Random Process

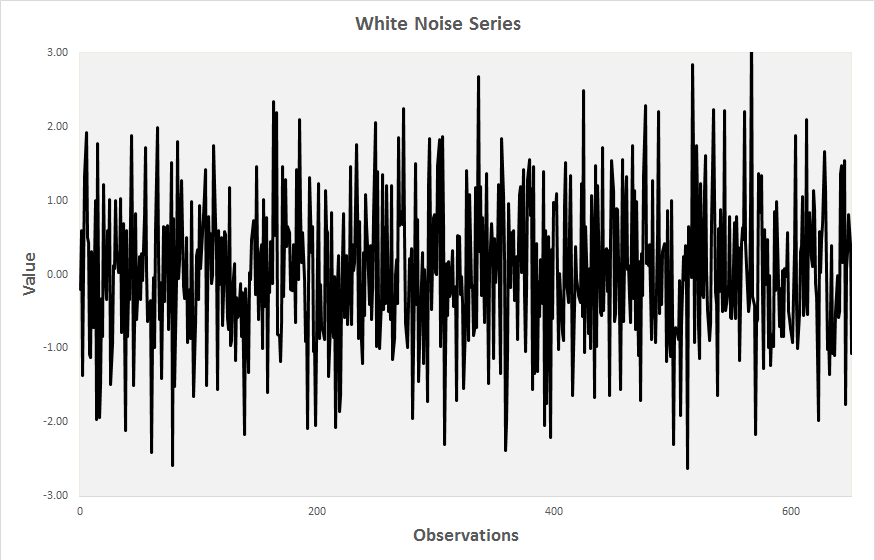

Most of time, the financial price series will exhibit some Random fluctuations. Therefore, you have to assume that some random process exists in the real world financial price series always. Random fluctuation is literarily independent from any causality and therefore they are not the predictable component in the price series. Randomness is an opposite component to the regularities we are looking to capture in the price series. Therefore, if the price series have strong randomness, it is bad for us. It is always better for traders to assume that any real world price series possess some randomness because they really do. Such a random process in the financial market data might be either white noise or something else. When the random process exists on their own, they are simple in terms of modelling and analysing because you can only describe the random series with mean and standard deviation. In real world, the financial market data possess the mixed price patterns between randomness and regularities. For simplicity, just imagine that we have isolated the randomness from our price series into a container in our laboratory. Then they will look like as in Figure 4-1.

Figure 4-1: White Noise series with fixed mean and average.

In fact, the best predictive model or trading strategy is those separating randomness perfectly from regularities. However, the perfect isolating of randomness from the regularities is almost impossible because the perfect quantification of randomness is not possible. Normally the daily return series for Stocks and Forex market data is considered as white noise random process. If they are white noise process, then the return series will have the fixed mean and standard deviation. The mean of the return series for a particular stock can be positive or negative rather than zero. If the mean of the return series is positive, you can buy and hold the stock for long run. If the mean of the return series is negative, you can sell and hold.

If the return series have zero mean, then you will lose money either buying or selling because of the commission you have to pay for. Buy and hold or sell and hold strategies are the typical long run passive strategies and this type of passive strategy need to be reinforced with modern portfolio theory. Otherwise, the long run strategy might suffer from the long period of drawdown.

