Breakout Trading or Reversal Trading

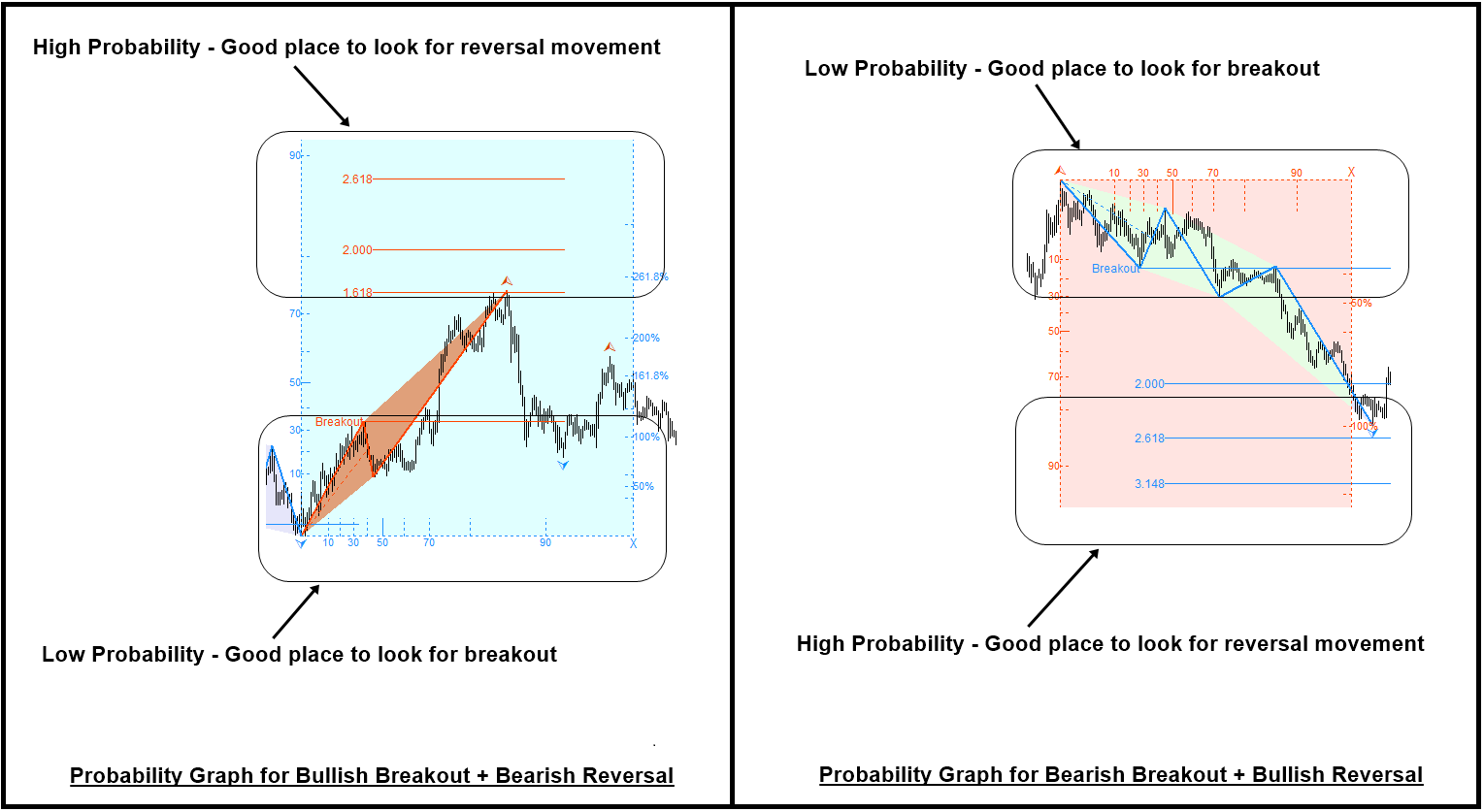

With Fractal Pattern Scanner, you can choose to trade with both breakout and reversal price movement. Fractal Pattern Scanner does it by detecting Mother Wave and by presenting the Probability Graph. You will get some clear idea on how to do that with the attached screenshot. Detection of mother wave provides us the important clue to predict both reversal and breakout movement.

Throughout your trading career, you could be specialized in either breakout trading or reversal trading. If you are ambitious, then you can specialize in both. Here we provide two in depth articles for breakout and reversal trading. Make sure that you read these two articles before choosing the trading style.

Here is the article to use reversal trading.

Here is the article to use breakout trading.

