Turning Point and Trend

In Forex and Stock market, a trend is a tendency for prices to move in a particular direction over a period. Depending on its period, trends can be short term, med term and long term. Depending on its direction, trends can be categorized into upward trends, downward trends and even sideways. Success with forex market investments is tied to the investor’s ability to identify trends and position themselves for profitable entry and exit points. A turning point is a price point from which a minor or major trend reversal happens. Turning point is a price action term that shows turning price points on the candlestick chart. Price action is the most advanced form of technical analysis, and retail traders most widely use price action to predict the price trend. Let us go deeper with the two notion of trend and turning point in terms of the practical trading point of view.

When you trade in the financial market, the first thing you need to understand is the turning point and trend. Especially, this is important in the context of your trading strategy. If you read many trading articles and books, you will find the diverse opinion over turning point and trend. Many people view turning point and trend as two separate subjects. However, it might be better to understand turning point and trend as one subject. Let us try to understand the trend. To do so, let us take human as an analogical example. We are born, we grow up, we become mature, and then we die. During this process, we can observe that there are four main stages. These four stages are universal across many creatures and objects observable in the earth.

- Stage 1: Birth

- Stage 2: Growth

- Stage 3: Maturity

- Stage 4: Death

The four stages of a trend can be described as follows:

- Birth: The first stage of a trend is the birth stage. This is where the trend is born, and the price starts to move in a particular direction.

- Growth: The second stage of a trend is the growth stage. This is where the trend starts to gain momentum and the price moves further in the direction of the trend.

- Maturity: The third stage of a trend is the maturity stage. This is where the trend is at its strongest, and the price moves the most in the direction of the trend.

- Death: The fourth stage of a trend is the death stage. This is where the trend starts to lose momentum, and the price starts to move against the trend.

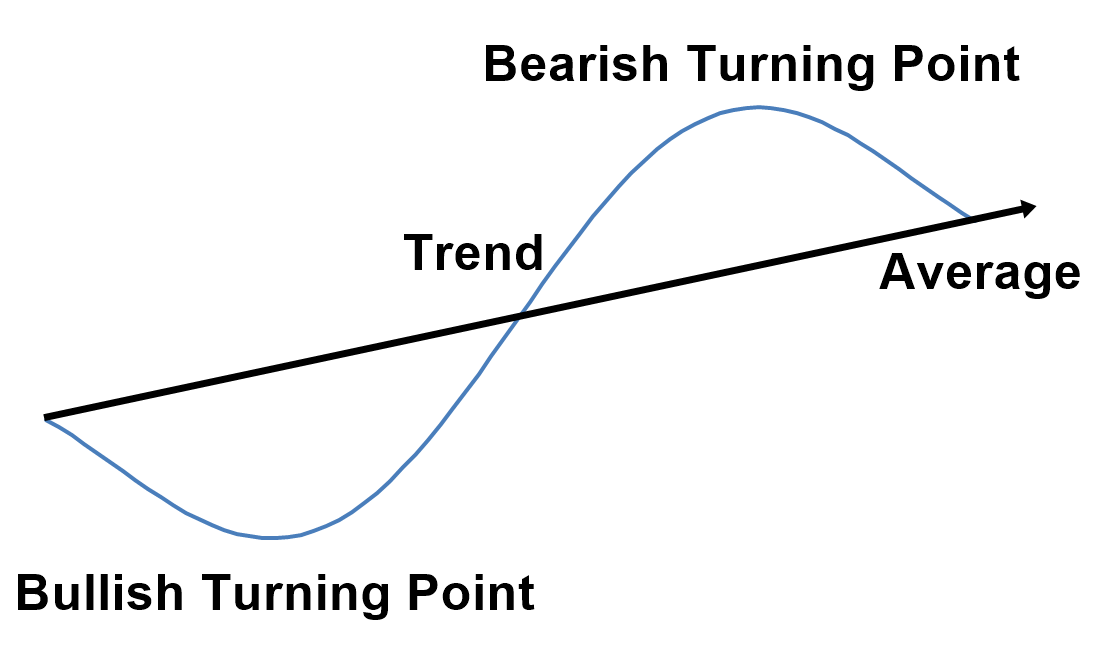

To find the location of trend and turning point during these four stages, please check the attached screenshot. For your forex and stock market trading, it is important to understand where your entry will be placed among the four stages. As well as understanding the momentum and mean reversion trading, the turning point and trend are also the important market timing knowledge for your forex and stock market trading.

In the trend strategy, your entry will be at the strong trend movement during the growth phase. This might be good if our entry is not too late. However, if we are late, then we will encounter the loss from early enterers starting to materialize their profits. In the turning point strategy, we are trying to pick up the new trend as early as possible in their birth stage. Therefore, it gives you the opportunity to become the early enterer. Hence, the profitable range is longer than typical trend strategy. In addition, you can also quit your position much earlier than other trend strategy players can.