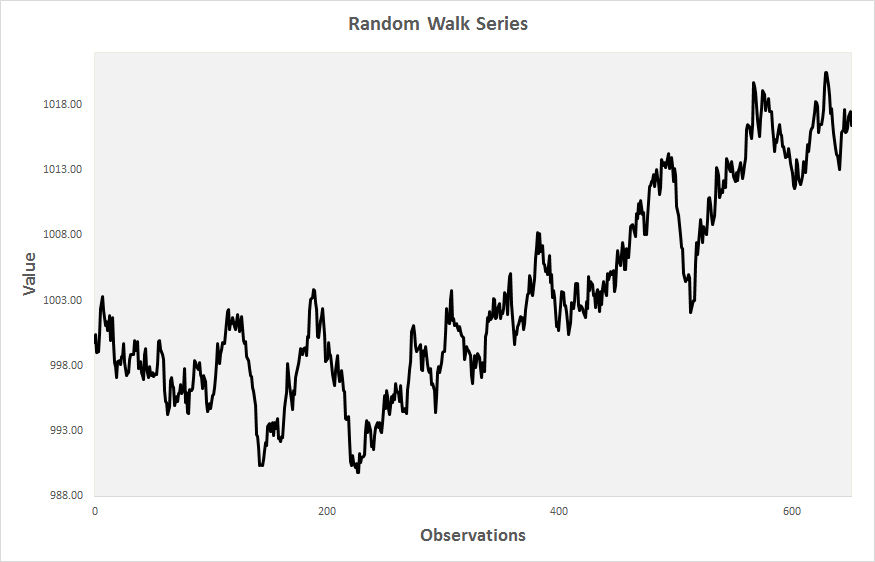

If we synthetically generate a random price series by summing up the value of the previous random price series, this series is called the Random Walk series. In contrast to the White noise series, we cannot recognize the fluctuation around the fixed mean any more for Random Walk series (Figure 4-2). Instead, they look like they are moving upwards or downwards. Sometimes, the Random Walk series move as if they will never come back to their origin any more. Since the Random Walk series are generated from summing unpredictable white noise series, the Random Walk series are also unpredictable too. In general, Random Walk series look like real world stocks and forex market price series but it will not show any regularities like trend or cyclic behaviour. Many people blindly assume that the price series are the perfect random walk series and they are not predictable. However, remember that there are the fundamentals moving the market. Traders and investors are not perfectly rational but they will also make their trading and investment decision based on the market fundamentals. For example, if USA increases the interest rate, then US dollar will be appreciated by pushing US dollar high against Euro. If the company director is involved with some serious sex scandals risking his director’s position, then the share price can be depreciated or this might cause the increased volatility of that share price at least. Of course, you might find many instances where fundamentals did not move the market. Even in such a case, it is better to assume that some unknown factors cancelled out the fundamental effect rather than assuming the market is totally Random Walk. You should assume the random walk process only if you have gathered strong evidence with the price series.

Figure 4-2: Synthetic Random Walk series.

Trading Strategy Note

If the price series is the pure Random Walk series, traders and investors have a very few choices for his strategy. If the return of the price series has the mean of zero, then there is no point to trade. However, with some positive return, you can construct portfolio of many assets according to the Modern Portfolio theory (Harry Markowitz, 1952). This is a systematic approach to reduce the risk dramatically across many different assets. However, this strategy is limited to the investors with large capitals since one has to split his investment over the reasonable number of assets. In addition, this strategy requires to solve the optimization problem to calculate weights for the capital allocation for the given correlation matrix between assets. Therefore, one will require a specialized software package to construct the optimal portfolio using this methodology. In addition, there are some fund management company make use of skewness in the return series for their investment strategy. This information is probably worth to note for your strategy development. Skewness can be readily obtained in many analytical tools like MS-Excel and MatLab.

Analytical Note

ARIMA (Autoregressive Integrated Moving Average) model is a popular econometric model used to study the different properties of the price series data in Finance and Economics. A white noise series can be modelled using ARIMA (0, 0, 0) since white noise is assumed to be stationary. At the same time, Random walk can be modelled using ARIMA (0, 1, 0) involving one order of the difference term. Therefore, we can clearly see that the difference between White Noise and Random Walk process is the presence of stationary process. To confirm the white noise process, the price series must be free from the serial correlation in the data. The distribution is assumed as the normal Gaussian distribution too.

Some More Tips about Random Process in Forex Trading

In Forex trading, understanding the concept of a random process is crucial because it highlights the challenges of predicting market movements and developing effective trading strategies. A random process in Forex trading refers to the idea that price movements follow a stochastic (random) pattern, making them inherently unpredictable over short time frames.

Key Concepts of Random Processes

- Random Walk Hypothesis:

- The random walk hypothesis suggests that price changes in financial markets are random and not influenced by past movements. According to this theory, future price movements are independent of past movements, making it impossible to predict future prices based on historical data alone.

