Posts

Market Prediction Book

Predicting Forex and Stock Market with Fractal Pattern

Subtitle: Science of Price and Time

Author: Young Ho Seo

Table of Contents

1 Introduction to Fractal Pattern in Financial Market

1.1 Geometric Recognition and Prediction, the Bible for Successful Trading

1.2 Turning Point, Peak, Trough, Swing High, Swing Low, and ZigZag

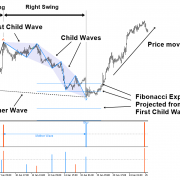

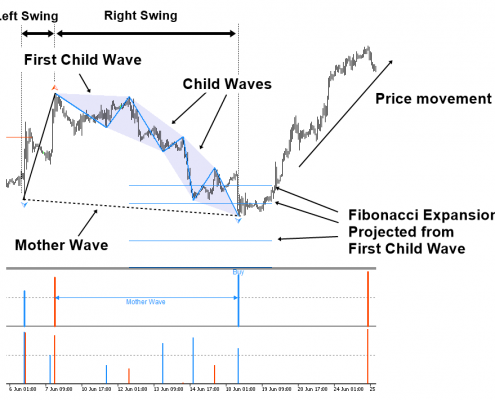

1.3 Fractal Wave, Mother Wave, and Child Wave

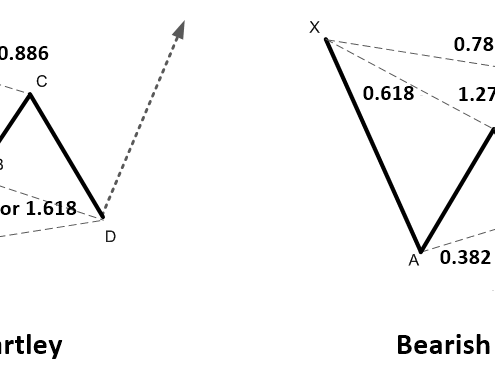

2 Geometric Regularity with Ratio and Proportion in Price Pattern

2.1 Finding Geometric Regularity within Fractal Waves

2.2 Detecting Price Patterns using Intersection

2.3 Detecting Price Patterns using Proportion

2.4 Detecting Price Patterns using Ratio

2.5 Application and Limitation of Price Patterns in Trading

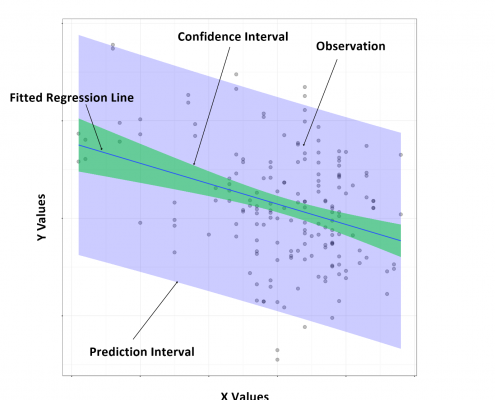

3 Statistical Regularity with Size in Price Pattern

3.1 Time Series Decomposition and Fractal Decomposition Analysis (FDA)

3.2 Fourier Transform and Peak Trough Transform

3.3 Deterministic Cycle and Stochastic Cycle in Financial Market

3.4 Singular Spectrum Analysis (SSA) and Fractal Cycle Analysis (FCA)

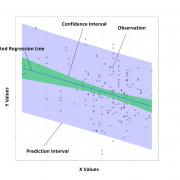

3.5 Turning Point Probability in Price and Time

4 Trading with Stochastic Cycles using Fractal Wave

4.1 Fibonacci Probability Graph

4.2 Mother Wave and Child Wave with Joint Probability

4.3 Predicting Volatility with Turning Point Probability

4.4 Support and Resistance Trading with Turning Point Probability

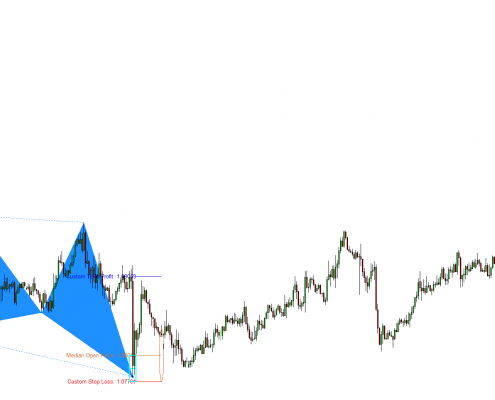

4.5 Harmonic Pattern Trading with Turning Point Probability

4.6 Falling Wedge Pattern and Rising Wedge Pattern with Turning Point Probability

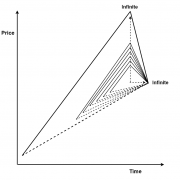

4.7 Gann Angles with Probability

4.8 Trading with Fractal Wave and Stochastic Cycles (Reversal Trading and Breakout Trading)

5 Risk Management in the Financial Trading

5.1 Position Sizing Techniques

5.2 Reward/Risk Ratio in your trading

5.3 Breakeven Success (or win) Rate

5.4 Know Your Profit Goal Before Your Trading

5.5 Compounding Profits

6 Price Patterns in the Financial Market

