Articles for Harmonic Pattern Trader

Here is the short but insightful article for Harmonic Pattern Trader for Forex, Crypto and Stock market trading. These articles will explain Harmonic Pattern Trading and Harmonic Pattern indicators with different harmonic pattern detection algorithm. If you are professional trader, then you must read these three articles before trading with them.

1) Turning Point and Trend: https://algotrading-investment.com/2019/07/06/turning-point-and-trend/

[summary of this article]

If you want to become the profitable trader, the first thing you need to understand is turning point and trend in the financial market. If you read many trading articles and books, you will find the diverse opinion over turning point and trend. Many people view turning point and trend as two separate subjects. However, it might be better to understand turning point and trend as two parts inside one body. Let us try to understand the trend. To do so, let us take human as an analogical example. We are born, we grow up, we become mature, and then we die. During this process, we can observe that there are four main stages. These four stages are universal across many creatures and objects observable in the earth.

Birth – Growth – Maturity – Death

Trend also goes through these four stages. Let us take an example in the financial market. For example, if we hear that Apple has some temporary problem in their smartphone supply line, this could stir up the Samsung’s Stock price because the demand for Samsung’s smart phone will be increased. Once this news is spread on the financial market, the upward trend will be born for Samsung’s stock price. At the beginning, this news could be known by few people. Later, more and more people could hear this news. Hence, Samsung’s stock price can build up upward momentum. However, this momentum will not last forever. Once people start to recognize that price rallied too high and some people start taking the profit by selling the stocks, the upward momentum can slow down. Especially, if we hear that Apple recovered the temporary problem in their smartphone supply line, the trend could die completely. As shown in this example, Birth, Growth, Maturity, and Death are the life cycle of trend.

2) Pattern are good predictor of Market Turning Point: https://algotrading-investment.com/2019/07/07/patterns-are-the-good-predictor-of-market-turning-point/

[summary of this article]

We will discuss several pattern analysis to predict the turning point in Forex and Stock market, covering the Fibonacci retracement, Harmonic Pattern and Elliott Wave Analysis. To have the good skills in predicting turning point, it is important to understand why turning point occurs in the financial market. Now let us question backwards “Do we have any stock price in smooth growth curve or smooth declining curve?” Smooth curve or straight line is good because it is easy to predict their next movement. Unfortunately, we will never have this sort of easy situation for our trading.

Even though some company’s stock price grown up for last 10 years like Google (Alphabet Inc.), we will continuously see down price move (i.e. swing low) after up price move (i.e. swing high) and vice versa. To the chartist, this sort of move is defined as price swings or zigzag movement. The zigzag price path is due to both fundamental reason and psychological reason. People do not like if the stock price is over-valued or under-valued under the given fundamental of the stock. For example, if the company has the surprise earnings, then stock price can go up high. However, once people think it went too much, price would start to come down. People do not see attractive price if the stock price is going up too quickly in the short period. In this case, without too much valid reason, stock price can just come down. We are just scared to see anything goes too extreme psychologically. Likewise, if stock price is going down fast due to some bad fundamental news, in theory, we should not buy the stock. In practice there are some people think that stocks are cheap to buy. Hence, price start to make its own correction. Like this, financial market has the endless feedback loop ensuring the price is not moving in one direction. Instead, price will move down after bullish rally and price will move up after bearish rally. This mechanism forms the zigzag price path. Hence, stock and currency price series will continuously show turning point, either high to low or low to high. Financial trader will face much tougher choice between these alternating turning points.

So what are the good ways of handling the buy and sell decision in stock and currency market? Fortunately, you are not the only one suffering from this decision problem. Many pioneer traders visited the same question before. In their conclusion, to study this sort of zigzag price path, the best way is to look at the patterns that are made up from zigzag price path. Hence, we will be cutting out some of the patterns from the long price series and then we will exam the cut out patterns with a special microscope designed for this purpose. Many legendary traders opened up ways to study these patterns. Focus in the pattern study is to find repeating patterns that are able to capture the profit in good success rate. Fortunately, we have over 100 years of established methods to deal with this sort of complex price patterns.

Firstly, the simple and easiest method is the Fibonacci price patterns. In Fibonacci price patterns, we cut out the patterns made up from three or four zigzag points to predict the potential turning point, respectively for retracement and for expansion. The peculiar point to the Fibonacci price patterns is that we use Fibonacci ratios derived from Fibonacci sequence numbers. Common Fibonacci ratios used by traders include 0.382, 0.500, 0.618, 0.782, 1.000, 1.272, 1.618, etc.

3) Harmonic Pattern Indicator Types: https://algotrading-investment.com/2019/03/15/harmonic-pattern-indicator-types/

[summary of this article]

Several types of Harmonic pattern indicator and Harmonic Pattern scanner used in Forex and Stock trading. Manual detection of Harmonic Patterns are tough and inefficient. Hence, it is convenient to use the automated Harmonic Pattern Detection Indicator or Scanner. However, not all the harmonic pattern indicators and scanners are the same. In the past the main variations of Harmonic pattern indicators can be categorized as following three different types.

- Type 1: Non lagging (fast signal) but repainting – option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint.

- Type 2: Lagging (slow signal) but non repainting – no option to enter at turning point. Indicator does not show the failed pattern but last pattern does not repaint.

- Type 3: Detecting pattern at point C but repainting – option to enter at turning point. Indicator detect pattern too early and you have to wait until the point D. Pattern may not achieve point D. Indicator does not show the failed pattern and last pattern can repaint.

