Mean Reversion and Momentum Trading Strategy

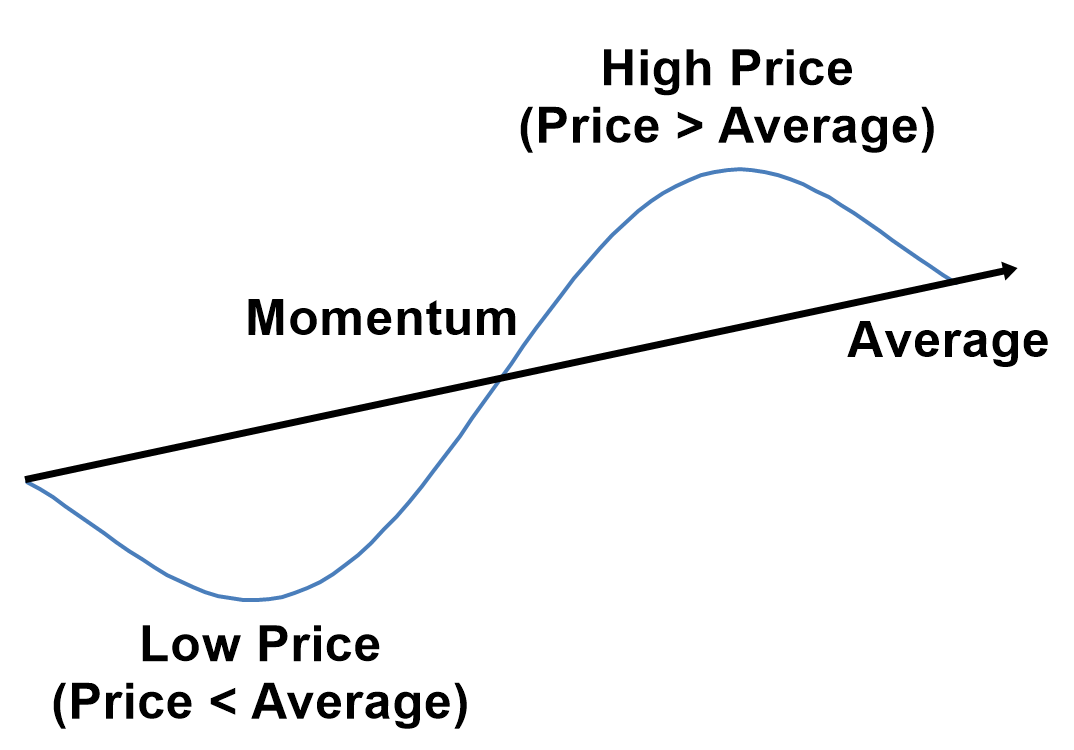

If you are the newbie in the day trading business, you must understand the difference between Mean Reversion and Momentum Trading in the Forex and Stock Market. Mean reversion and momentum trading are the two dominating trading strategies used in the Forex and Stock Market. Most of trading strategy we can think of will fall under a category of mean reversion or momentum trading. These two trading strategies show completely different market timing. For example, momentum trading tries to take the entry when the price shows a strong directional movement. Momentum trading is often considered as the trend following strategy. On the other hand, mean reversion trading tries to take the entry when the price is far from the mean. Mean Reversion trading is often the core trading principle behind “Buy Low and Sell High” strategy like value investing. In momentum trading, the trader tries to pick trend whereas in the mean reversion trading, trader tries to pick the turning point. We have briefly covered some basics of Mean Reversion and Momentum Trading strategy. You need to dig deep on this topic if you really want to survive in the day trading business. The book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading) is exactly the book dedicated for this topic. This book will tell you the untold story of the mean reversion and momentum trading strategies. The book can be found in all the major book distributors in the world. Please choose the best book distributor you like from the link below including amazon.com, Google Play Book, scribd.com, Apple Book and so on.

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

Among the trading community, the preference between the mean reversion trading and momentum trading are completely different. Some trader uses the mean reversion trading better and some trader uses the momentum trading better. To find out which trading style you are good at with, you need to try both trading strategies. In fact, mean reversion and momentum trading can explain the water and fire elements of the human characteristics. Mean reversion trading explains the human characteristics of being “Cautious” or being “Realistic” like water. Momentum trading explains the human characteristics of “Impulsive behaviour” or “Heard Behaviour” like fire. However, the wise trader will not view these two trading strategy as two different subjects because one comes after the other.

After you have understood the difference between momentum trading and mean reversion trading, next you will need to understand the tools to perform the strategies. There could be many tools from value investing, pairs trading, fundamental analysis, support, resistance, trend line, triangle pattern, rising wedge, falling wedge, channels, Fibonacci ratio analysis, Harmonic pattern, Elliott wave theory, and X3 Chart pattern. We provides the automated pattern scanner to ease your trading. You can have a look at these two patterns scanner to accomplish either your momentum trading or mean reversion trading strategies.

1. Harmonic Pattern Plus

Harmonic pattern plus is extremely good product for the price although this is repainting harmonic pattern indicator. With dozens of powerful features including Pattern Completion Interval, Potential Reversal Zone, Potential Continuation Zone, Automatic Stop loss and take profit sizing.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

2. Price Breakout Pattern Scanner

Price Breakout Pattern Scanner is the powerful pattern scanner designed to solve the puzzle of the market geometry beyond the technical indicators. With built in Japanese candlestick patterns + Smart Renko features together, Price Breakout pattern scanner can help you to define the accurate market entry for your breakout trading. Here is some screenshots from Price Breakout Pattern Scanner.

Below are the links to Price breakout Pattern Scanner

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Related Products