Before reading above articles, please read this most basic but most important article first if you have not read yet.

https://algotrading-investment.com/2020/04/05/geometric-prediction-the-bible-for-successful-trading/

More educational articles can be found here.

https://algotrading-investment.com/2019/07/23/trading-education/

In terms of Fractal Pattern Scanner setting, please use this short article.

https://algotrading-investment.com/2020/05/24/fractal-pattern-scanner-trading-operation-tips/

Some More Tips about Break Trading and Reversal Trading

Breakout trading and reversal trading are two popular strategies in forex trading, each with distinct approaches and methodologies. Here’s an in-depth look at both strategies:

Breakout Trading

Concept

Breakout trading involves entering a position when the price breaks through a defined level of support or resistance, anticipating that the price will continue in the direction of the breakout.

Key Elements

- Identification of Levels:

- Support and Resistance: Identify key levels where the price has historically had difficulty moving past.

- Consolidation Zones: Look for periods where the price has been moving sideways within a range.

- Volume Analysis:

- Confirmation: Higher-than-average volume during the breakout can confirm the strength and validity of the breakout.

- Entry and Exit Points:

- Entry: Enter the trade as the price breaks above resistance (for a long position) or below support (for a short position).

- Stop-Loss: Place stop-loss orders just outside the breakout level to manage risk.

- Take-Profit: Set profit targets based on the distance of the previous range or using technical indicators.

Example of Breakout Trading

Scenario: EUR/USD is trading in a range between 1.1000 (support) and 1.1100 (resistance).

- Identification: Recognize the consolidation zone between 1.1000 and 1.1100.

- Volume Confirmation: Wait for a surge in volume as the price approaches the resistance level.

- Entry: Enter a long position if the price breaks above 1.1100 with strong volume.

- Stop-Loss: Place a stop-loss order at 1.1050 (below the breakout point).

- Take-Profit: Set a take-profit target at 1.1200, based on the height of the range (1.1100 – 1.1000 = 0.0100).

Advantages and Challenges

Advantages:

- Clear Signals: Breakouts provide clear entry and exit signals.

- Potential for Significant Gains: Capitalizing on strong price movements can lead to substantial profits.

Challenges:

- False Breakouts: The price may briefly move past the level and then reverse, causing losses.

- Volatility: Breakouts can be accompanied by high volatility, which can be challenging to manage.

Reversal Trading

Concept

Reversal trading involves entering a position when the price shows signs of reversing direction after an extended trend. This strategy aims to capitalize on the change in trend direction.

Key Elements

- Identification of Trends:

- Trend Lines: Draw trend lines to identify the direction and strength of the current trend.

- Technical Indicators: Use indicators like RSI, MACD, and Stochastic to spot overbought or oversold conditions.

- Pattern Recognition:

- Reversal Patterns: Look for chart patterns like Head and Shoulders, Double Tops/Bottoms, and Hammer/Candlestick patterns that indicate potential reversals.

- Confirmation Signals:

- Divergence: Check for divergences between price and indicators like RSI or MACD.

- Volume: Look for declining volume in the direction of the current trend and increasing volume in the direction of the new trend.

- Entry and Exit Points:

- Entry: Enter the trade once confirmation signals align with the identified reversal.

- Stop-Loss: Place stop-loss orders above/below recent highs/lows to manage risk.

- Take-Profit: Set profit targets based on key support/resistance levels or the length of the previous trend.

Example of Reversal Trading

Scenario: GBP/USD has been in a strong uptrend but shows signs of a potential reversal.

- Identification: Notice the RSI is above 70 (overbought) and the price is forming a Double Top pattern.

- Pattern Recognition: Confirm the Double Top pattern with declining volume.

- Entry: Enter a short position if the price breaks below the neckline of the Double Top pattern.

- Stop-Loss: Place a stop-loss order above the recent high.

- Take-Profit: Set a take-profit target at a key support level or based on the height of the Double Top pattern.

Advantages and Challenges

Advantages:

- High Reward Potential: Reversal trades can offer significant profits if the new trend is sustained.

- Early Entry: Getting in at the beginning of a new trend can provide better entry points.

Challenges:

- False Signals: Reversals can be difficult to identify, and false signals are common.

- Timing: Accurately timing the reversal is challenging and requires careful analysis.

Comparison of Breakout and Reversal Trading

Breakout Trading

- Pros: Clear entry points, potential for quick profits.

- Cons: Risk of false breakouts, high volatility.

Reversal Trading

- Pros: Potential for high rewards, early entry into new trends.

- Cons: Difficult to identify true reversals, risk of false signals.

Both breakout and reversal trading strategies require a solid understanding of technical analysis, effective risk management, and the ability to stay disciplined. Traders often choose a strategy based on their trading style, risk tolerance, and market conditions.

Related Products