Type 1. Non lagging (fast signal) but repainting

First type is non lagging but repainting harmonic indicators. This sort of Harmonic pattern indicator is the typical harmonic pattern indicators used by many traders. The advantage is that you do get the signal early as possible. You have an opportunity to trade from the turning point all the ways down to the continued trend. The disadvantage is that you are not able to test your strategy in chart because this type of harmonic pattern indicator does not show the entry of the failed patterns in chart but only successful one. In fact, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are under this category. They would provide the fastest signal but you will not able to test your strategy in your chart because they do not show the failed entry in chart.

Type 2. Lagging (slow signal) but non repainting

The second type is that lagging but non repainting. Some people use pretty words like minimal lag Harmonic pattern indicator or etc. But really lagging is just lagging. You can not make it really pretty though. As the literal meaning of lagging indicates, this type of harmonic pattern indicators provide you the lagging signal comparing to the first type. It will only provide you the signal after some times passed the turning point. Hence, you do not have an option to consider your entry from turning point. Depending on the pattern size, sometimes, the lagging can be only several bars but it can range up to several dozens of bars like 30 or 60 bars. Sometimes, your entry might be at the first reversal after the turning point. Hence you have be careful with this sort of entry. The advantage is that you will not experience repaint with the latest pattern though. I am not sure if non repainting property can offset the disadvantage of lagging signals because professional harmonic pattern traders are looking for the turning point entry.

Throughout above articles, we also emphasize the importance of estimating true success rate for harmonic pattern to build the winning trading strategy.

Also below we provide the links for the automated Harmonic Pattern Detection indicator.

4) Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

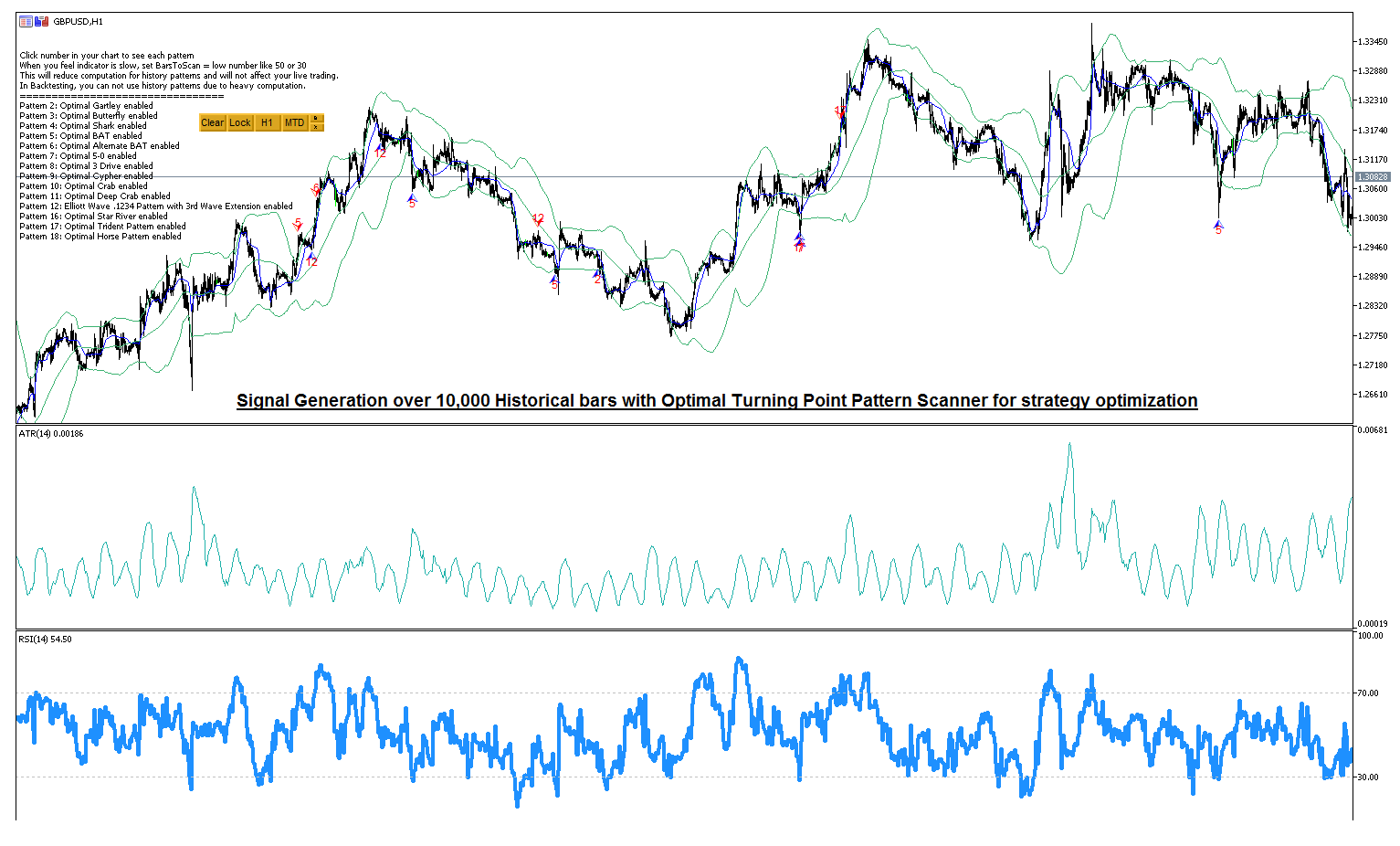

5) X3 Chart Pattern Scanner

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

Related Products