The longer profitable range means that we need fewer trades to achieve good profits. At the same time, there are some weaknesses of the turning point strategy too. For example, turning point strategy might signal buy or sell entry too early while the ongoing trend was not finished. Since both trend and turning point strategy have their own strength and weakness, it is possible that you can compromise between turning point strategy and trend strategy too. For example, you do not immediately trade at the turning point signal but you can wait until you observe that some price movement is following the new trend direction. Therefore, this becomes semi-turning point strategy. Many of good traders use semi-turning point strategy since they are the hybrid of turning point strategy and trend strategy. The fact is that skills to predict the turning point is important for the successful trading. Even though you are trading with trend strategy, it is still advantageous to have good skills in predicting turning point. Hence, the methodology of predicting turning point was sought after by many legendary traders in the financial market nearly 100 years. It is one clear piece of winning logic for successful trading helping “You act faster than other trader.”

To give you more insight about turning point and trend in terms of trading strategy, we have summarized the important terms as follows:

- Trends: a trend is a tendency for prices to move in a particular direction over a period. Depending on its period, trends can be short term, med term and long term. Depending on its direction, trends can be categorized into upward trends, downward trends and even sideways.

- Turning Point (General Term): A turning point is a price point from which a minor or major trend reversal happens.

- Turning Point (Scientific Term): A turning point is a price level in which the market can change its direction from bearish to bullish or from bullish to bearish. In fact, the turning point can be considered as the peak and trough in cycle. To visualize it, just consider a simple cycle like a sine curve or cosine curve ranging betweeen 1 and -1 in y axis. Then you can mark the peak at 1 and you can mark the trough at -1 in the curve.

- Stochastic cycle: Turning point becomes a powerful weapon when you understand the market cycle in Forex and Stock market. However the market cycle is not like a simple cycle like a sine curve or cosine curve. Instead, the market cycle is the stochastic cycle. For example, a sine curve is a determininstic cycle, whose cycle period is fixed. In stochastic cycle, the cycle period is not fixed but probablistic meaning that the cycle period can be alternating around the mean or average. The harder part is that, there are multiple of stochastic cycles in the market cycle of Forex and Stock market.

- Fractal Wave: Fractal wave is one tool that can study or predict all the stochastic cycles present in the market in both using statistical and non statistical methods. Fractal wave is simple and effective method proven for many decades along with the evolution of the financial market since Bernoit Mandelbrot dedicated most of his life to the study of fractals, as well as the mathematics of roughness and self-similarity.

- Fractal Wave for Non statistical method: Fibonacci trading, Support and resistance trading, Harmonic Pattern, Elliott Wave pattern and X3 Chart Pattern can be considered as the chart pattern analysis using the Fractal Wave concept.

- Fractal Wave for statistical method: Firstly, Fractal Wave theory can be used to perform the Fractal Decomposition technique to extract each market cycle (=stochastic cycle) in Forex and Stock market. Secondly, once the Fractal Decomposition is done, one can visualize each stochastic cycle using Fractal Cycle Analysis.

- Turning Point Probability: turning point probability is the probability measured in each stochastic cycle extracted and visualized in the Fractal Cycle Analysis to indicate the potential turning point to make a buy or sell decision. Just like other probability, the turning point probability ranges between 0 and 1 or between 0% and 100%.

- Trend Probability: Although there are many ways to calcualte the trend probability, one can simply calculate the trend probabilty in the Stochastic cycle uisng this simple equation: “the trend probability = 1.0 – the turning point probability”.

The book: Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading) is exactly the book dedicated for this topic. This book will tell you the untold story of the trend and turning point strategies. The book can be found in all the major book distributors in the world. Please choose the best book distributor you like from the link below including amazon.com, Google Play Book, scribd.com, Apple Book and so on.

In the trend strategy, your entry will be at the strong trend movement during the growth phase. This might be good if our entry is not too late. However, if we are late, then we will encounter the loss from early enterers starting to materialize their profits. In the turning point strategy, we are trying to pick up the new trend as early as possible in their birth stage. Therefore, it gives you the opportunity to become the early enterer. Hence, the profitable range is longer than typical trend strategy. In addition, you can also quit your position much earlier than other trend strategy players can.

After understanding the trend and turning point, we can improve your forex and stock market trading in many different ways. One way we did it was to combine the turning point probability and trend probability with your traidng. The direct representation of its principle can be found from our Fractal Pattern Scanner. You have the full access to the turning point probability and trend probability from Fractal Pattern Scanner to improve your support and resistance trading. Please have a look at the indicator.

Below is the landing page for Fractal Pattern Scanner in MetaTrader version.

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

At the same time, you can use Harmonic Pattern to predict the potential turning point. However, Harmonic Pattern Detection could be tedious process if you have to do them manually. You can use the automated tool for your trading. If you are looking for the Harmonic Pattern Scanner, then here are some choice between repainting harmonic pattern scanner and non repainting harmonic pattern scanner. We present one repainting and one non repainting harmonic pattern scanner for your information below.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Related Products