- Efficient Market Hypothesis (EMH):

- The EMH posits that all available information is already reflected in current prices. There are three forms of EMH:

- Weak Form: Prices reflect all past trading information.

- Semi-Strong Form: Prices reflect all publicly available information.

- Strong Form: Prices reflect all information, both public and private.

- The EMH posits that all available information is already reflected in current prices. There are three forms of EMH:

Implications for Forex Trading

- Unpredictability:

- If Forex markets follow a random walk, predicting short-term price movements becomes extremely difficult. This challenges the effectiveness of many technical analysis methods that rely on historical price patterns.

- Market Efficiency:

- The level of market efficiency influences the extent to which a random process governs price movements. In highly efficient markets, opportunities for consistent profits through traditional analysis may be limited.

Tools and Methods to Analyze Random Processes

- Statistical Tests:

- Autocorrelation Test: Measures the degree of correlation between current and past price movements. A lack of significant autocorrelation suggests a random process.

- Runs Test: Evaluates the randomness of a sequence of price changes by examining the occurrence and length of consecutive price rises or falls.

- Variance Ratio Test: Compares the variance of returns over different time horizons to detect deviations from the random walk hypothesis.

- Technical Analysis:

- Despite the random walk hypothesis, technical analysis remains widely used. It involves studying historical price charts and using indicators to identify patterns and trends that might suggest non-random behavior.

- Quantitative Models:

- Models like ARIMA (AutoRegressive Integrated Moving Average) and GARCH (Generalized Autoregressive Conditional Heteroskedasticity) are used to analyze time series data. These models assume that while the process may exhibit some randomness, there are underlying patterns that can be modeled and predicted.

Practical Application in Forex Trading

- Risk Management:

- Understanding that price movements may be random reinforces the importance of robust risk management practices. Traders should use stop-loss orders, position sizing, and diversification to manage risk effectively.

- Algorithmic Trading:

- Algorithmic trading systems often incorporate statistical and quantitative methods to exploit inefficiencies in the market. These systems can identify patterns that are not immediately apparent, even in markets that exhibit random characteristics.

- Long-Term Trends:

- While short-term price movements may appear random, long-term trends can often be identified and exploited. Fundamental analysis, which examines economic indicators, interest rates, and geopolitical events, can help in identifying these trends.

Examples

- Daily Price Movements:

- The daily price movements of a currency pair, such as EUR/USD, may exhibit random characteristics, making it difficult to predict short-term fluctuations accurately.

- Intraday Volatility:

- Intraday volatility often appears random due to the influence of high-frequency trading, news releases, and market sentiment.

Advantages and Limitations

Advantages:

- Realistic Approach: Acknowledging the randomness of market movements leads to more realistic expectations and strategies.

- Focus on Risk Management: Emphasizes the importance of managing risk rather than relying solely on predictions.

Limitations:

- Challenging for Prediction: Makes it difficult to develop reliable short-term trading strategies.

- May Overlook Patterns: Randomness does not account for identifiable patterns and trends that can emerge over longer time frames.

Conclusion

The concept of a random process in Forex trading underscores the complexity and unpredictability of financial markets. While short-term price movements may often appear random, traders can still find opportunities by focusing on long-term trends, employing robust risk management practices, and using advanced statistical and quantitative methods to identify non-random patterns. Understanding the balance between randomness and underlying market structures is key to developing effective trading strategies.

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide To Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). This article is only draft and it will be not updated to the completed version on the release of the book. However, this article will serve you to gather the important knowledge in financial trading. This article is also recommended to read before using Price Breakout Pattern Scanner, Advanced Price Pattern Scanner, Elliott Wave Trend, EFW Analytics and Harmonic Pattern Plus, which is available for MetaTrader 4 and MetaTrader 5 platform.

Below is the landing page for Price Breakout Pattern Scanner, Advanced Price Pattern Scanner, Elliott Wave Trend, EFW Analytics and Harmonic Pattern Plus. All these products are also available from www.mql5.com too.

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Related Products