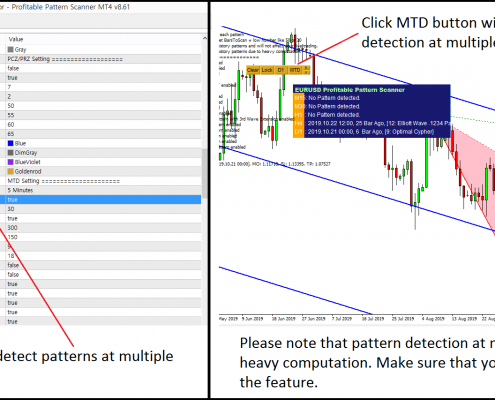

6.1 Why Do We Need New Pattern Framework for day trading?

6.2 How the X3 Pattern Framework is different from other Approaches

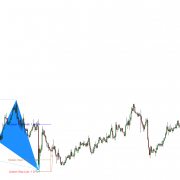

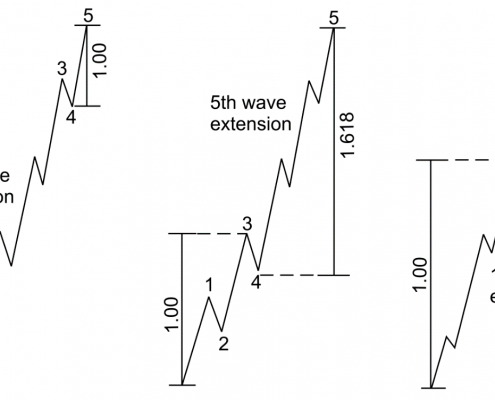

6.3 Defining Price Patterns with Retracement and Expansion Ratio

6.4 Scientific Lag Notation for Retracement Ratio and Expansion Ratio

6.5 Closing Retracement Ratio to Describe the Structure of Pattern

6.6 Factored Expansion Ratio to Describe Structure of Pattern

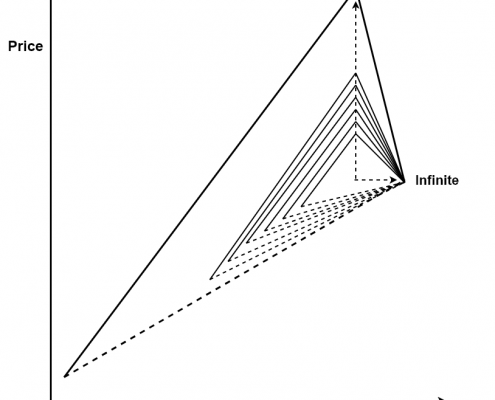

6.7 Converting Number of Points to Number of Triangles

7 Pattern Notation with Name, Structure, and Ideal Ratios

7.1 Pattern with 1 Triangle (3 points) Examples

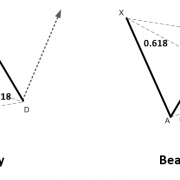

7.2 Pattern with 2 Triangles (4 points) Examples

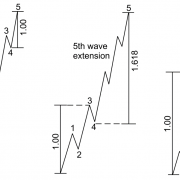

7.3 Pattern with 3 Triangles (5 points) Examples

7.4 Pattern with 4 Triangles (6 points) Examples

7.5 Pattern with 7 Triangles (9 points) Examples

8 Tutorial with Peak Trough Analysis

8.1 Loading Peak Trough Analysis indicator to Your Chart

8.2 Working with Fibonacci Retracement in Your Chart

8.3 Working with Fibonacci Expansion in Your Chart

9 Tutorial with X3 Price Pattern in Excel Spreadsheet

9.1 Calculating the Fibonacci Retracement Ratio in Microsoft

9.2 Calculating the Fibonacci Expansion Ratio in Apple

9.3 Detecting AB=CD pattern in Facebook

10 Tutorial for Chart Patterns

11 Risk Management in the Financial Trading

11.1 Position Sizing Techniques

11.2 Reward/Risk Ratio in your trading

11.3 Breakeven Success (or win) Rate

11.4 Know Your Profit Goal Before Your Trading

11.5 Compounding Profits

12 Special Chapter: Algorithm and Prediction for Artificial Intelligence, Time Series Forecasting, and Technical Analysis (Stock Market Prediction)

13 Special Chapter: Turning Point Prediction After Two Years Usage

14 References

Book Distributor

Just click link below to purchase our book from other Reputable Distributors. Use one of this reliable distributor to buy our eBooks.

Also you can visit this link to view all the distributors of our EBook:

https://books2read.com/u/4XXMJe