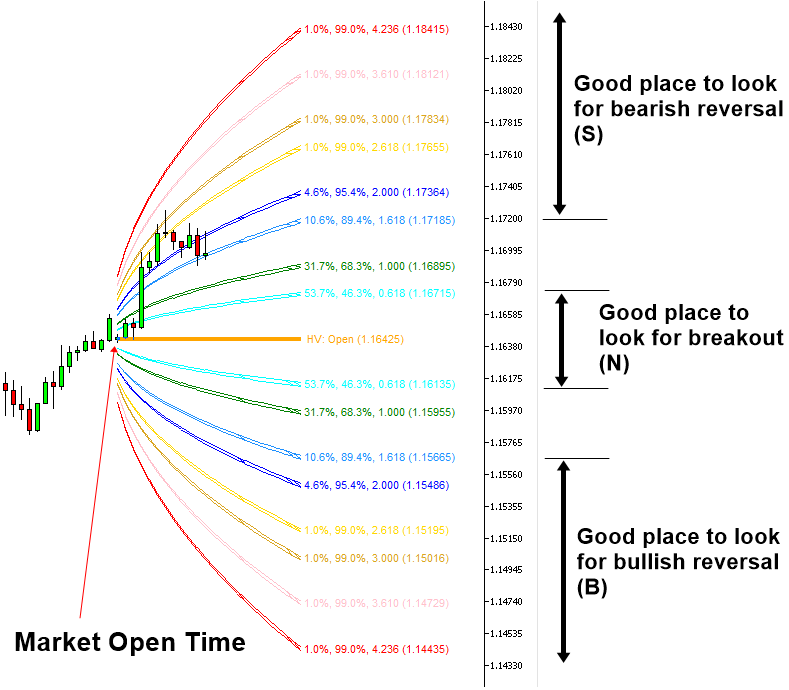

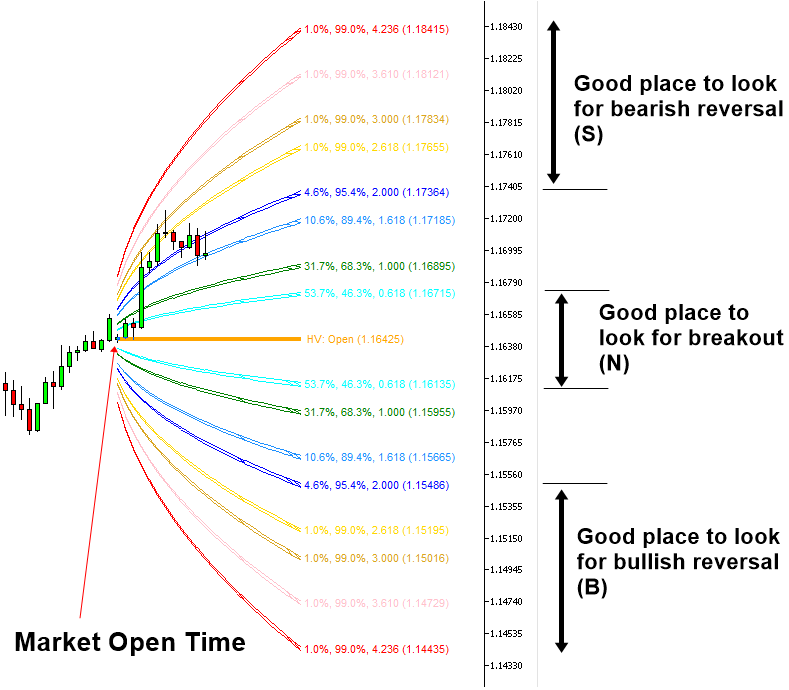

We can also use the Fibonacci Volatility indicator with Z score configuration to create three important volatility areas for our trading. For example, neural area (N), bullish reversal area (B) and bearish reversal area (S) can be defined as in Figure 5.1-20. If you want to have the conservative definition of these three areas, then you can define them as in Figure 5.1-21. If you want to have even more conservative definition of these three areas, then you can define them as in Figure 5.1-22.

Figure 5.1-20: Bullish reversal area (B) and bearish reversal area (S) in the Fibonacci Volatility indicator in less conservative definition

Figure 5.1-21: Bullish reversal area (B) and bearish reversal area (S) in the Fibonacci Volatility indicator in the conservative definition

Figure 5.1-22: Bullish reversal area (B) and bearish reversal area (S) in the Fibonacci Volatility indicator in more conservative definition

About this Article

This article is the part taken from the draft version of the Book: Predicting Forex and Stock Market with Fractal Pattern. This article is only draft and it will be not updated to the completed version on the release of the book. However, this article will serve you to gather the important knowledge in financial trading. This article is also recommended to read before using Fibonacci Volatility Indicator, which is available for MetaTrader 4 and MetaTrader 5.

Below is the landing page for Fibonacci Volatility Indicator for MetaTrader 4 and MetaTrader 5.

https://www.mql5.com/en/market/product/52670

https://www.mql5.com/en/market/product/52671

https://algotrading-investment.com/portfolio-item/fibonacci-volatility-indicator/

Related Products